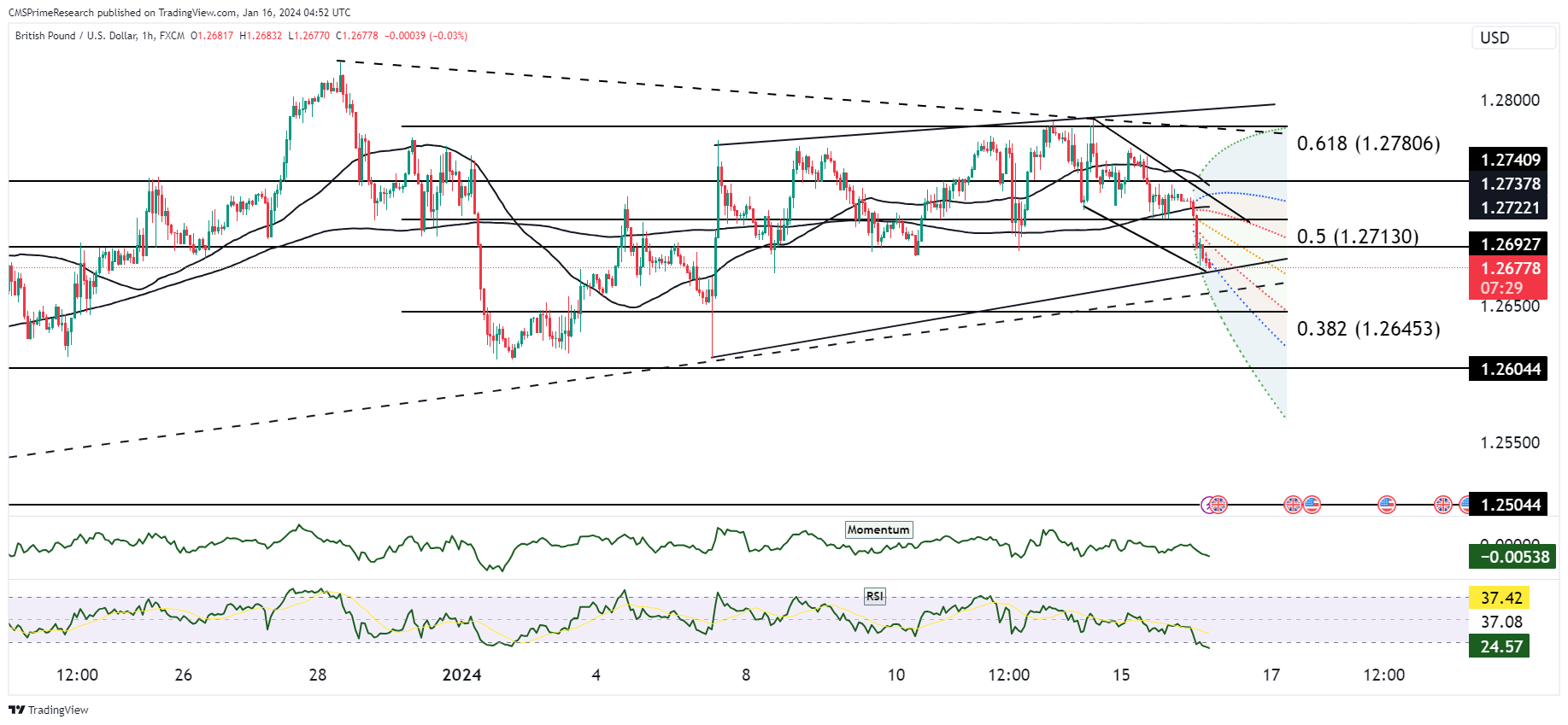

GBP USD strong bear trend in place, with price waiting to test the 1.2640 level

The technical structure of GBP/USD suggests a dominant bearish sentiment, with strong “Sell” signals emanating from both moving averages and technical indicators. The convergence of the moving averages on a downward trajectory underscores a bearish bias in the market. The RSI, deeply ensconced in oversold territory, implies that the currency pair may have been excessively sold, and a corrective rebound could be on the horizon. Nonetheless, the Stochastic and MACD reinforce the prevailing downward momentum, with the former also in oversold territory and the latter hovering around the zero line, indicating a lack of bullish momentum.

Pivot point analysis reveals that the pair is teetering around crucial support levels. The currency has been navigating a tight range, encapsulated by 1.2678 and 1.2731, with the base of this range near 1.2610 forming a key support level. This support has been rigorously tested, and a break below could precipitate a move towards the significant 1.2610 support zone.

On the fundamental side, market sentiment has soured, evidenced by a selloff in global equities and a corresponding rise in the USD and Treasury yields. The UK employment data looms large, with the unemployment rate and job change figures poised to inject volatility into the pair. Given the current economic climate, stronger-than-expected job numbers could provide a lifeline for the beleaguered pound, whereas a miss could further entrench the bearish outlook.

Market Sentiment Ratings or Percentages:

- Bearish Sentiment: 70% – Predicated on the strong technical sell signals and the recent dip in risk appetite, which has favored the safe-haven USD.

- Neutral Sentiment: 20% – Reflecting the indecision as traders await the UK jobs data, which has caused the moving averages to coil and signals to show no strong bias.

- Bullish Sentiment: 10% – There’s a minor bullish undertone due to the oversold condition, which could trigger a technical rebound, especially if reinforced by positive fundamental data.

In summary, GBP/USD presents a stark picture of bearish dominance with potential for a volatility spike in light of impending economic data. The market’s focus is trained on the key support level at 1.2610, with a breach here likely intensifying bearish momentum. Conversely, a favorable jobs report could catalyze a rally, challenging immediate resistance at 1.2731. Investors should navigate this landscape with prudence, attentive to both the technical cues and the fundamental event risks that could sway market sentiment.

Key Levels to Watch: : 1.2690,1.2609,1.2745,1.2652

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2677 | 1.2709 |

| Level 2 | 1.2652 | 1.2728 |

| Level 3 | 1.2628 | 1.2800 |