GBP/USD Eases from Recent Highs Near 1.30 Amid Strong U.S. Retail Sales; UK Inflation Data in Focus

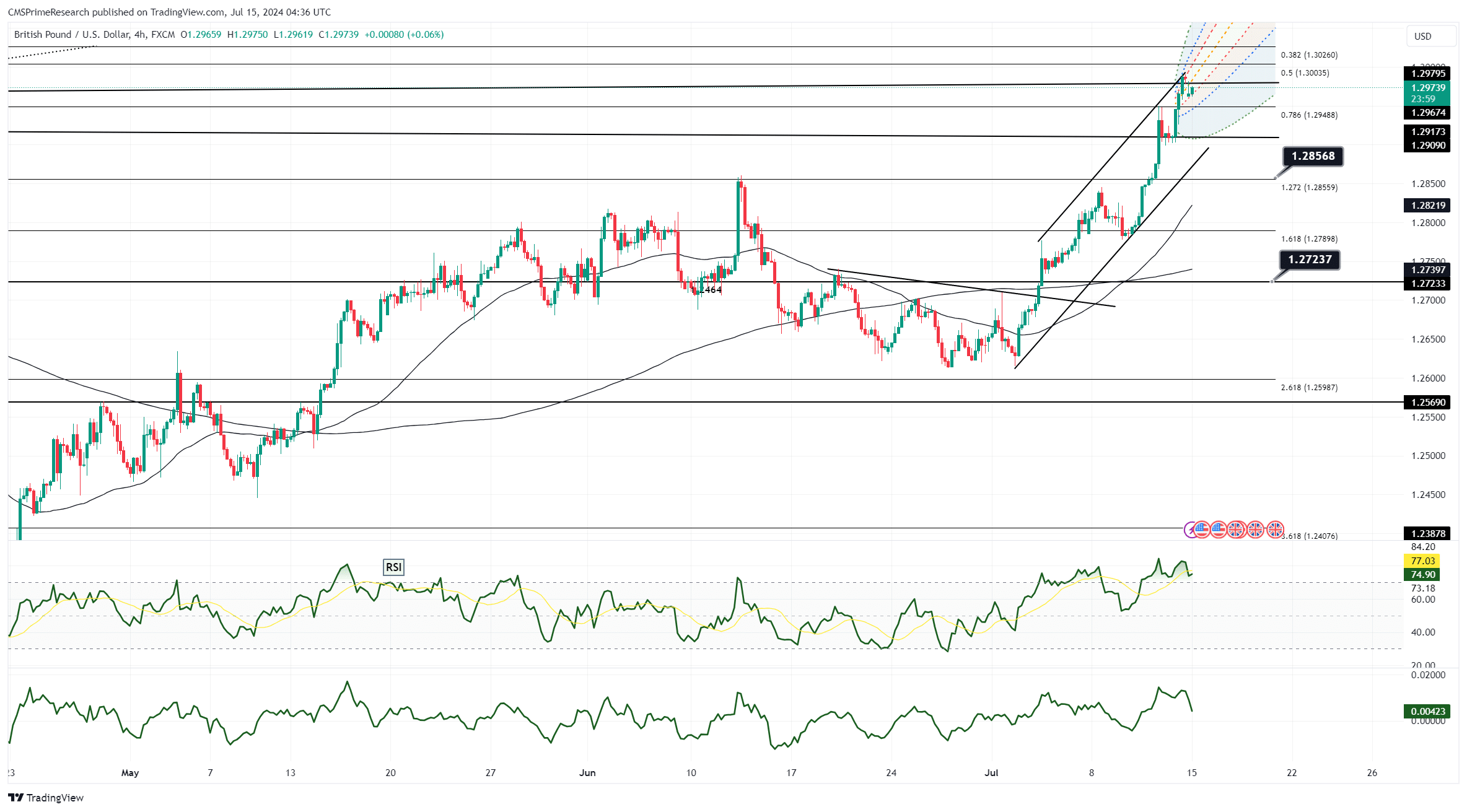

GBP/USD retreated further from recent highs near 1.30 following stronger-than-expected U.S. June retail sales data, which slightly tempered expectations for Federal Reserve rate cuts. The pair slipped from 1.2970 to 1.2939, but the modest decline indicates that a move towards 1.30 remains feasible. Despite the dip, bullish sentiment towards the pound remains, with Wednesday’s UK inflation data now taking on greater importance. According to Reuters, UK core CPI is expected to hold steady at 3.5% year-on-year, while headline CPI is forecasted to dip slightly to 1.9% year-on-year. A downside surprise in the data could prompt a decline in GBP/USD due to dovish shifts in Bank of England rate expectations. Conversely, an unexpected rise in UK inflation could increase the likelihood of another BoE rate hold next month, potentially driving sterling above the 1.2995 resistance level and towards the late July 2023 high of 1.3041 and the 2023 high of 1.3144.

At the close of the North American session, GBP/USD was slightly down by 0.1%, trading at 1.2953 within a daily range of 1.2980 to 1.2939. Resistance ahead of 1.30 remains firm, with the pair easing from 1.2970 after the U.S. retail sales data exceeded expectations. The market is now focusing on Wednesday’s UK CPI data for insights into BoE policy, with a month-on-month core CPI forecast of 0.1%. The divergent U.S.-UK rate outlook has supported the pound, but a weak CPI print may lead to a sell-off in long sterling positions, which have nearly doubled since late June.

Key technical levels include resistance at 1.2995 (July 15 high), 1.3041 (July 19, 2023 high), and 1.3144 (July 13, 2023 high). Support is seen at Tuesday’s low of 1.2939, the 23.6% Fibonacci retracement of the 1.2613-1.2995 move at 1.2905, and the rising 10-day moving average at 1.2858.