Sterling Edges Lower Amid Uncertainty Surrounding Fed and BoE Policies

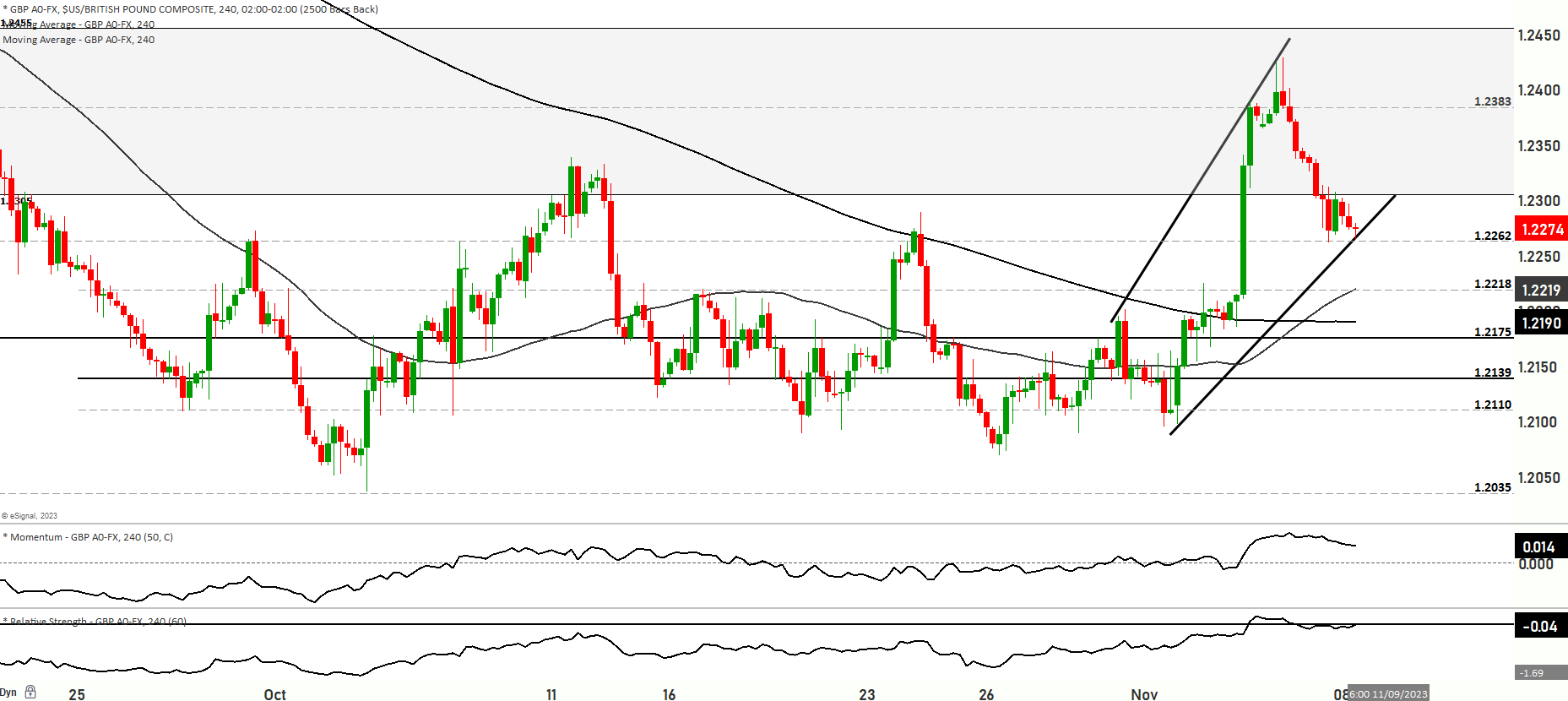

GBP/USD has experienced a minimal 0.05% decline within a quiet Asian trading range spanning from 1.2281 to 1.2300. The day features speeches by Bank of England (BoE) Governor Bailey in Dublin and Federal Reserve Chair Powell. The light data schedule places significant importance on these central bank comments for both the British pound and the US dollar. Meanwhile, a UK think tank has recommended that Finance Minister Hunt focus on investing in the economy rather than implementing tax cuts. In terms of technical analysis, momentum studies are providing mixed signals, while the 5, 10, and 21-day moving averages are on an upward trajectory. The 21-day Bollinger Bands are flatlining, indicating a neutral setup that suggests consolidation. The recent high at 1.2428 and the 200-day moving average at 1.2434 are likely to serve as the range top. Initial support levels include 1.2264, the New York low, followed by 1.2223, the 10-day moving average, and 1.2201, the 21-day moving average.

GBP/USD exhibited minimal movement within a narrow range of 1.2306 to 1.2285 in early North American trading, recording a 0.32% decline to reach 1.2300. Market participants are grappling with the potential policy moves of both the Federal Reserve and the Bank of England. Recent dovish expectations from the Fed and sterling’s gains post-payrolls have been unraveled. Key questions for GBP/USD traders revolve around the extent to which inflation has receded recently and whether central banks will pivot towards rate cuts. The Reserve Bank of Australia (RBA) rate hike today was viewed as dovish, as the bank emphasized a data-dependent path and stepped back from its October comment that further tightening might be necessary. Meanwhile, the Bank of England (BoE) has signaled a rapid decline in inflation from current levels, allowing the bank to maintain its current interest rates despite UK inflation, both headline and core, remaining above 6%. With the Fed also holding rates steady and data suggesting that previous Fed hikes have tempered US inflation, the timing of rate cuts in 2024 will be pivotal for sterling traders. If the BoE shifts towards rate cuts ahead of the Fed, the recent strength in GBP/USD could quickly dissipate, with the October low at 1.2039 coming into focus. Additionally, a close below the daily cloud could put multiple daily moving averages (DMAs) near 1.22 in focus.

GBP/USD slipped -0.55% to 1.2270 by the North American close, after trading within a range of 1.2346 to 1.2264 earlier in the day. The uncertainty surrounding Fed and BoE policies persists, with the BoE’s rate hike cycle nearing its end and expectations of further dovish shifts due to low growth. Key support levels include 1.2262, which corresponds to the 50% Fibonacci retracement of the move from 1.2096 to 1.2428, as well as the 10, 21, and 30-day MAs clustered near 1.2200. On the upside, resistance levels include 1.2292 (10-hour moving average), 1.23 (daily cloud base), 1.2324 (55-day DMA), and 1.2435 (200-day DMA). The ongoing flux in Fed and BoE policies continues to impact sterling’s performance.

Key Levels to watch are 1.2303, 1.2263, 1.2429

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2241 | 1.2305 |

| Level 2 | 1.2218 | 1.2342 |

| Level 3 | 1.2200 | 1.2435 |