GBP/USD Edges Higher Amid Labour Party Landslide and Anticipated US Jobs Data

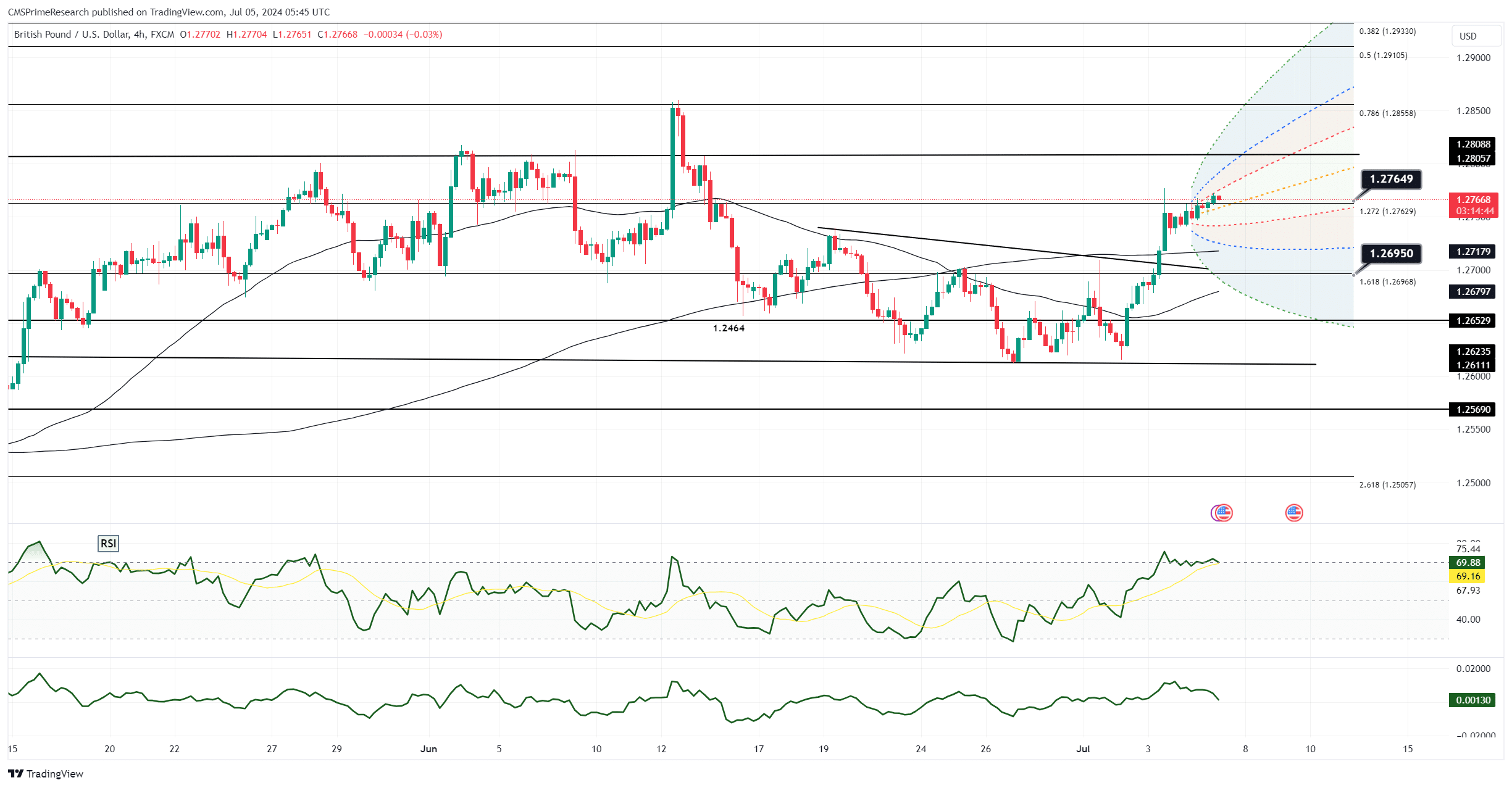

Market participants are keenly observing London’s reaction to the election results and the impact of the volatile US jobs data. Technical analysis shows positive daily momentum studies alongside contracting 21-day Bollinger Bands, suggesting some underlying strength. However, the mixed signals from the 5, 10, and 21-day moving averages create a modest positive bias rather than a strong trend.

Initial support for GBP/USD is noted at Wednesday’s low of 1.2679, with further support at last week’s base of 1.2613. On the upside, resistance is identified at this week’s high of 1.2776 and the June high of 1.2859. The currency pair is currently consolidating at a three-week high.

The Labour Party’s victory, as projected by the polls, brings Keir Starmer to power with a significant majority. Starmer’s centre-left stance and his team’s stability are viewed favourably after years of political uncertainty under Conservative rule. The forthcoming Autumn Statement will reveal Labour’s policies, which need to address various economic challenges such as rising debt interest payments, increased health and defence spending, the cost of reducing greenhouse gas emissions, and an ageing population.

With these challenges in mind, Starmer will likely need to increase revenue to meet his election promises. Maintaining investor confidence while navigating these economic issues will be critical. The London Stock Exchange Group (LSEG) indicates a 56.7% probability of a quarter-point rate cut by the Bank of England on August 1, unchanged after a BoE survey showed a decline in employer wage expectations. Upcoming data and announcements from the new government will be crucial in influencing this finely balanced decision, which will have a significant impact on sterling.

In summary, the GBP/USD pair is showing resilience in the wake of Labour’s dramatic win, with technical indicators pointing to a cautious optimism as the market digests the election outcome and anticipates further economic data.