Introduction:

Forex Statistical Arbitrage is a sophisticated strategy employed in the foreign exchange market. This strategy utilizes statistical and quantitative methods to identify and exploit subtle price differences across various currency pairs. At its core, this approach is anchored in the mean reversion principle, a concept suggesting that prices and returns are inclined to revert to their historical averages over time.

Let’s delve into the specifics:

-

Pair Selection: This step is about choosing the right currency pairs. Traders look for pairs that have historically moved in tandem, such as EUR/USD and GBP/USD, due to similar economic influences in the Eurozone and the UK.

-

Statistical Analysis: In this phase, traders use sophisticated statistical models to gauge the correlation between these pairs. The goal is to pinpoint moments when their prices significantly stray from their usual relationship – these moments are potential goldmines for arbitrage.

-

High-Frequency Trading (HFT): The strategy is often executed using high-frequency trading methods. This is essential for quickly capitalizing on fleeting opportunities presented by minor, short-lived price discrepancies.

-

Data-Driven Decisions: This strategy is profoundly reliant on both historical and real-time market data to inform trading decisions.

Forex statistical arbitrage is primarily a tool for institutional investors and hedge funds, given its complexity and the significant computational resources required. While aiming to be market-neutral and less susceptible to broader market risks, it’s crucial to acknowledge the inherent risks such as model inaccuracies, operational challenges, and evolving currency market dynamics.

Identifying over-performing and under-performing currency pairs

In the context of Forex statistical arbitrage, traders identify over-performing and under-performing currency pairs by analyzing market trends and employing quantitative methods, with a focus on principles like bifurcations, the importance of uniqueness, open mapping protocol, and strength relative to basis. Here’s how these concepts apply:

-

Bifurcations: Bifurcation in financial markets refers to a point where a small change can significantly shift the market trend. In statistical arbitrage, traders may identify bifurcation points in currency pairs, signaling a potential shift from over-performance to under-performance or vice versa.

-

Alterior Thinking Processes: This involves looking beyond conventional market analysis methods. Traders might use advanced statistical models and algorithms to detect subtle patterns and inefficiencies in currency pair movements that are not immediately apparent through traditional analysis.

-

Importance of Uniqueness: Each currency pair exhibits unique characteristics and behaviors. Traders analyze these unique factors, such as country-specific economic indicators, to understand the performance of currency pairs. This uniqueness is crucial in distinguishing between over-performing and under-performing pairs.

-

Open Mapping Protocol: In financial analysis, this concept can be analogous to the openness in analyzing various data sources and market signals. Traders integrate diverse data points, including economic indicators, political events, and market sentiment, to map out potential arbitrage opportunities.

-

Strength to Relative Basis: This involves comparing the performance of currency pairs relative to each other and to broader market indices. By examining the relative strength, traders can categorize currency pairs into over-performing and under-performing groups.

In practical terms, traders might use techniques such as the Augmented Dickey-Fuller test for time series analysis to check for stationarity and non-stationarity in currency pairs, and the Z-score for identifying the deviation from the mean and generating trading signals. Furthermore, they must consider transaction costs and trading speed, as these factors greatly influence the viability and profitability of arbitrage opportunities.

Additionally, it’s important to note the impact of market conditions and regulatory environments in different countries, which can affect the feasibility of implementing statistical arbitrage strategies. This comprehensive approach, grounded in both traditional and innovative analytical methods, is essential for successfully identifying and exploiting arbitrage opportunities in the dynamic forex market.

Mean Reversion and Relative Value in Currency Pairs

The application of the mean reversion principle in Forex statistical arbitrage, involves several complex elements.

-

Bias and Estimations in Mean Reversion: In the context of Forex statistical arbitrage, mean reversion suggests that currency pairs tend to revert to their historical average prices over time. This principle requires careful bias adjustment and estimation, as traders must predict when and how this reversion will occur, taking into account market anomalies and fluctuations.

-

Market-Driven Spectrum: Currency pair performance in Forex markets is significantly influenced by a spectrum of market-driven factors, including geopolitical events, economic data releases, and central bank policies. The mean reversion strategy in statistical arbitrage must be dynamically adjusted to account for these factors, which often cause short-term deviations from long-term averages.

-

Underlying Process Schemas: In Forex markets, the underlying processes include complex interactions between different currencies, influenced by global economic dynamics. Traders use statistical tools like the Augmented Dickey-Fuller (ADF) test for cointegration to determine if a linear combination of currency pairs is stationary, implying a potential for mean reversion.

-

Complexity in Modeling Mean Reversion: The complexity of financial markets, particularly in Forex trading, demands sophisticated modeling techniques. For instance, dynamic modeling of mean-reverting spreads for statistical arbitrage involves using state-space models with time-varying parameters to account for sudden changes in market conditions.

-

Applying A Model: In Forex, this means segmenting currency pairs based on their economic fundamentals or market behavior and applying tailored mean reversion strategies to each segment.

