GBP USD bullish, waiting to test the 1.2745 level.

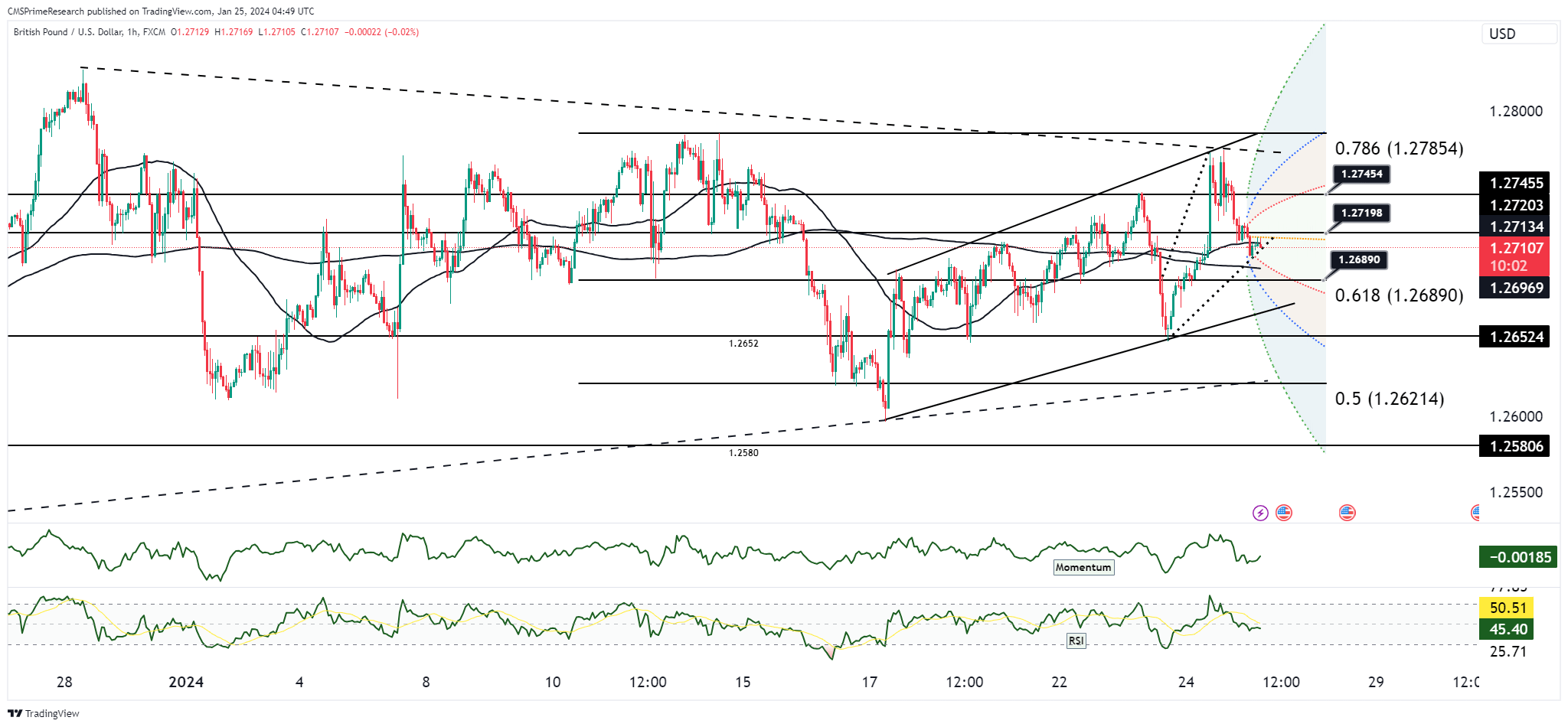

The GBP/USD is navigating through a delicate juncture as indicated by the technical patterns on the chart. The pair is experiencing slight softness as it awaits pivotal economic events. In the Asian session, it has maintained a narrow range, showing a tentative market stance. The technical indicators suggest a consolidation phase with the 5, 10, and 21-day moving averages (DMAs) coiling, and the 21-day Bollinger bands contracting, hinting at a potential breakout in the near term.

The daily momentum indicators are flatlining, reinforcing the consolidation phase narrative. Initial support is established at this week’s low around 1.2650, followed by the lower band of the 21-day Bollinger at 1.2635. On the upside, resistance is marked by the recent New York high at 1.2774, with the 1.2788 level standing as the 2024 peak. The currency pair seems to be in a broader range play between 1.2600 and 1.2825 over a seven-week period, suggesting a wait-and-see approach by market participants.

GBP/USD is under the influence of external drivers in the absence of tier 1 UK data. Market sentiment is being swayed by the anticipation of further stimulus measures from China, the forthcoming European Central Bank (ECB) decision, and the release of US GDP figures. With the Bank of England’s (BoE) monetary policy decisions and Brexit negotiations as backdrop contexts, the pair remains susceptible to shifts in broader market sentiment and risk appetite.

Offshore factors, including global economic health indicators and central bank policies, are likely to dominate the fundamental narrative for the GBP/USD. The pair will be especially reactive to the ECB’s rate decision, as any unexpected moves could have a ripple effect on the pound due to the close economic ties between the UK and the Eurozone.

Overall Market Sentiment:

- Positive Sentiment: 50% – This reflects the robust resistance levels that could cap the upside but also indicates that the market has not fully embraced a bearish stance.

- Negative Sentiment: 30% – There is caution ahead of major economic announcements which might sway the pair negatively.

- Neutral Sentiment: 20% – Indicative of the ongoing consolidation and the market’s wait for clearer signals to determine direction.

The prevailing sentiment is cautiously optimistic, likely due to the market’s expectation of further economic stimulus and a wait-and-see approach ahead of the ECB decision and US GDP data release. The market is positioned for a potential shift but remains guarded, as reflected in the technical setups and the forthcoming fundamental catalysts.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2700 | 1.2721 |

| Level 2 | 1.2690 | 1.2730 |

| Level 3 | 1.2677 | 1.2745 |