In the dynamic realm of currency trading, where shifts in market sentiment can happen in the blink of an eye, having a strategic approach is paramount. Volatile news events have the potential to trigger significant market movements, offering both opportunities and challenges for traders. This article delves into the top five trading strategies tailored to navigate the intricacies of trading currency pairs during periods of high market volatility. By understanding these strategies, traders can harness the power of volatility to their advantage and make informed decisions even in the face of rapidly changing news landscapes.

Breakout Trading Strategy for Currency Pairs

Understanding Breakouts

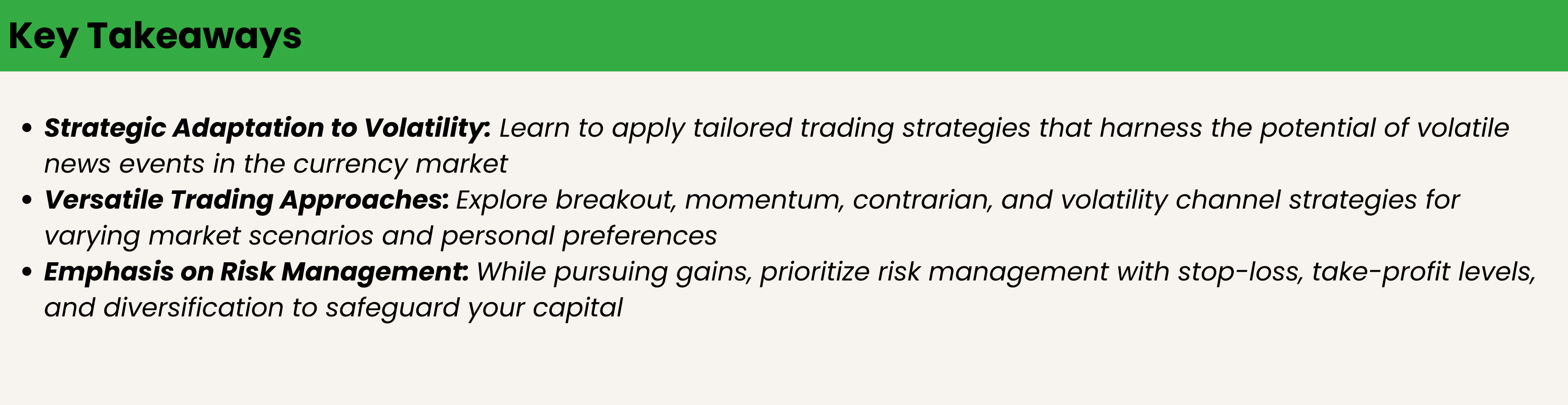

A breakout occurs when the price of a currency pair moves beyond a defined support or resistance level with increased trading volume. Breakouts are used when the market is already near the extreme high or low of the recent past, ensuring that traders don’t miss significant market moves.

Identifying Key Technical Levels

Key technical levels include support and resistance levels, which can be identified using various tools such as trend lines, moving averages, and Fibonacci retracements. These levels help traders determine potential breakout points in the market.

Disclaimer: The above example is just for educational purposes only. Not Investment or trading advice.

Placing Breakout Orders

For the specified currency pairs (EUR/USD, USD/JPY, GOLD, GBP/USD), traders can place buy stop orders above resistance levels and sell stop orders below support levels. This allows them to enter the market when a breakout occurs. For example, the European opening range strategy focuses on EUR/USD and can be applied to other European majors like GBP/USD.

Managing Risk with Stop-Loss and Take-Profit Levels

To manage risk, traders should set stop-loss orders below the low (if buying) or above the high (if selling) of the breakout level. Take-profit levels can be set based on a predetermined profit target or by using trailing stops to lock in gains as the market moves in the desired direction.

Real-World Examples

- EUR/USD: The European opening range strategy is a breakout strategy that focuses on the EUR/USD pair. It involves identifying a key price level during the European trading session and buying or selling at that price to take advantage of the breakout.

- USD/JPY: The 1-hour breakout strategy for the USD/JPY pair involves trading during the Asian session when the market is more active with the Japanese Yen.

- GOLD: A breakout strategy for trading gold involves identifying key support and resistance levels and entering the market when the price breaks through these levels. This can be done using the ETF with the ticker code GDX.

- GBP/USD: The 15-min GBP/USD range breakout trading system involves drawing horizontal lines at the high and low of candles/bars between two specific times during the New York trading session. Traders can place buy stop orders at the high and sell stop orders at the low with stop-loss orders set accordingly.