-

Risk Management and Regulatory Considerations: As with any trading strategy, mean reversion in Forex statistical arbitrage involves risk. The strategy might not perform as expected in strongly trending markets and is not immune to sudden market shifts. Furthermore, statistical arbitrage faces different regulatory situations in various countries, affecting its feasibility and profitability.

In summary,the principles of adapting to complex systems, understanding market-driven factors, and managing biases and estimations are crucial for successfully applying the mean reversion principle in this context. Traders must navigate the complexity of currency markets, using advanced statistical methods to identify and exploit mean-reverting behavior in currency pairs.

Key Challenges Traders Face

Implementing Forex statistical arbitrage strategies involves navigating a range of challenges and limitations, often associated with pivotal methodologies, theoretical underpinnings, advanced complexity, fine-tuning strategy to risk, risk on complexity, probabilistic thinking, and mapping interconnectivity. Here are some of the key challenges:

-

Technology and Execution Speed: Rapid execution is crucial in arbitrage trading, as price discrepancies can disappear within seconds. Traders must have access to fast, reliable trading platforms to take advantage of these opportunities. Delays in execution due to technological limitations can significantly impact the profitability of arbitrage trades.

-

Model Risk and Complexity: The mathematical models used in statistical arbitrage, such as correlation tables and co-integration tests, are based on historical data and may be built on assumptions that could become invalid. This complexity requires sophisticated statistical tools, high-speed computational systems, and advanced algorithms.

-

Market Efficiency and Profitability: As more traders adopt arbitrage strategies, the market tends to become more efficient, making profitable opportunities harder to find. The profit potential from forex arbitrage has decreased over time, requiring traders to constantly adapt and innovate their strategies.

-

Regulatory Challenges: Different countries have varying regulations on arbitrage trading. Navigating these legal frameworks can be complex and time-consuming. Traders must ensure compliance with the relevant regulatory bodies to avoid legal repercussions.

-

Risks of Overconfidence and Model Failure: There’s a risk of overconfidence in statistical arbitrage strategies. Unexpected market events or changes can break the statistical relationships, leading to significant losses, especially if leverage is applied.

-

Costs and Slippage: Arbitrage involves multiple transactions across different markets, resulting in additional costs such as transaction fees, spreads, and slippage. These costs can erode potential profits.

-

Risk Management in Complex Strategies: Managing risk in complex arbitrage strategies is crucial. Traders must consider the correlation between arbitrage strategies, portfolios, and positions during the portfolio construction process. The best defense is to assume that the model could fail at any time and fully understand each strategy’s risks.

-

Probabilistic Thinking and Interconnectivity: Understanding the probabilistic nature of market movements and the interconnectedness of global financial markets is essential. Statistical arbitrage requires a deep understanding of how different economic factors and market dynamics influence currency pairs.

-

Utilization of Advanced Algorithms and AI: With the advancement in technology, the future of statistical arbitrage lies in developing more sophisticated algorithms, machine learning, and artificial intelligence. This involves collecting vast amounts of data, feature engineering, and model training and validation.

-

Adapting to Market Conditions: Traders need to be adaptable to changing market conditions. What works in one market environment may not work in another. Continuous monitoring and adjusting of strategies are necessary for success.

