GBP/USD Faces Challenges Amid Central Bank Speculations and Yen Dynamics

The GBP/USD downside appears limited after failing to sustain a break below 1.29 on Tuesday. However, a return to the 2024 highs reached earlier this month remains difficult as traders await directions from both the Bank of England (BoE) and the Federal Reserve (Fed). Additionally, yen dynamics may influence the pair. The recent weakness in sterling partly stemmed from GBP/JPY selling after Toshimitsu Motegi, secretary-general of Japan’s ruling Liberal Democratic Party, suggested the Bank of Japan (BoJ) should more clearly signal its intent to normalize monetary policy, including steady interest rate hikes. This echoed comments from Prime Minister Fumio Kishida, who indicated that BoJ policy normalization would support Japan’s shift to a growth-driven economy, intensifying hawkish rate expectations ahead of the upcoming BoJ meeting. Consequently, GBP/JPY declined by 0.71%.

Sterling bulls face hurdles following recent gains, which saw GBP net speculative long positioning reach all-time highs. Year-to-date, GBP/USD has risen by 1.47%, while GBP/JPY has surged by 12.3%. However, if the BoJ surprises markets with a rate hike or stricter rate guidance, yen buying could increase against major currencies, leading to significant sterling selling versus the yen and potentially capping GBP/USD below the recent high of 1.3044.

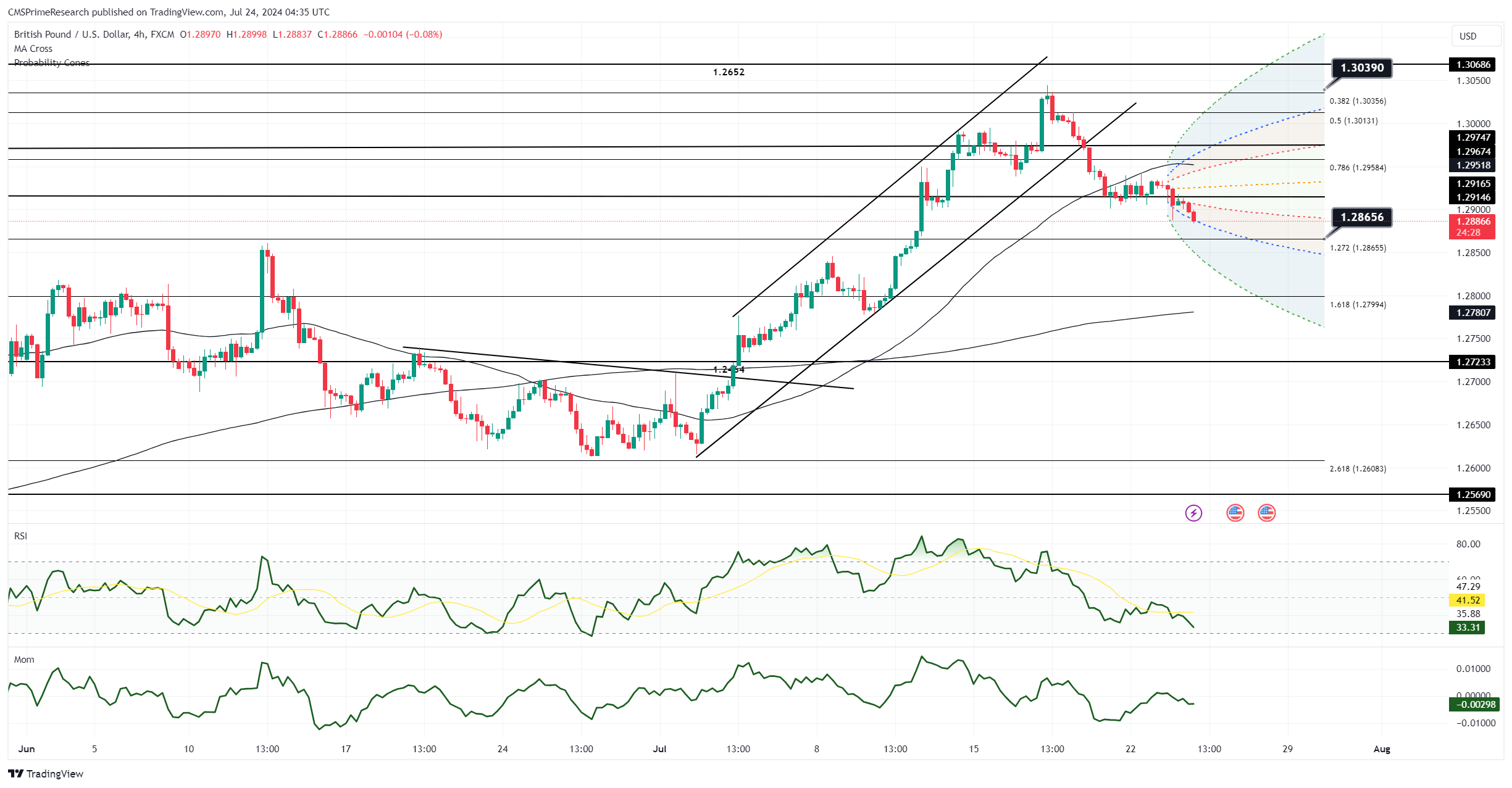

In late New York trading, GBP/USD was down 0.15% at 1.2910, within a North American range of 1.2920-1.2900. The pair hit a one-week low of 1.2889 overnight due to cross sales and a hawkish BoJ outlook. Traders are now focused on the UK flash PMI data due on Wednesday for insights into UK growth and inflation, which will influence the BoE’s stance. Additionally, Friday’s PCE index data will be crucial for the Fed’s policy direction.

Key support levels include Tuesday’s low of 1.2889, the daily low of 1.2848 from July 11, and the 50% retracement of the 1.2613-1.3044 move at 1.2829. Resistance levels are at Tuesday’s North American pullback high of 1.2920, the 10-day moving average at 1.2940, and the 200-hour moving average at 1.2954.

The central question remains: Will the BoJ cast a shadow over sterling? With significant data releases and central bank guidance pending, the market is braced for potential volatility.