EUR/USD Retreats Amid Tariff Concerns, but Bullish Trend Remains Intact

EUR/USD edged lower on Wednesday, surrendering initial gains after briefly trading above 1.0910, despite the U.S. February inflation data release suggesting lower price pressures. The initial reaction saw Treasury yields and the dollar weaken, supporting EUR/USD toward session highs at 1.0925. However, the rally quickly reversed as ongoing tariff tensions resurfaced, widening German-U.S. yield spreads and enhancing the dollar’s attractiveness. Traders remain cautious, aware that the Fed may reassess its stance on rate cuts amid persistent inflation threats posed by rising tariffs.

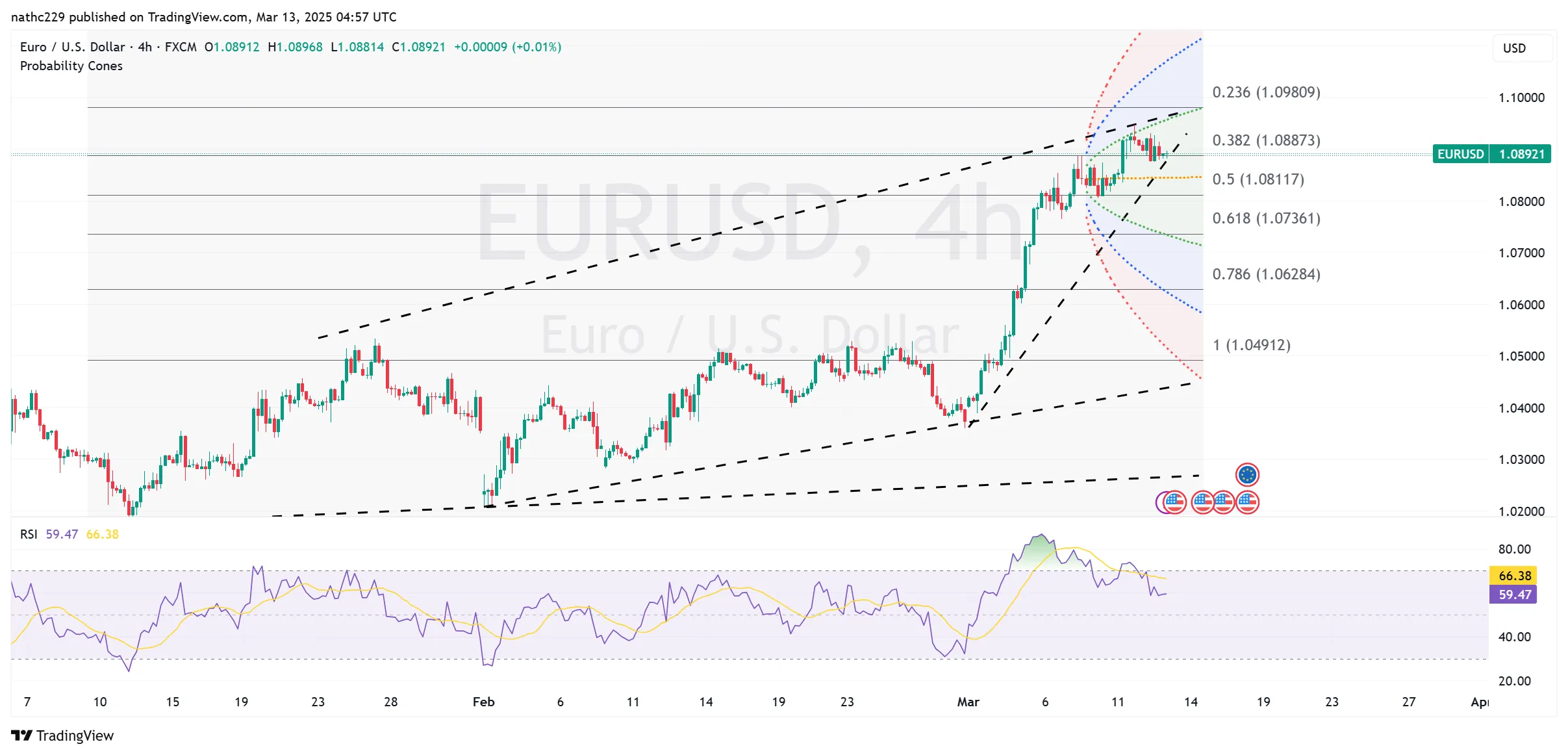

Technically, EUR/USD continues to consolidate around 1.0900 after testing intraday lows near 1.0875. The pair remains within striking distance of key resistance at the recent high of 1.0950/60. A decisive break above this area would confirm bullish continuation toward the November 2024 highs near 1.1000 and potentially set up a retest of the 2024 yearly peak. On the downside, initial support is noted at 1.0875, followed by firmer support at the 21-day moving average at 1.0830. Momentum indicators such as RSI remain bullish but have moderated slightly, suggesting short-term consolidation.

Looking ahead, tariff developments and upcoming U.S. economic data, including Thursday’s February CPI and Friday’s payroll figures, will play a crucial role in determining the next directional move for EUR/USD. Should U.S. data weaken, reinforcing expectations of Fed rate cuts, the euro may regain upside momentum. Conversely, if tariff-related inflation concerns persist, the euro could face renewed pressure, possibly retesting support near 1.0830 or below.