EUR/USD softened slightly during the Asian session, trading within a narrow 1.1156-1.1173 range as turbulent stock markets in the region took center stage. Volatility in Asian equities, particularly the Nikkei’s sharp 4.65% decline due to rising Japanese government bond (JGB) yields, weighed on risk sentiment, sidelining EUR/USD. However, China’s stock market was buoyed by a 5.5% surge in the Shanghai Composite Index, driven by optimism over Politburo pledges to support the property sector. While Asian market turmoil dominated the early trading hours, traders are also positioning ahead of key speeches from European Central Bank (ECB) President Christine Lagarde and U.S. Federal Reserve Chair Jerome Powell, which are expected to provide further direction.

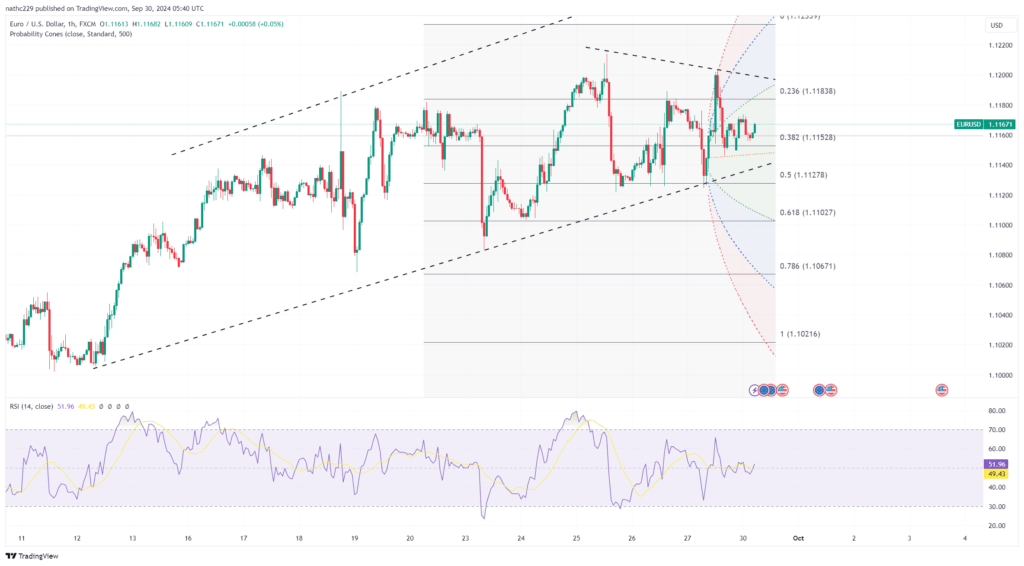

Technically, EUR/USD remains in a modest topside bias as daily momentum indicators flat-line while the 5, 10, and 21-day moving averages are gradually rising. However, the pair remains constrained by immediate resistance at Wednesday’s high of 1.1214, followed by the 0.618% Fibonacci retracement level of the 2021-22 fall at 1.1271. On the downside, initial support lies at last week’s low of 1.1084, with further key support at the September 19 base of 1.1068. Options markets are also active, with large option expirations at 1.1120/25 and 1.1200, which may contribute to short-term price containment as the month-end approaches.

Looking ahead, the spotlight shifts to a busy week of U.S. economic data releases, culminating in Friday’s non-farm payrolls report, where a Reuters poll projects 140,000 new jobs for September. With several Fed officials, including Chair Powell, scheduled to speak, the market will be focused on policy guidance regarding interest rates and inflation. Eurozone data, including final PMIs, inflation (HICP), and unemployment figures, will also be closely watched. With key technical resistance levels capping EUR/USD’s upside, the pair may struggle to extend gains unless U.S. data underperforms, which could drive further dollar weakness and boost EUR/USD toward the 1.1271 level.