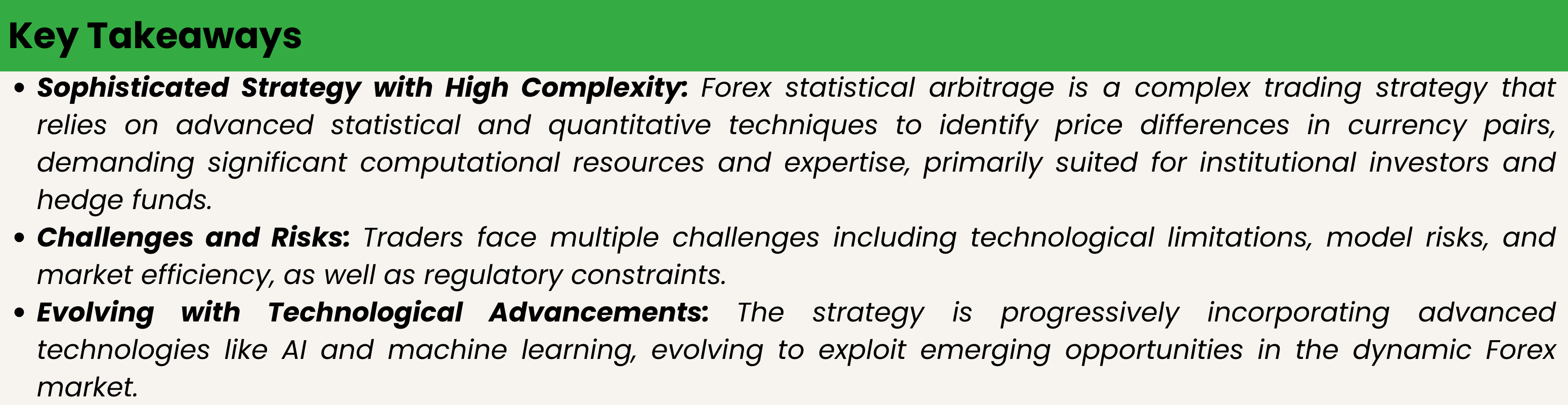

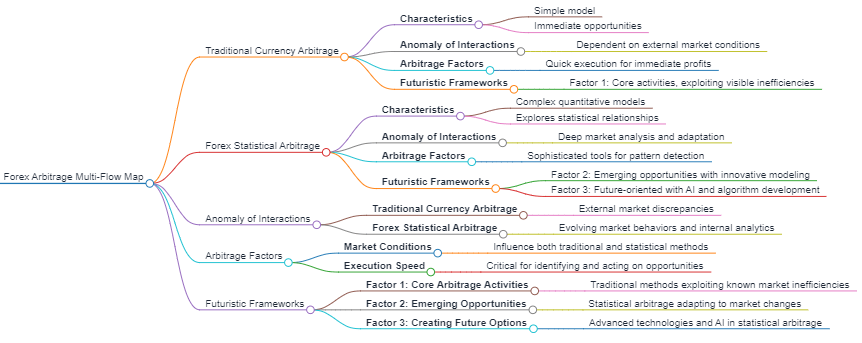

Statistical Arbitrage Vs Traditional Currency Arbitrage Methods

The key differences between Forex statistical arbitrage and traditional currency arbitrage methods can be understood by understanding thier key Diffirences

Image Source: CMS Prime

-

Modeling Frameworks:

- Traditional Currency Arbitrage: This method typically involves simpler models, such as direct two-currency arbitrage or triangular arbitrage. These strategies exploit straightforward discrepancies in currency pair prices across different markets or exchanges. For example, triangular arbitrage involves exploiting inconsistencies between three currency pairs, taking advantage of the exchange rates to make a profit.

- Forex Statistical Arbitrage: In contrast, statistical arbitrage uses more complex quantitative models that identify statistical relationships between currency pairs. This approach involves trading pairs based on their historical correlation or cointegration, looking for deviations from the normal relationship between the pairs and taking positions accordingly.

-

Impact of Other Exogenous Factors:

- Traditional Currency Arbitrage: This strategy often depends on external factors such as discrepancies in pricing, which are outside the control of the trader. The success of traditional arbitrage is heavily reliant on market conditions and inefficiencies.

- Statistical Arbitrage: Statistical arbitrage, while also influenced by market conditions, is more dependent on internal resources such as sophisticated statistical tools, high-speed computational systems, and algorithms. This strategy requires a deeper understanding of market dynamics and the ability to process and analyze vast amounts of data effectively.

-

Three Factors to Consider:

- Factor 1 (Core Arbitrage Activities): Traditional currency arbitrage fits into this category as it involves exploiting immediate and visible market inefficiencies. It’s more about capitalizing on existing opportunities in the market.

- Factor 2 (Emerging Opportunities): Forex statistical arbitrage aligns more with this horizon. It requires innovation in modeling techniques and often explores less obvious, emerging patterns in currency pair relationships.

- Factor 3 (Creating Future Options): In the long term, the development of new algorithms and AI integration in Forex statistical arbitrage represents this horizon. It’s about creating future trading opportunities and advancing the field of currency trading.

In summary, while traditional currency arbitrage relies more on exploiting straightforward market inefficiencies and requires less sophisticated tools, Forex statistical arbitrage involves complex quantitative models and algorithms to identify and exploit pricing discrepancies based on historical correlations and cointegrations. The latter requires more advanced technological resources and a deeper understanding of market dynamics, fitting into a more innovative and future-oriented framework.

Three-Layer Foundation for Interpreting Scope and Bias in Forex Statistical Arbitrage Challenges

Layer 1: Fundamental Causes

- Technological limitations and execution speed constraints are often due to the rapid evolution of financial markets and the delay in corresponding technological advancements.

- The complexity and model risk stem from the inherent unpredictability of financial markets and the reliance on historical data, which may not always predict future outcomes accurately.

- Market efficiency increases as more traders employ similar strategies, naturally eroding arbitrage opportunities due to the market’s self-correcting nature.

Layer 2: Operational Implications

- Despite these challenges, traders persist in using statistical arbitrage strategies because of the potential for high profits in short-term discrepancies.

- The allure of harnessing complex models and advanced algorithms offers a competitive edge, driving traders to continuously innovate and adapt.

- Regulatory challenges and risks are often accepted as a part of the process, with the understanding that careful navigation can lead to lucrative opportunities.

Layer 3: Adaptation and Evolution

Market Sentiments:

- Positive: There is a continuous drive for technological advancement and innovation in trading strategies. The use of AI and machine learning can potentially open new doors for profitable arbitrage opportunities.

- Negative: The increasing market efficiency and regulatory complexities pose significant challenges, potentially limiting profitability and increasing operational risks.

- Neutral: The market’s nature of constant evolution requires traders to be adaptable and vigilant, balancing the positive potential against the inherent risks.

Conclusion

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.