GBP USD waiting to push toward the 1.2730 level, BOE news to impact

GBP/USD has recently displayed resilience, reversing early North American session weakness to ascend post the U.S. ADP and employment cost data. The pair found support as the data signaled a slowdown in U.S. employment and a reduction in labor costs, which fueled dovish sentiments after Federal Reserve rate policy. This dovish outlook led to a decrease in U.S. yields and contributed to sterling’s rally above the 1.27 mark.

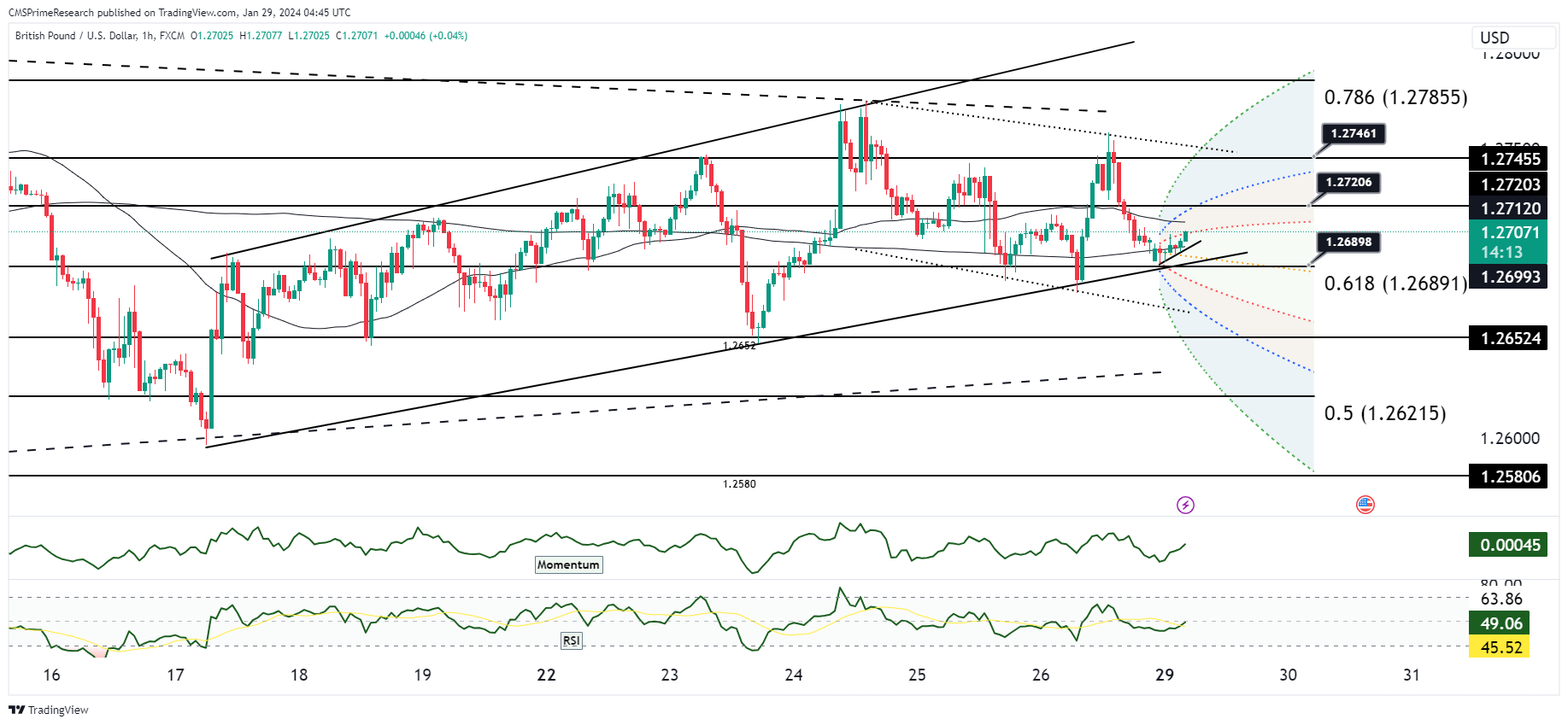

Technically, the pair is grappling with resistance near a confluence of daily averages that has historically acted as a pivot point for GBP/USD in 2024. Despite the indicators signaling a ‘Strong Sell’, the currency pair’s recovery above critical support levels exhibits bullish undertones, suggesting that buyers are attempting to regain control. The momentum indicator is stable, while the RSI hovers near the midpoint, indicating neither overbought nor oversold conditions – a sign of potential equilibrium between buyers and sellers.

The currency pair remains bounded within a channel, with key Fibonacci levels at 1.26785 providing immediate support and 1.27750 acting as a near-term resistance. The ability of GBP/USD to stay above these levels may determine the short-term trend direction.

The recent U.S. employment data points towards a deceleration in the labor market, with a dovish tilt in the Fed’s stance. While the FED has has maintained its stance on no rate change in the Recent FOMC, Powell’s comments on inflation and economic performance still lingers critical.

On the UK side, the Bank of England (BoE) meeting looms large, with expectations set for rates to hold steady amidst persistent above-target inflation. The upcoming UK fiscal policy decisions, including potential tax cuts, inject additional uncertainty into the GBP/USD outlook. These factors contribute to an expectation of continued range-bound trading for the pound, with key technical levels delineated by the December high at 1.2825 and the January low at 1.2597.

Overall Market Sentiment:

The market sentiment for GBP/USD, taking into account the technical structure and fundamental context, can be quantified as follows:

- Positive Sentiment: 50% – Driven by GBP’s rebound above 1.27 and the potential dovish shift in Fed policy.

- Negative Sentiment: 30% – Reflecting the ‘Strong Sell’ technical indicators and the cautious stance ahead of central bank meetings.

- Neutral Sentiment: 20% – Indicative of the current wait-and-see approach as markets digest recent economic data and anticipate central bank guidance.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2700 | 1.2721 |

| Level 2 | 1.2690 | 1.2730 |

| Level 3 | 1.2677 | 1.2745 |