GBP USD in a range following key UK economic events this week

The Bank of England (BoE) has been facing significant credibility challenges since it started increasing interest rates in December 2021. Market perception of Governor Andrew Bailey’s effectiveness has been notably critical. He has been perceived as less decisive than his predecessor, often seeming hesitant or apologetic during announcements from the Monetary Policy Committee. These reactions highlight a contrast between Bailey’s approach and the assertiveness typically expected in his role.

Currently, the BoE is navigating a complex situation, attempting to balance reducing inflation without exacerbating a recession. Governor Bailey recently stated that it is premature to consider interest rate cuts. However, this view is somewhat at odds with his Chief Economist’s opinion, who finds the market’s expectation of a rate cut by August next year to be reasonable.

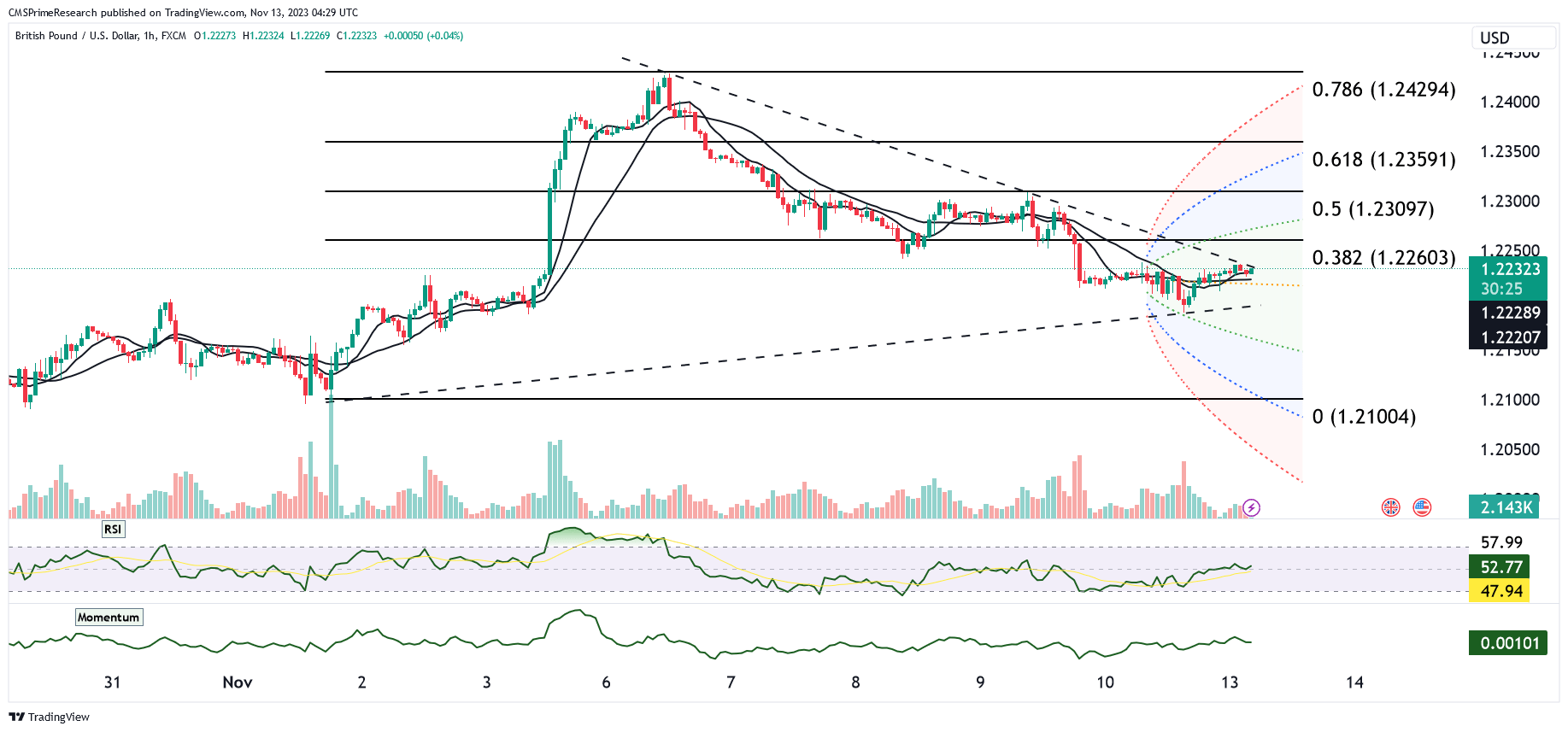

In the currency markets, GBP/USD has shown resilience amidst these uncertainties. It remained stable in a range of 1.2225-1.2236 in a subdued start to the week in Asia, influenced by strong pay growth in both the UK’s private and public sectors. This data supports the BoE’s stance of maintaining higher rates for a longer period. The currency pair’s movement has been somewhat independent of significant data releases in London, with the USD and overall risk appetite influencing sterling more directly. Technical analysis shows a neutral setup, with momentum studies indicating a potential for consolidation. Key resistance and support levels have been identified based on recent trading ranges.

Furthermore, GBP/USD recently erased gains following the U.S. jobs data, indicating the pair’s sensitivity to broader market dynamics, including shifts in risk appetite and key economic indicators. With major data releases scheduled in both the U.S. and UK, including CPI, retail sales, and labor market figures, there is potential for increased volatility and price movements in the near term.

This scenario underscores the delicacy of the BoE’s current position, as it seeks to manage inflationary pressures without stifling economic growth, all while maintaining market confidence in its policies and forward guidance.

Bank of England’s Interest Rate Dilemma Amid Market Uncertainty and GBP/USD Stability

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2203 | 1.2257 |

| Level 2 | 1.2176 | 1.2280 |

| Level 3 | 1.2148 | 1.2303 |