By applying these strategies to the specified currency pairs, traders can take advantage of breakout opportunities in the currency markets. Remember to manage risk with stop-loss and take-profit levels to protect your capital and lock in gains.

Employing tailored trading strategies during times of heightened volatility allows traders to not only navigate the challenges but also exploit the opportunities presented by news events.

News-Based Momentum Strategy for Currency Pairs

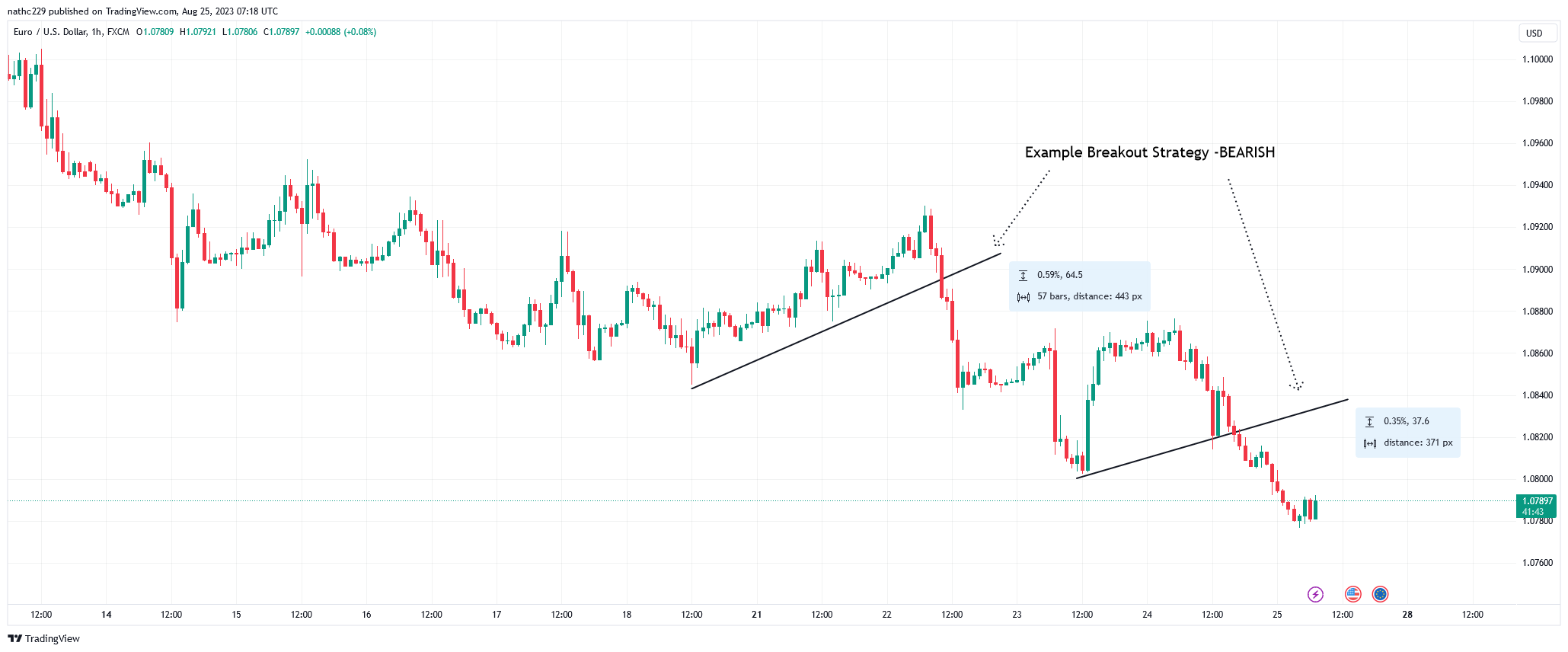

The significance of news events in trading cannot be underestimated. These events have an impact on the market leading to increased volatility and creating opportunities for traders. Major news events, such as changes in central bank policies, shifts in government policies and unexpected economic data releases can greatly influence currency pairs.

To ensure that traders stay well informed about market moving news it is crucial to rely on sources like Bloomberg, Financial Times and CNBC. These sources offer coverage of markets and provide daily updates on important events along with thorough analysis.

In the paced market quick decision making and efficient trade execution are paramount. Traders can leverage trading to capitalize on momentum driven by news events by automating trade execution based on predefined parameters and user instructions.

