EUR/USD Analysis: Yield Spreads Fail to Deter Bullish Momentum

The EUR/USD currency pair exhibited resilience in the face of challenges as of the latest market update, but the pair saw a robust rally extending its gains. This positive momentum aligns with bullish technical signals, including the consolidation of gains and the maintenance of Relative Strength Indices (RSIs) above the 200-day moving average (MA). Looking ahead, market participants will closely watch for November German Ifo and Eurozone manufacturing and non-manufacturing PMI data as key risk factors in the coming week.

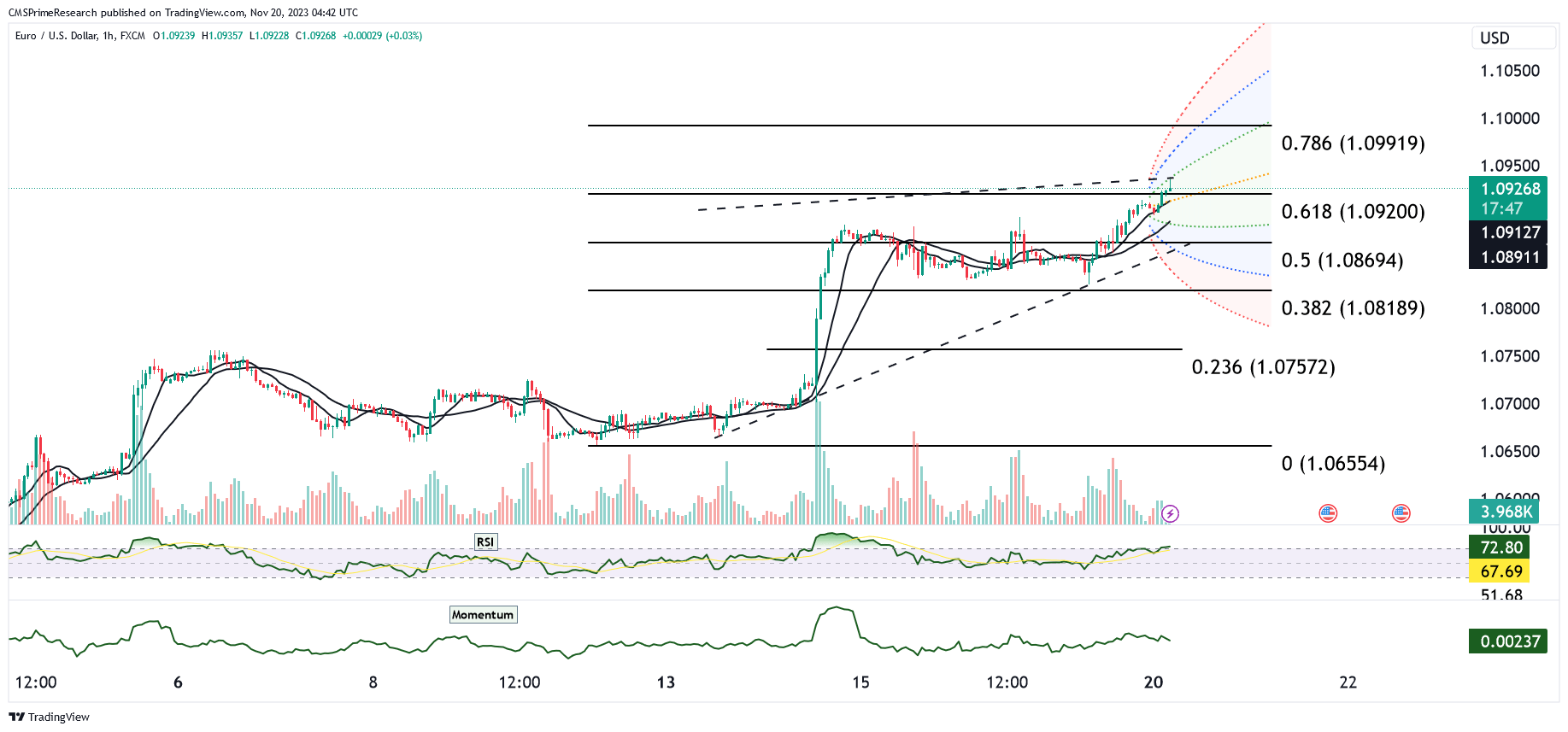

In a subsequent development, EUR/USD continued to edge higher as the USD/JPY pair led the broader US dollar lower. While a brief dip to 1.0897 occurred early in the Asian session, the selling pressure on the US dollar resumed later in the morning. This was evident as USD/JPY dipped below the 149.00 level, prompting EUR/USD to advance to 1.0924 in sympathy with the broad USD weakness. Despite the gains, EUR/USD faced some resistance due to EUR/JPY selling, resulting in a modest 0.33% decline in the cross. Key resistance for EUR/USD is situated at the 61.8% retracement level of the July to October decline, positioned at 1.0959. The overall sentiment towards the USD appeared decisively bearish as the market increasingly priced in the end of the Federal Reserve’s tightening cycle. EUR/USD’s bullish trend is further confirmed by the alignment of the 5, 10, and 21-day moving averages (MAs). Key support levels for the pair include the 200-day MA at 1.0806 and the 10-day MA at 1.0787.

Key Levels to Watch: 1.10000,1.10469,1.08395

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08850 | 1.09331 |

| Level 2 | 1.08393 | 1.09705 |

| Level 3 | 1.08081 | 1.10012 |