GBP/USD Hits Fresh 2025 High, Bulls Eye 1.30 Amid Weakening Dollar

GBP/USD strengthened sharply into the North American close, rising 0.58% to 1.2949 after setting a fresh 2025 high of 1.2962. The pair continues to benefit from declining U.S. Treasury yields and weakening demand for the USD amid escalating recession fears and trade tensions driven by President Trump’s tariff announcements. Despite the bullish momentum, concerns over the stagnant UK economy and potential fiscal risks remain headwinds for further sterling gains. Traders will closely monitor upcoming U.S. CPI data on Wednesday and next week’s UK inflation and BoE announcements for clearer directional cues.

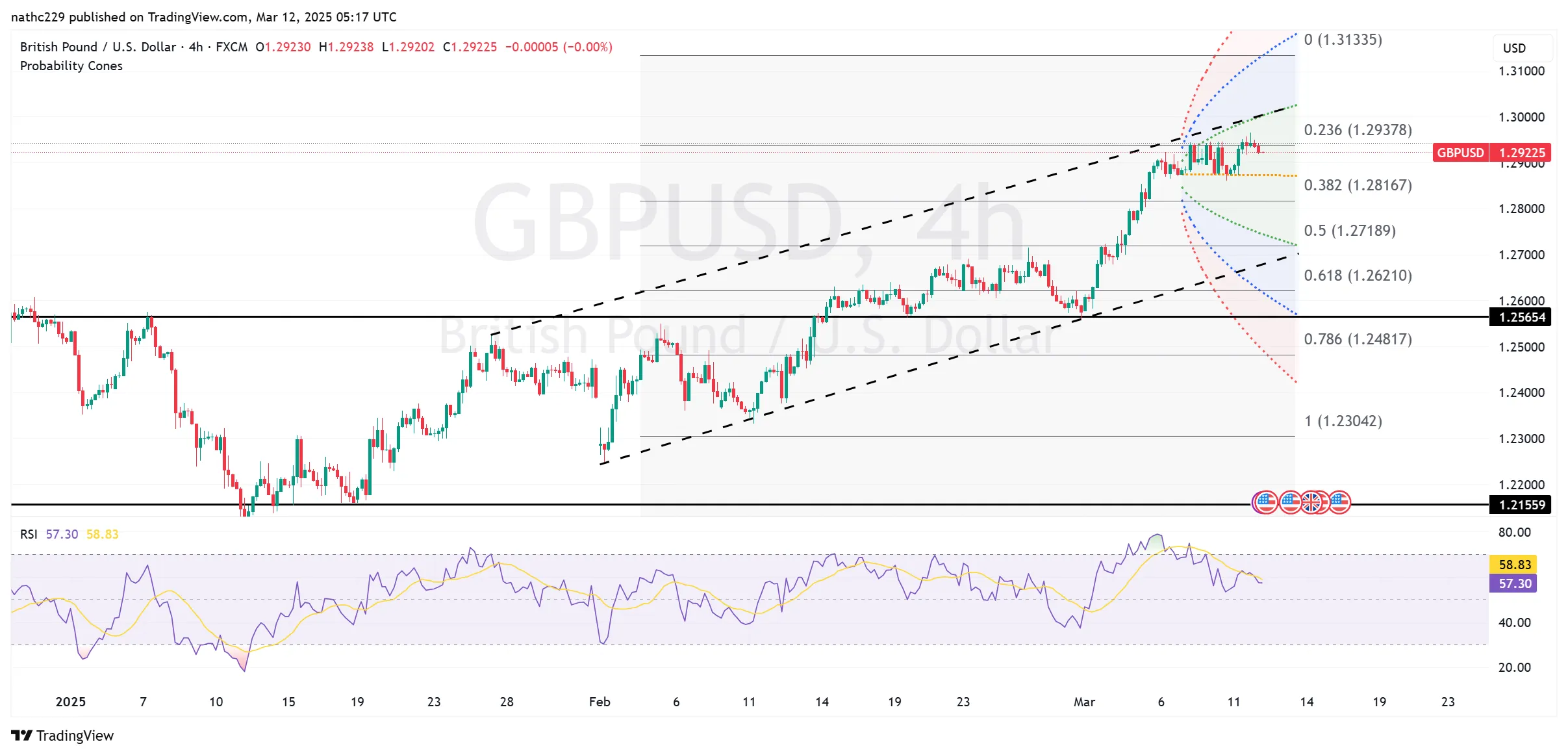

From a technical viewpoint, GBP/USD maintains a bullish bias, trading comfortably above key moving averages including the converging 200-day and 10-day moving averages at 1.2790/88, which should act as robust support if tested. Immediate resistance now stands at Tuesday’s peak of 1.2952, with a decisive break potentially targeting the psychologically important 1.30 level. Beyond this, November 2024 highs around 1.3046 would come into focus. RSI indicators continue to rise but remain below overbought territory, suggesting scope for further upside in the short term.

In the coming sessions, Wednesday’s U.S. CPI release will be crucial in shaping expectations for Fed policy, which could either reinforce the current dollar weakness or prompt a corrective pullback if inflation data surprises positively. Similarly, next week’s UK inflation data and the Bank of England’s policy meeting will be pivotal in assessing whether GBP/USD can maintain its upward trajectory. With traders cautious ahead of key data releases, GBP/USD is likely to remain buoyant near current highs, provided support at 1.2790/88 remains intact.