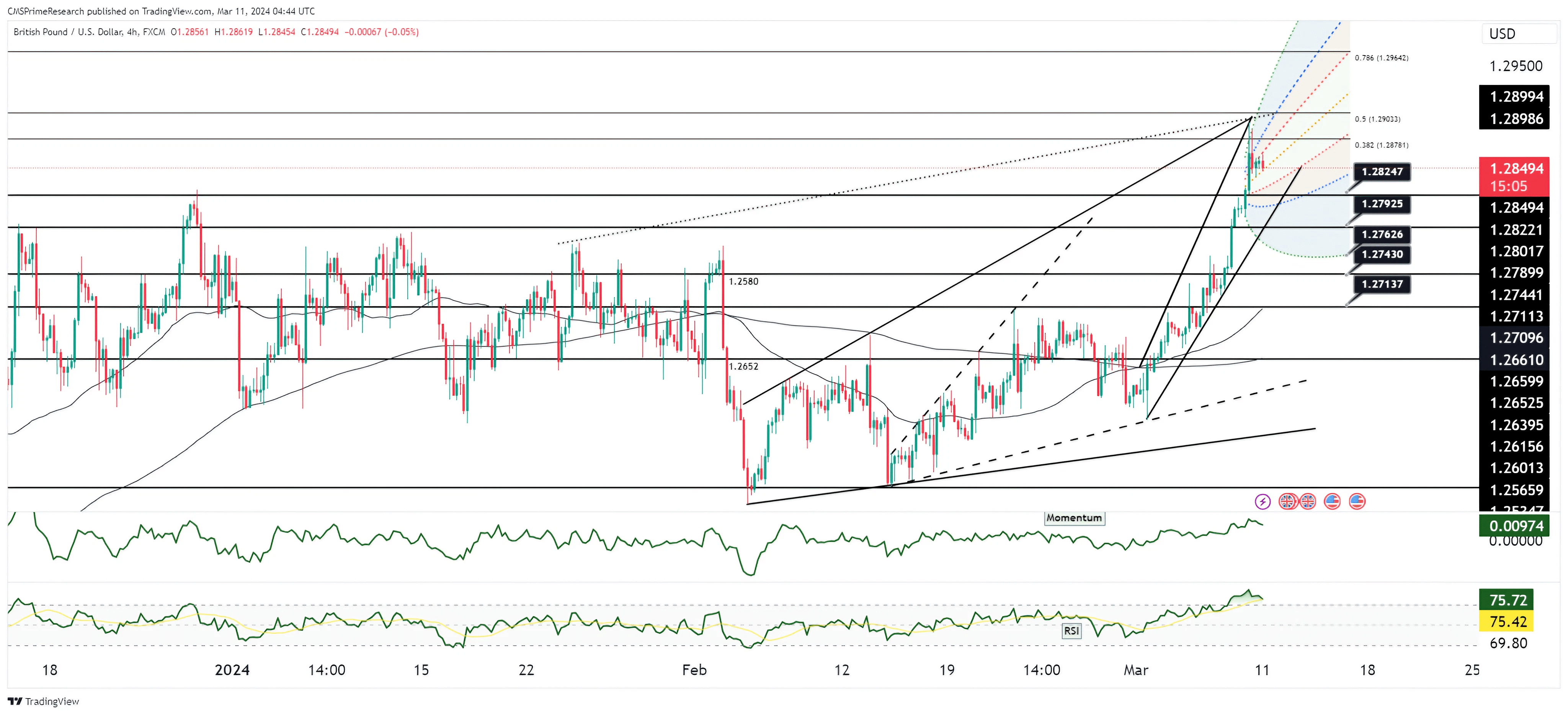

GBPUSD eyes super bullish trend near 1.2925 level

Technical Analysis:

The GBP/USD pair has seen relatively little movement in the Asian session, trading between 1.2840 and 1.2870. This follows a sharper rise on Friday, where the currency peaked at 1.2940 post-U.S. payrolls announcement. The ascent on Friday may have been slightly over-extended, as indicated by the subsequent consolidation phase.

The Ichimoku Kijun line’s role as a balance point for market price suggests a neutral to slight bullish sentiment in the short-term as the price hovers above this line. The presence of the 55-MA and 200-MA nearby also signifies a substantial consolidation zone where bearish momentum might be countered.

From a fundamental perspective, the GBP seems to be in higher demand than the EUR, with the EUR/GBP cross being under pressure and trending lower. The Commitments of Traders (COT) report reflects that Institutional Managed Money and Commodity Trading Advisors (CTAs) were net buyers of the GBP, a trend that may persist.

This cross’s stability in the face of carry trade reversals suggests that the GBP is performing well against a backdrop of changing risk appetites, especially when compared to other yen crosses.

Overall Market Sentiment: Considering the technical support levels holding steady and the fundamental demand for the GBP over the EUR, the market sentiment leans positive for the GBP. However, the recent high reached on Friday suggests caution, which introduces a degree of negative sentiment due to the possibility of an overextension.

The sentiment percentage breakdown for the GBP/USD pair, derived from the current technical and fundamental perspectives, is approximately:

- 60% Positive: Supported by the technical consolidation above key MAs and the recent demand for GBP as reflected in COT data.

- 20% Negative: Reflecting the cautious sentiment post-Friday’s high, considering the potential overextension.

- 20% Neutral: Indicating the current market indecision as the pair consolidates within a narrow range.

The positive sentiment is primarily due to the GBP’s relative strength against other major currencies and the buying interest from institutional traders. The cautious negative sentiment is a result of the quick retraction from the high, suggesting a market reassessment of the post-payroll rally. Neutral sentiment indicates that while the market acknowledges the GBP’s strength, it is waiting for further cues to commit to a clearer direction.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2615 | 1.2700 |

| Level 2 | 1.2530 | 1.2720 |

| Level 3 | 1.2470 | 1.2750 |