Managing risk is essential when engaging in news based momentum trading. Traders should implement stop loss and take profit strategies to mitigate losses. Stop loss orders can be strategically placed below the levels when buying) or above the high (when selling) while take profit levels can be set based on predetermined profit targets or by using trailing stops.

To illustrate these strategies further;

For trading purposes there’s a strategy called the opening range strategy that focuses on the EUR/USD pair. It revolves around identifying a price level during the trading session and making buy or sell decisions based on that level to take advantage of potential breakouts.

Another strategy for the USD/JPY pair is the 1 hour strategy. This involves trading during the Asian session when the Japanese Yen is in play.

Traders who understand the significance of news events in trading and rely on news sources can make quick decisions and execute trades effectively. To manage risks and optimize profits in news based momentum trading it’s important to implement stop loss and take profit strategies.

From breakout trading to contrarian strategies, traders have an array of techniques at their disposal. This diversity empowers them to choose strategies in line with market dynamics and their individual trading styles."

Volatility Channel Strategy for Currency Pairs

Understanding Volatility Channels

Volatility channels are a set of lines plotted above and below an asset’s price, representing its historical price range. These channels help traders identify potential trading opportunities by highlighting periods of high and low volatility in the currency market.

Creating Volatility-Based Trading Ranges

To create volatility-based trading ranges, traders can use tools such as Bollinger Bands, Keltner Channels, or Average True Range (ATR). These indicators help establish dynamic support and resistance levels based on the asset’s historical price movements and volatility.

Identifying Breakouts and Fakeouts

Breakouts occur when a currency pair’s price moves beyond the volatility channel, indicating a potential trend change. However, not all breakouts lead to sustained trends; some may be fakeouts, which are false signals. Traders can use tools like volume indicators and price action analysis to differentiate between genuine breakouts and fakeouts.

