GBP/USD Remains Stable Amid Market Volatility and Divergent Rate Expectations

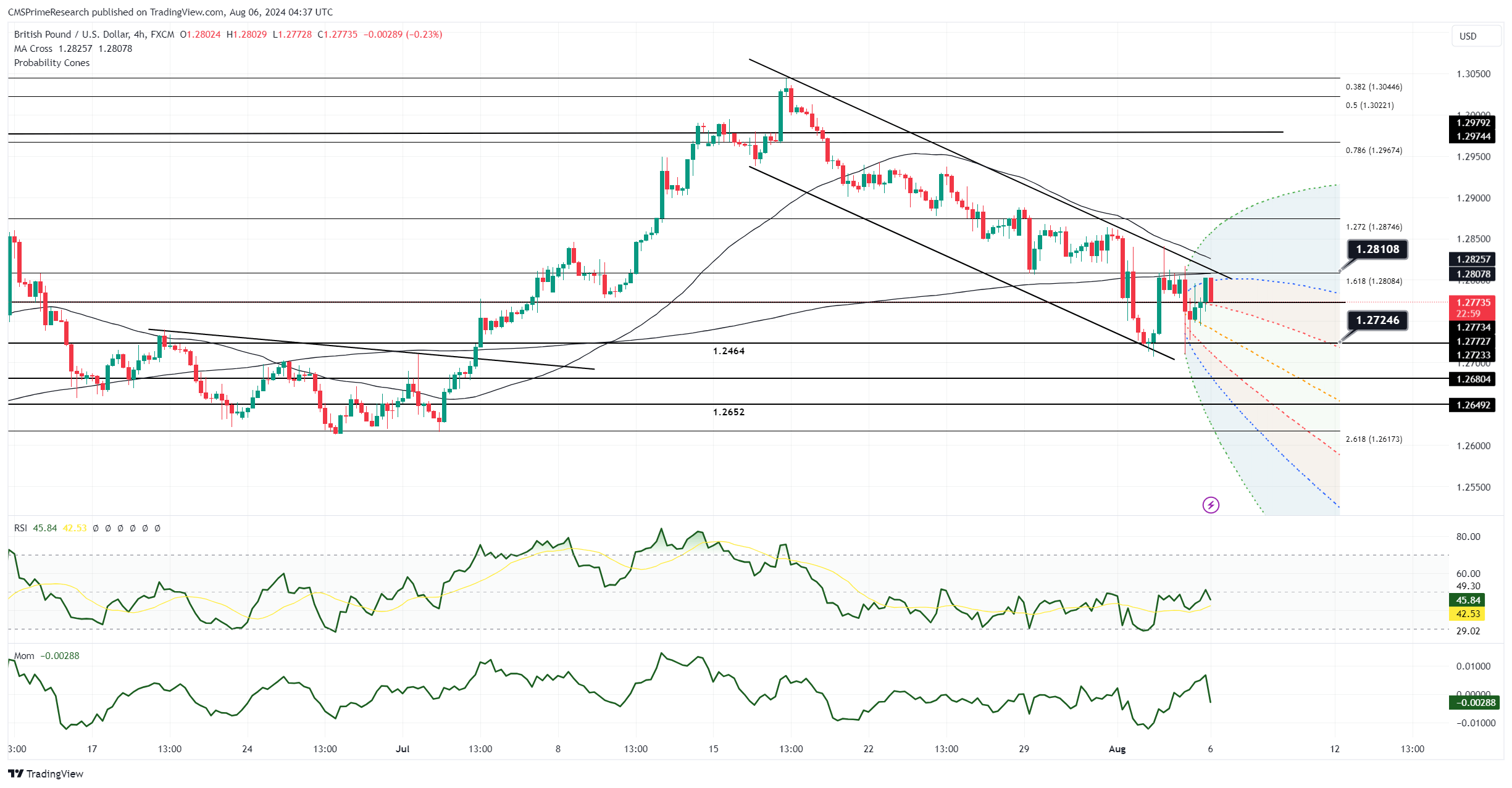

The GBP/USD pair, despite dipping 0.2% to 1.2779 on Monday, remains within its recent range, supported by the daily cloud top at 1.2706 and limited by the descending 10-day moving average (DMA) at 1.2841. With the current unfavorable macroeconomic outlook, the risks appear to lean towards the downside, particularly following the Bank of England’s (BoE) recent 25 basis point rate cut.

Amid global market turbulence, especially after Friday’s disappointing U.S. payroll report, GBP/USD has shown remarkable resilience. This strength is largely attributed to short-term interest rate (STIR) futures signaling a less dovish BoE rate trajectory in the near term. LSEG’s IRPR pages indicate that the market is anticipating just over two additional 25 basis point BoE rate cuts in 2024. In contrast, the Federal Reserve is expected to reduce rates by 50 basis points in both September and November, with an additional 25 basis point cut in December.

The divergence in rate cut expectations between the BoE and the Fed is likely to support the pound in the near term. UK Sonia futures are currently pricing in rates 50 basis points higher than their U.S. SOFR counterparts for 2025. However, if upcoming UK output and CPI data in mid-August show decreasing inflation and growth, traders might increase their expectations for BoE rate cuts, aligning them more closely with those of the Fed. This could lead GBP bears to test the daily cloud top support, bringing early-July lows around 1.26 into play.

EUR/USD Reverses Most Early Gains Amid Improved Risk Sentiment

EUR/USD initially rallied in New York trading, starting near 1.0950 after hitting 1.08938 overnight on EBS. The pair extended its gains to reach 1.1009, driven by U.S. dollar sales and narrowing German-U.S. spreads. However, some of these gains were reversed as risk sentiment improved following the U.S. July ISM non-manufacturing PMI report.

The unwinding of carry trades slowed, with USD/JPY nearing 145.00 and USD/CNH approaching 7.1400. Stocks and gold recovered from their lows, and EUR/JPY traded above 158.00 late in the session. As a result, EUR/USD fell from its high, settling near 1.0955, up only 0.41% by the end of the day.

From a technical perspective, the outlook for EUR/USD is bullish. The trend line from the 2023 highs was breached, and both daily and monthly RSIs are on the rise. Upcoming events such as China’s July trade report and the Reserve Bank of Australia’s policy meeting may influence risk sentiment in Asia, affecting EUR/USD movements.

In summary, while GBP/USD remains steady amid differing rate expectations, EUR/USD’s performance will be closely linked to overall market risk sentiment and upcoming economic data releases.