GBP/USD Retreats Near 1.2700 Amid Softer CPI Data; Critical Support at 1.2630, Resistance at 1.2745

Sterling bulls have temporarily paused near the 1.2700 level after reaching a five-week high of 1.2701 early Thursday. This pullback followed Wednesday’s release of softer-than-expected CPI and retail sales data, which dampened gains and set a cautious tone ahead of the UK inflation data set for May 22. Despite earlier concerns about inflation approaching the Federal Reserve’s 2% target, Fed rate expectations have remained steady. With both core and headline inflation rates declining, these fears have subsided, shifting the focus to September for a potential Fed rate cut. Concurrently, downward pressure on the pound has been exacerbated by MPC member Megan Greene’s more dovish stance on UK inflation and interest rate expectations. Greene pointed to increased uncertainty about inflation and suggested that a BoE rate cut in June is possible, depending on the upcoming UK CPI data.

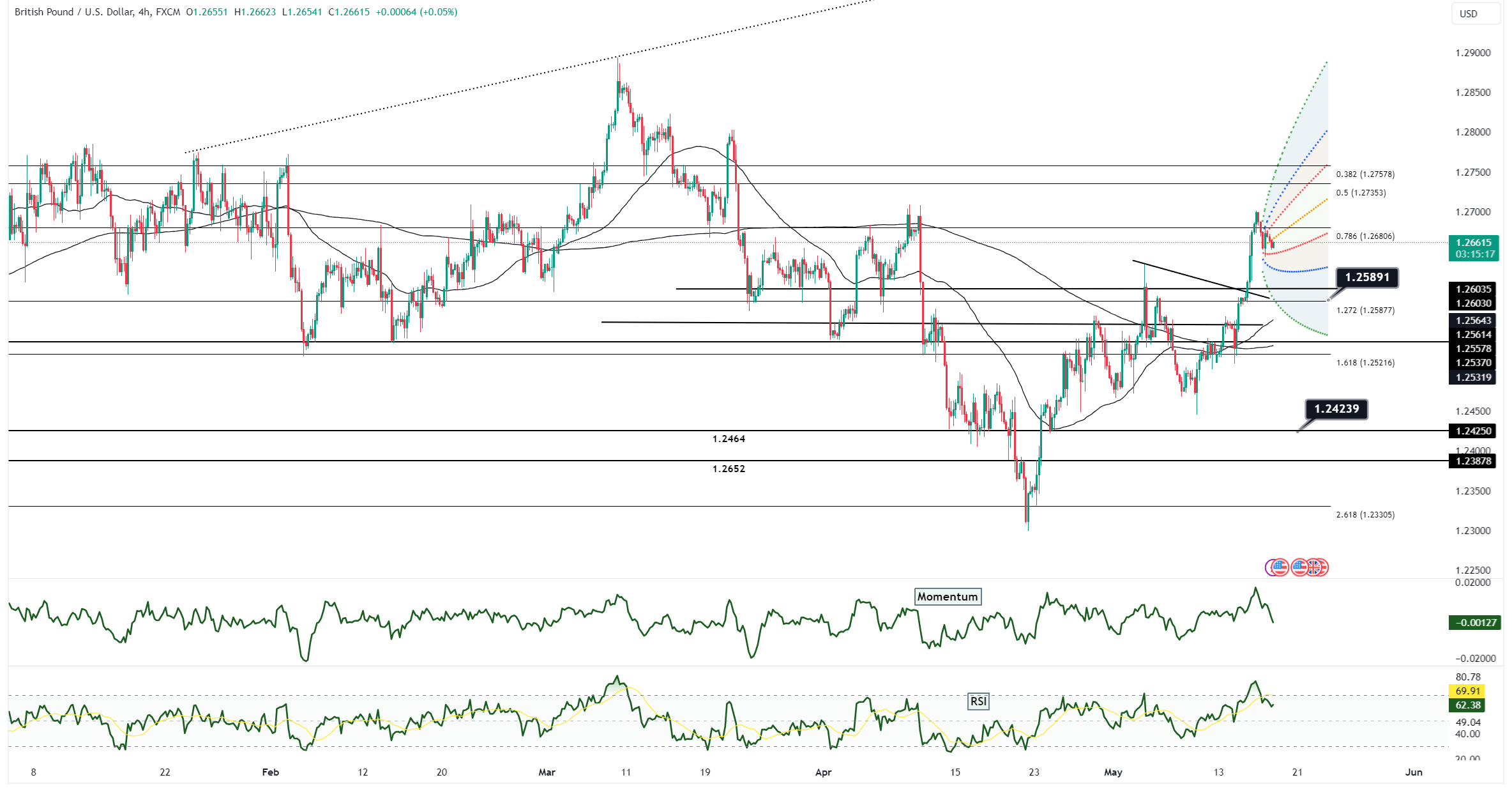

The GBP/USD pair closed North American trading 0.1% lower at 1.2675, with Thursday’s trading range fluctuating between 1.2700 and 1.2650. The pair faced resistance at the 1.2700 mark, matching the high from the Asia session, after the release of softer CPI and retail sales data. The UK CPI report on May 22 will be crucial for insights into BoE policy, especially considering Greene’s recent remarks indicating a less aggressive approach. Key resistance levels are observed at 1.2700, 1.2712, and 1.2745, while support levels are marked at 1.2640, 1.2630 (aligned with the 100-day moving average), and 1.2595. Traders will closely watch these levels, with resistance at 1.2700 being a critical point for the next direction in GBP/USD movement.