GBP/USD Peaks on Strong UK Services CPI as BoE Rate Decision Looms; Political Uncertainty Ahead of UK Election

Overview

The GBP/USD pair, commonly referred to as “Cable,” recently reached an intra-week peak of 1.2733. This rise is attributed to higher-than-expected UK services Consumer Price Index (CPI) data. Specifically, the UK services CPI increased by 5.7% year-on-year, surpassing the forecasted 5.5%. Meanwhile, the overall UK CPI met expectations with a 2.0% year-on-year increase.

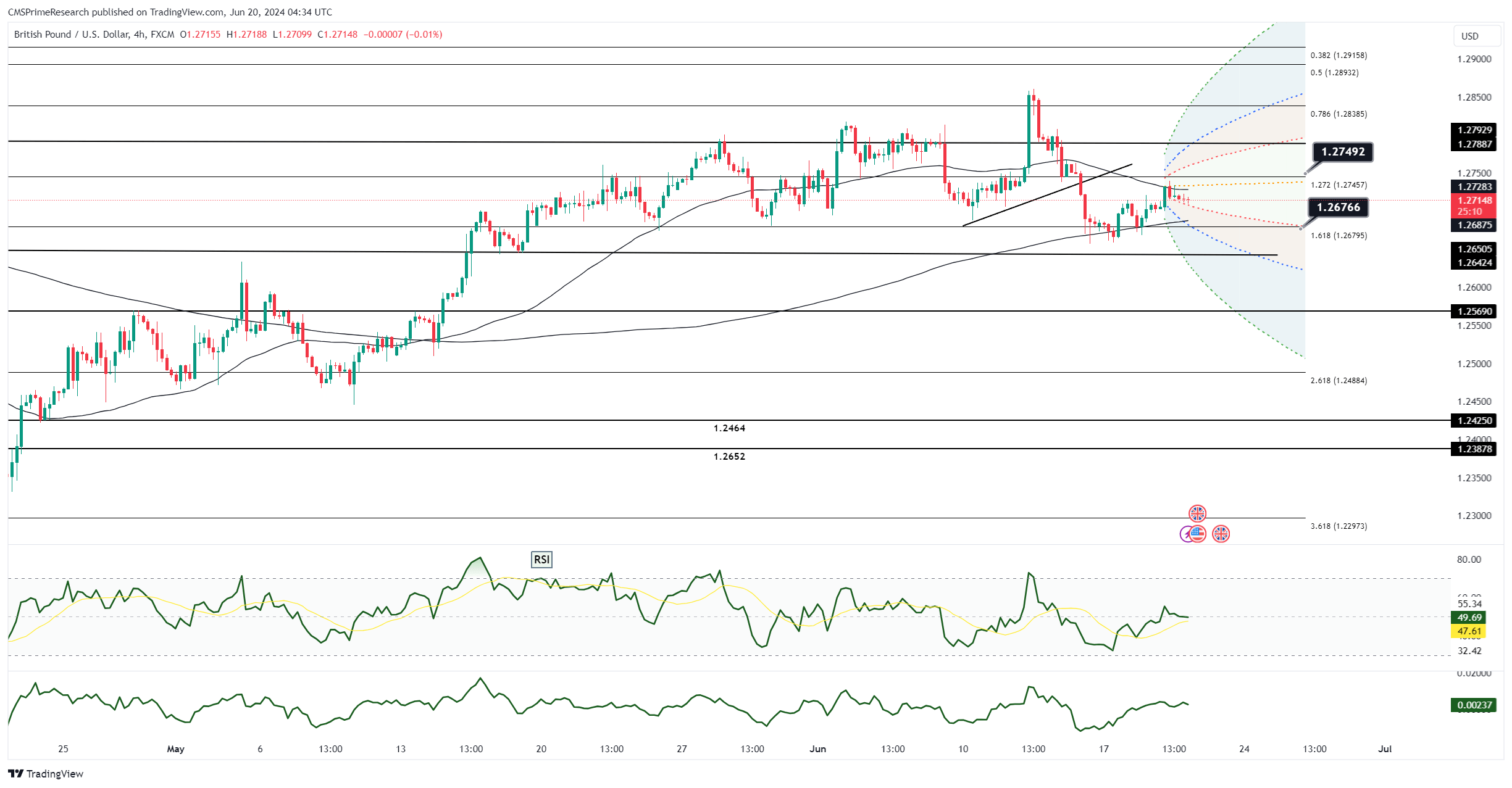

Price Action and Resistance Levels

Cable rose to 1.2729 following the release of the UK services CPI data, with an intra-week high noted at 1.2733. Before the UK CPI data was released, the pair traded within the 1.2701-1.2711 range during the Asian session. Key resistance levels to watch are 1.2742, which corresponds to the 21-day moving average (21DMA), and 1.2763, the high recorded on June 14.

Market Expectations and Economic Forecasts

The upcoming Bank of England (BoE) rate decision is a significant event for Sterling traders. The market currently anticipates a 68% chance that the BoE will maintain its rates in August, an increase from 54% earlier in the week. This shift in sentiment is driven by the higher-than-expected services CPI. However, a recent Reuters poll revealed that 63 out of 65 economists predict a 25 basis point rate cut to 5% on August 1, following the UK general election.

BoE Policy and Market Sentiment

The BoE’s decision-making is under intense scrutiny, especially with the services CPI surpassing expectations. The central bank’s challenge is balancing high inflation pressures against potential economic softening. The BoE has held rates for seven consecutive sessions, and this trend is expected to continue on Thursday, just two weeks before the UK election. Any change in voting patterns among Monetary Policy Committee (MPC) members, particularly if more members join Dave Ramsden and Swati Dhingra in advocating for a rate cut, could narrow the gap between market expectations and economists’ forecasts, potentially impacting GBP negatively.

Political Context and Market Impact

Political developments also play a crucial role in shaping market sentiment. An Ipsos poll suggests that the Labour Party is likely to win 453 out of 650 seats, while the Conservatives are expected to secure 115 seats. Such a political shift could influence the BoE’s policy direction and market sentiment towards the GBP.

Conclusion

The GBP/USD pair faces a mixed risk environment. On one hand, continued high inflation suggests that the BoE might maintain or even increase rates. On the other hand, if economic conditions deteriorate, a dovish shift and potential rate cuts could lead to significant repositioning by traders. Sterling’s performance in 2024 is closely tied to these dynamics, making the BoE’s upcoming decisions and the UK’s political landscape critical factors to monitor.