GBP/USD Steadies as PCE Data Lifts Pound Briefly Before Inflation Concerns Emerge

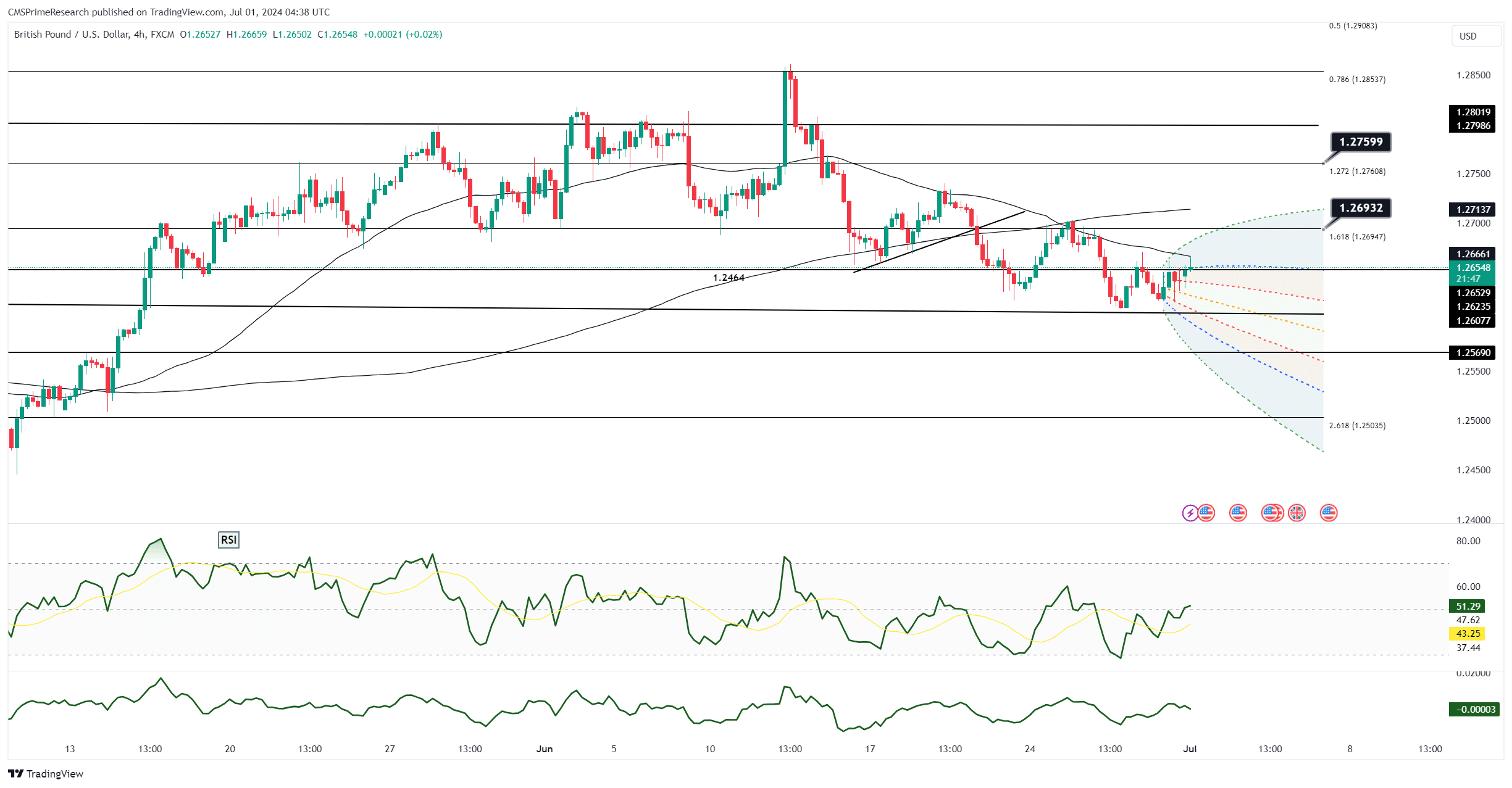

After the release of U.S. Personal Consumption Expenditures (PCE) data, GBP/USD steadied. The pound initially rose to a Friday high of 1.2670, just below the 10-day moving average resistance, as the PCE data suggested inflation was heading towards the Fed’s 2% target. However, this rise was short-lived as other data indicated ongoing inflationary pressures. Without significant updates from U.S. or UK economic data or central banks, GBP/USD is expected to stay within its recent range, between Thursday’s low of 1.2613 and Tuesday’s high of 1.2702, as traders wait for clearer signs on whether the Fed and Bank of England (BoE) will take different paths with their rates.

Both the Fed and BoE are predicted to make nearly two rate cuts by December. Futures suggest the BoE might cut rates earlier, possibly in August, compared to the Fed in September. This anticipation has weighed down the pound since the BoE’s dovish comments at its last meeting. Looking further ahead, UK rates are expected to dip slightly below U.S. rates after 2025, according to SOFR and SONIA futures, which could further pressure the pound. Nevertheless, the U.S.-UK rate spread is expected to be +10 to +15 basis points by December 2026 and 2027, likely keeping GBP/USD near current levels unless there are major changes in inflation or growth prospects.

Sterling’s initial rise after the PCE data was undone by positive Chicago PMI and University of Michigan data. By the North American afternoon, sterling was steady at 1.2643, up 0.03%, within a range of 1.2670 to 1.2620. The rise was tempered by increasing U.S. consumption data. Next week features a U.S. holiday on Thursday, with UK and French elections, the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday, and the Non-Farm Payrolls (NFP) report on Friday in focus. Federal Reserve members Barkin, Daly, and Bowman will discuss the policy need to see lower inflation. Key resistance levels for GBP/USD are 1.2670 (Friday high), 1.2702 (June 25 high), and 1.2736 (50% Fibonacci retracement of the 1.2860-1.2613 move). Support levels are 1.2627 (55-DMA), 1.2620 (Friday post-UMich low), and 1.2583 (daily cloud top)