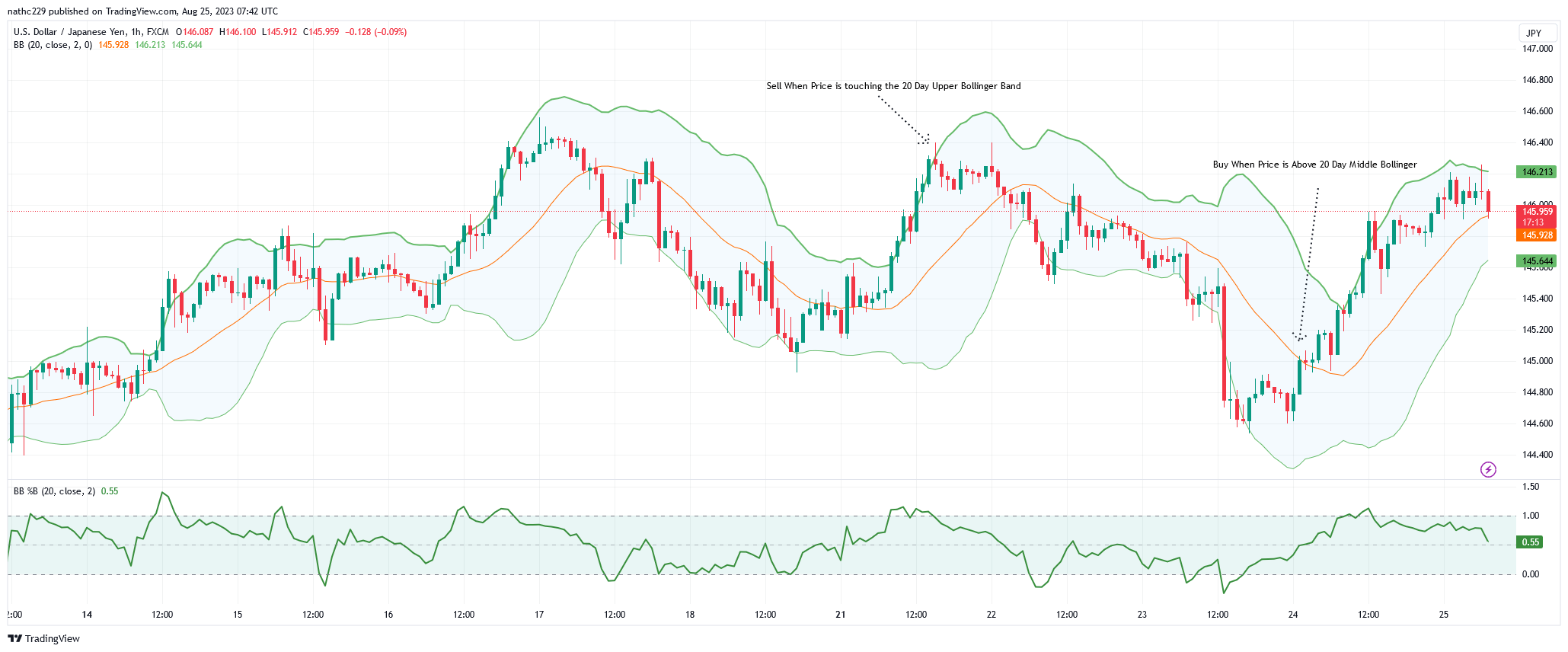

Using Bollinger Bands and Other Indicators

Bollinger Bands are a popular tool for implementing the volatility channel strategy. They consist of a moving average (usually the 20-day simple moving average) and two standard deviation bands above and below the moving average. Traders can also use other indicators, such as the RSI or MACD, to confirm signals generated by the volatility channels.

Disclaimer: The above example is just for educational purposes only. Not Investment or trading advice.

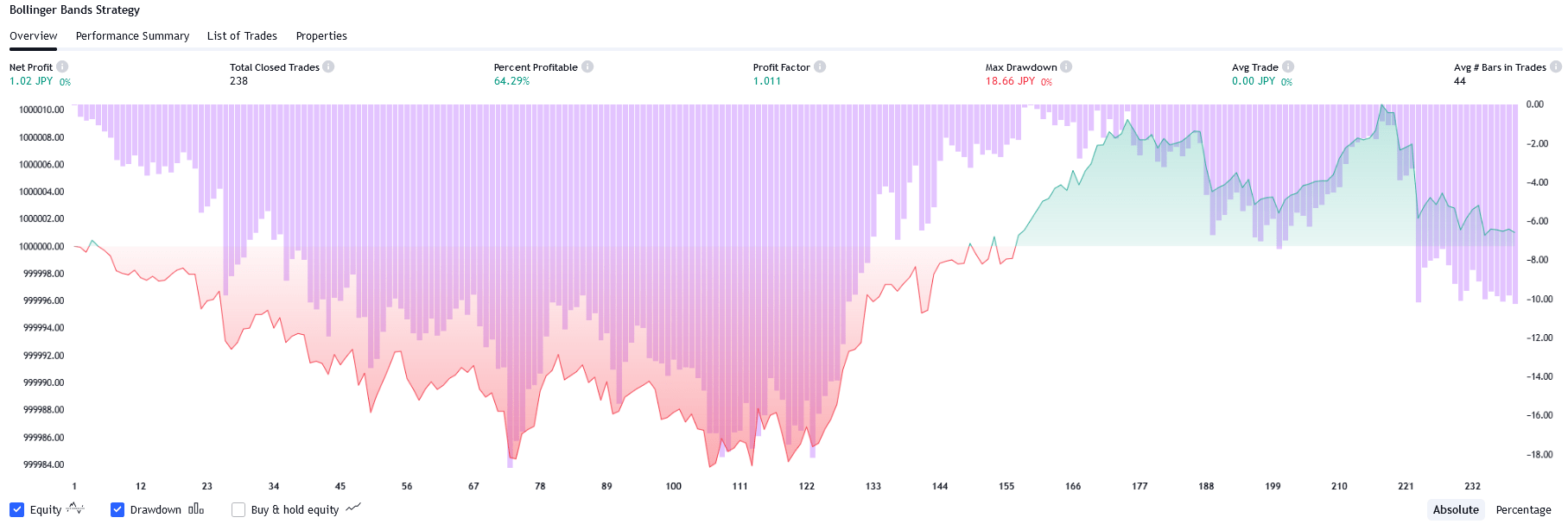

Backtesting and Optimization

Before applying the volatility channel strategy to live trading, it’s essential to backtest and optimize the strategy using historical data. This process helps traders determine the effectiveness of the strategy and fine-tune parameters such as the lookback period, channel width, and indicator settings.

By understanding volatility channels and creating volatility-based trading ranges, traders can identify breakouts and fakeouts in the currency market. Using Bollinger Bands and other indicators can help confirm signals, while backtesting and optimization ensure the strategy’s effectiveness.

High-Impact Economic Events Trading Strategy for Currency Pairs

Selecting High-Impact Economic Indicators

High-impact economic indicators are data releases that can significantly influence currency markets. Examples include interest rate decisions, employment reports, and GDP growth figures. Traders should focus on these indicators to identify potential trading opportunities in currency pairs.

