EUR/USD surged to a 14-month high of 1.1214 in early New York trading, fueled by expectations that the Federal Reserve will cut rates more aggressively than the European Central Bank (ECB). The rally came as investors continued to price in a higher probability of a 50 basis point Fed rate cut in November, with the CME FedWatch tool indicating over 60% odds, up from just 37% last week. Despite the initial optimism, EUR/USD faced heavy selling pressure as risk sentiment deteriorated, with U.S. Treasury yields climbing and risk-off flows pushing USD/CNH higher. The dollar strengthened, and the broader market saw declines in stocks and commodities, leading EUR/USD to erase its gains, falling to 1.1130 by the session’s close.

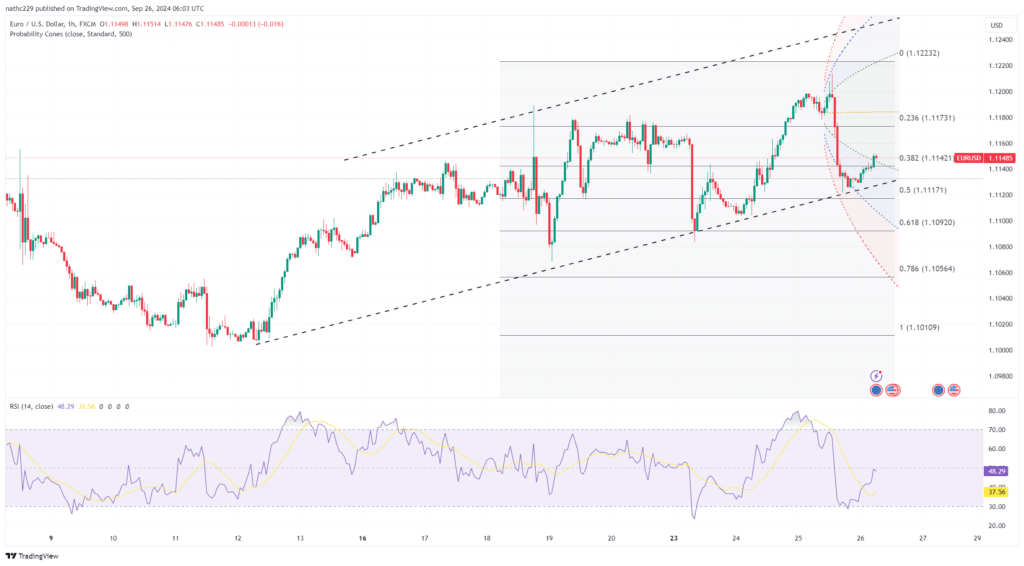

From a technical standpoint, EUR/USD’s retreat is concerning for bulls. The pair not only pierced the 5-day moving average, but also formed an inverted hammer candle, signaling a potential reversal. Additionally, RSI divergence suggests waning momentum for further upside, cautioning long positions. The broader picture, however, remains tilted in favor of the euro, as the Fed’s more aggressive rate-cutting cycle is expected to widen the policy gap with the ECB. U.S. short-term rates markets are pricing in 170bps of Fed cuts by Q2 2025, while Euribor futures indicate only 100bps of cuts from the ECB. This divergence should keep EUR/USD supported, especially if U.S. economic data starts to weaken, reinforcing the likelihood of deeper Fed cuts.

Looking ahead, traders will focus on key U.S. data, particularly weekly jobless claims and the August PCE report, which will provide the latest insights into the U.S. labor market and inflation. If these indicators show signs of softening, it could lead to further tightening of the U.S.-German yield spread, favoring the euro. However, if the data surprises to the upside, it could reverse EUR/USD’s gains as the dollar strengthens on revived expectations of a resilient U.S. economy. For now, EUR/USD remains caught between its bullish long-term outlook and short-term technical warning signs.