EUR/USD Finds Support After Sharp Slide, Key Technical Levels in Focus

EUR/USD Finds Support After Sharp Slide, Key Technical Levels in Focus

Overview

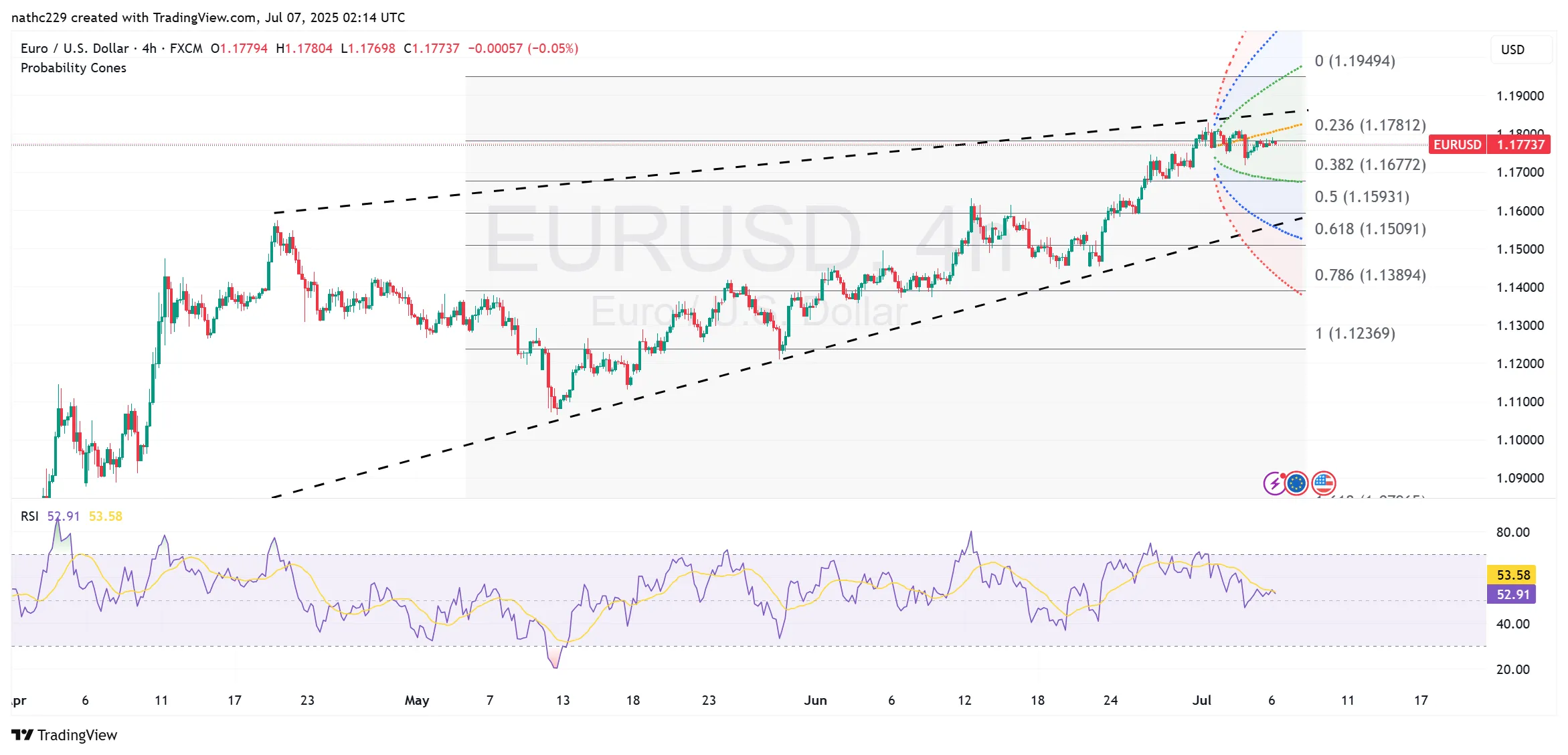

EUR/USD exhibited resilience during Asia trading after facing considerable selling pressure following stronger-than-expected U.S. employment data. The pair managed to regain stability above key support levels, signaling continued bullish momentum despite recent volatility. Traders now closely monitor significant technical barriers and upcoming option expiries to determine short-term direction.

