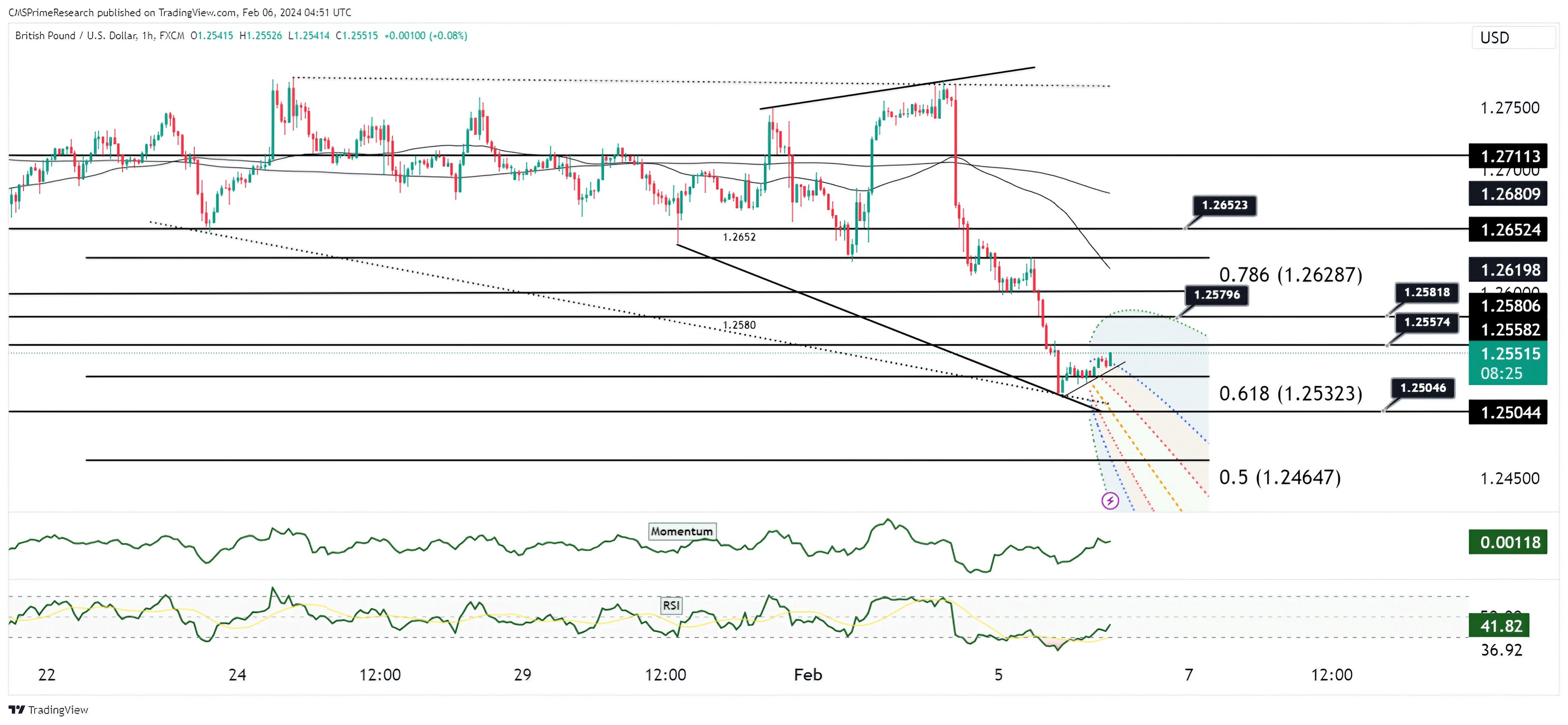

GBP USD bearish with Neutral sentiment waiting to test the low of 1.24650

The GBP/USD pair has demonstrated a bearish momentum, as indicated by the first chart. After encountering resistance around the 1.27113 level, the price has made a sharp downturn, breaking past several Fibonacci retracement levels. Currently, the pair finds tentative support at the 38.2% Fibonacci level of the recent swing from 1.2039 to 1.2825. However, this support appears fragile, with the next significant support level being the 100-day moving average (DMA) at 1.2475.

The resistance is now forming at the falling 10-hour moving average (HMA) at 1.2572, followed by the previous day’s high at 1.2619 and further at the daily cloud top around 1.2691. The RSI indicator sits near the mid-line, not signaling an extreme condition, but the momentum indicator’s decline suggests a loss of upward drive.

Fundamentally, the British Pound’s weakness is attributed to a combination of factors. Federal Reserve Chair Powell’s less dovish remarks have diminished the market’s anticipation of rate cuts in 2024, bolstering the U.S. dollar as yield prospects improve. Concurrently, upbeat Institute for Supply Management (ISM) data has provided additional uplift to the USD.

On the other side of the pair, the Bank of England’s (BoE) recent Monetary Policy Committee (MPC) vote revealed a split, which has been interpreted as less hawkish, weakening the GBP. Upcoming economic data releases, including retail sales, employment figures, and the Consumer Price Index (CPI), will be critical for the currency. These releases may either alleviate or exacerbate the Pound’s current pressure.

Overall Market Sentiment:

The sentiment could be approximately:

- 65% Negative: The significant downward price action and bearish technical indicators drive a largely pessimistic outlook.

- 25% Neutral: The RSI being near mid-levels suggests some market participants are awaiting further data before committing to a direction.

- 10% Positive: A small proportion may hold an optimistic view, likely banking on potential positive economic data from the UK that could offer the GBP some support.

This sentiment assessment aligns with the current market narrative that emphasizes a stronger USD against a backdrop of less accommodative monetary policy and mixed signals from the BoE.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2500 | 1.2620 |

| Level 2 | 1.2490 | 1.2630 |

| Level 3 | 1.2470 | 1.2690 |