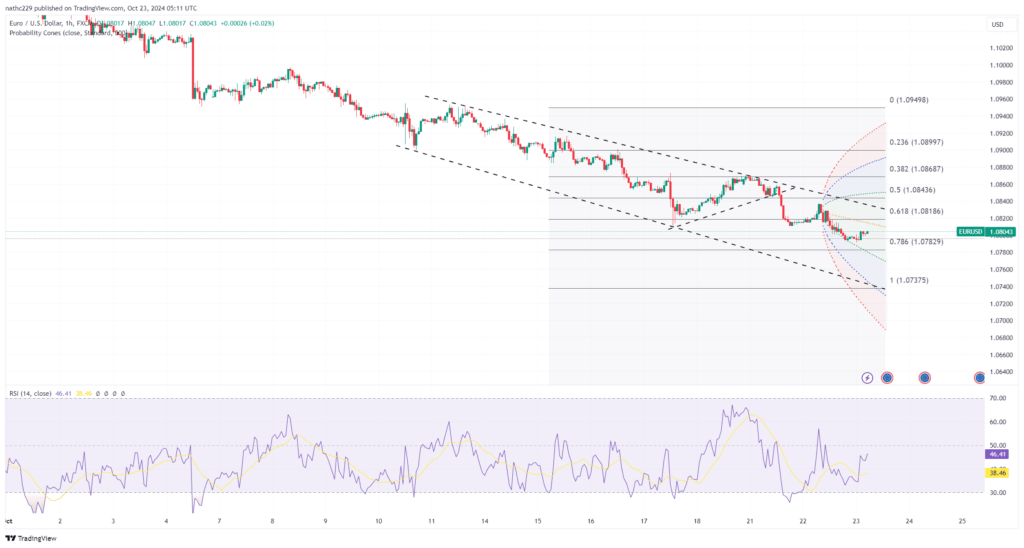

EUR/USD extended its slide during the New York session, trading close to the key psychological level of 1.0800. The widening U.S.-German yield spreads, coupled with stronger U.S. economic data, pressured the euro lower. The IMF’s upgraded U.S. GDP forecasts for 2024 and 2025, contrasted with downward revisions for the euro zone and China, reinforced the divergence in growth outlooks and added to the dollar’s appeal. Additionally, dovish rhetoric from ECB policymaker Mario Centeno, who highlighted the risk of inflation undershooting the 2% target, further weighed on the euro. EUR/USD hit a fresh 2.5-month low of 1.0801, with falling RSIs and a break below the 5- and 200-day moving averages pointing to continued downside risks.

Technically, the outlook for EUR/USD remains bearish, with a daily inverted hammer candle forming after the pair failed to sustain gains near its 5-day moving average. This bearish reversal pattern signals that the pair could face further downside pressure. The key support zone between 1.0775 and 1.0800 is now in jeopardy as yield spreads continue to favor the U.S. dollar, and the ECB’s dovish stance suggests little room for euro recovery in the near term. A break below 1.0775 could trigger a wave of sell stops, accelerating EUR/USD’s decline toward the next major support level near 1.0600.

Looking forward, EUR/USD faces a challenging path as growth divergences between the U.S. and the eurozone deepen. With U.S. yields remaining elevated and eurozone yields under pressure, the dollar’s yield advantage is likely to persist, putting further strain on the euro. If the 1.0775/1.0800 support zone gives way, the pair could see a sharp move lower, with bears likely targeting the 1.0600 region. In the absence of any significant shift in the ECB’s policy outlook or a reversal in U.S. economic sentiment, the bearish trend is expected to remain intact for the time being.