Technical Analysis

EUR/USD endured significant selling pressure, dropping sharply to an intraday low of 1.1717 after the release of surprisingly robust U.S. employment figures, which caused U.S. Treasury yields to spike. However, the currency pair subsequently demonstrated resilience, rebounding modestly during the Asia session to trade within a narrow range between 1.1754 and 1.1772 amid thin holiday market conditions.

Immediate technical support remains crucial at the ascending 200-hour moving average (HMA) positioned at the recent low of 1.1717. A sustained break below this support would likely trigger additional bearish momentum, targeting deeper support levels at 1.1680 and potentially the psychological threshold of 1.1650.

On the upside, immediate resistance is at the descending 100-HMA at 1.1773. Just above this, a wafer-thin hourly Ichimoku cloud between 1.1788 and 1.1789 presents another significant resistance zone. A clear breach above these levels is necessary to confirm a return to bullish momentum, potentially challenging the recent high at 1.1810.

Momentum indicators such as the Relative Strength Index (RSI) suggest cautious optimism, having stabilized from recent volatility but still requiring confirmation from a breakout above key technical resistances.

Economic Indicators and Market Factors

The recent U.S. employment report significantly influenced EUR/USD volatility, driving a notable rise in U.S. Treasury yields and strengthening the dollar. Non-farm payrolls exceeded market expectations, sharply diminishing immediate rate-cut expectations from the Federal Reserve and enhancing the dollar’s short-term attractiveness.

Despite the initial negative impact, EUR/USD’s recovery during the Asia session suggests market participants maintain underlying bullish sentiment for the euro. This sentiment is supported by narrowing U.S.-German yield spreads, bolstered by improved European economic indicators and resilient Eurozone economic recovery expectations.

Upcoming economic indicators remain pivotal, with traders particularly attentive to U.S. inflation data, employment reports, and central bank communications, all potentially significant drivers for EUR/USD.

Options Market Dynamics

Today’s option expiries at the 1.1800 level involve modest volumes; however, substantial expiries scheduled for Monday could substantially influence short-term volatility. Notably, on Monday, massive expiries totaling EUR 3.9 billion between 1.1770 and 1.1775, and EUR 4.3 billion between 1.1800 and 1.1850, could serve as critical technical magnets, limiting volatility or driving sudden price movements around these strike levels.

Risks and Consequences

EUR/USD remains vulnerable to several potential risks. Renewed strength in U.S. economic indicators, such as employment and inflation, could quickly shift sentiment toward a more hawkish Fed stance, pressuring the euro lower.

Geopolitical uncertainties and shifts in broader risk sentiment represent additional volatility factors. Ongoing developments in global trade, political dynamics within the Eurozone, and broader financial market sentiment could rapidly alter the current market equilibrium.

From a technical perspective, a clear breach of critical support at 1.1717 would signal potential for significant bearish momentum, heightening risks of a deeper correction.

Trading Strategies

Traders holding bullish positions should cautiously manage risks, placing protective stops below immediate technical support at 1.1717. Confirmatory bullish signals from sustained moves above the 100-HMA (1.1773) and Ichimoku cloud resistance (1.1788-89) would support additional long exposure.

Conversely, bearish traders might wait for a decisive breach below the 200-HMA (1.1717) before initiating new short positions, targeting lower supports around 1.1680 and 1.1650.

Conclusion

EUR/USD maintains a cautiously bullish bias, supported by critical technical levels and resilient market sentiment despite recent volatility. Traders must vigilantly monitor upcoming economic data, central bank developments, and significant option expiries to navigate effectively in the current dynamic environment.