Preparing for Economic Calendar Releases

Traders should monitor an economic calendar to stay informed about upcoming high-impact events. This allows them to prepare for potential market volatility and adjust their trading strategies accordingly.

Understanding Indicators and Data

Trading Leading vs Lagging Indicators

Leading indicators, such as purchasing managers’ indices (PMIs) and consumer sentiment surveys, can provide early signals of economic trends. Lagging indicators, like GDP growth and unemployment rates, confirm existing trends. Traders can use both types of indicators to make informed trading decisions in the currency market.

Interpreting and Responding to Economic Data

When economic data is released, traders should compare the actual figures with market expectations. If the data significantly deviates from expectations, it can cause increased volatility in currency pairs. Traders can capitalize on these price movements by entering trades based on the direction of the market reaction.

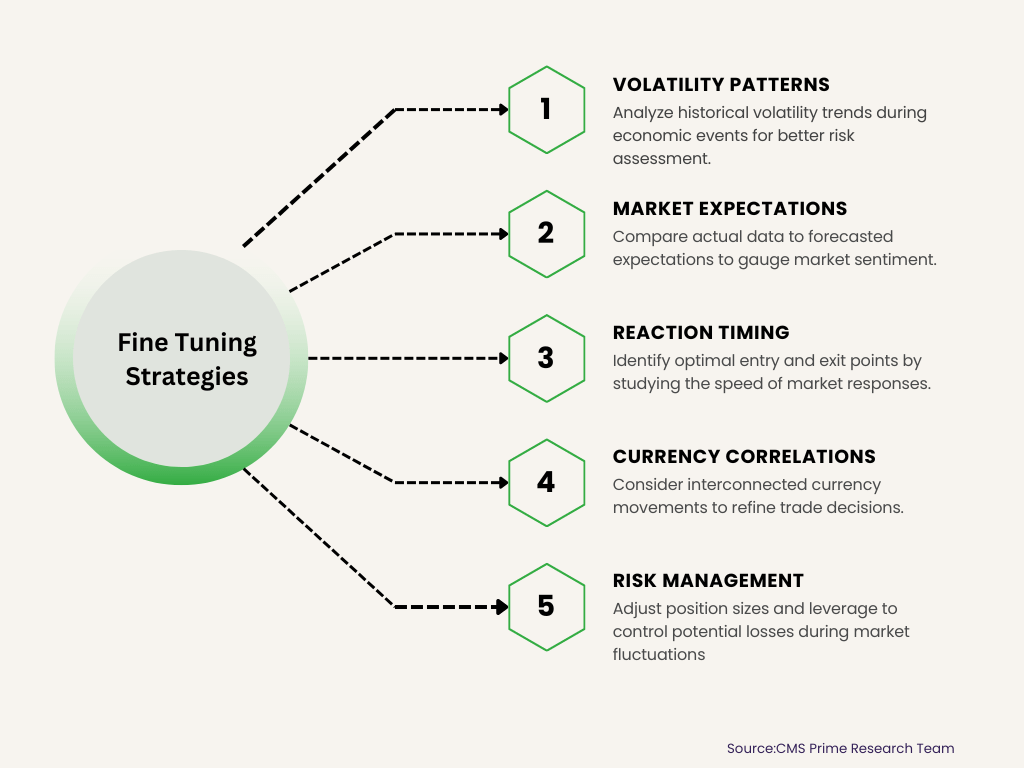

Fine-Tuning Strategy Based on Historical Data

Traders should analyze historical data to fine-tune their high-impact economic events trading strategy. This process involves examining past economic releases and their impact on currency pairs to identify patterns and improve the strategy’s effectiveness.

By selecting high-impact economic indicators and preparing for economic calendar releases, traders can develop a robust trading strategy for currency pairs. Trading leading and lagging indicators, interpreting and responding to economic data, and fine-tuning the strategy based on historical data can help traders capitalize on market opportunities during high-impact economic events.

Conclusion:

In the world of currency trading, volatility is an ever-present force that can make or break a trade. Armed with the insights from these top five trading strategies, traders can confidently approach even the most unpredictable news events. Whether it’s capitalizing on breakouts, reacting swiftly to news-driven momentum, adopting contrarian approaches, or leveraging volatility channels, these strategies offer a comprehensive toolkit to navigate through the stormy waters of the currency market. Remember, success in trading lies not only in seizing opportunities but also in the careful management of risk. By integrating these strategies into your trading arsenal and adapting them to your unique trading style, you’re better equipped to thrive in the exciting and challenging world of volatile currency trading.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.