EUR/USD Consolidates Gains; Bullish Structure Intact Ahead of Key German Fiscal Vote

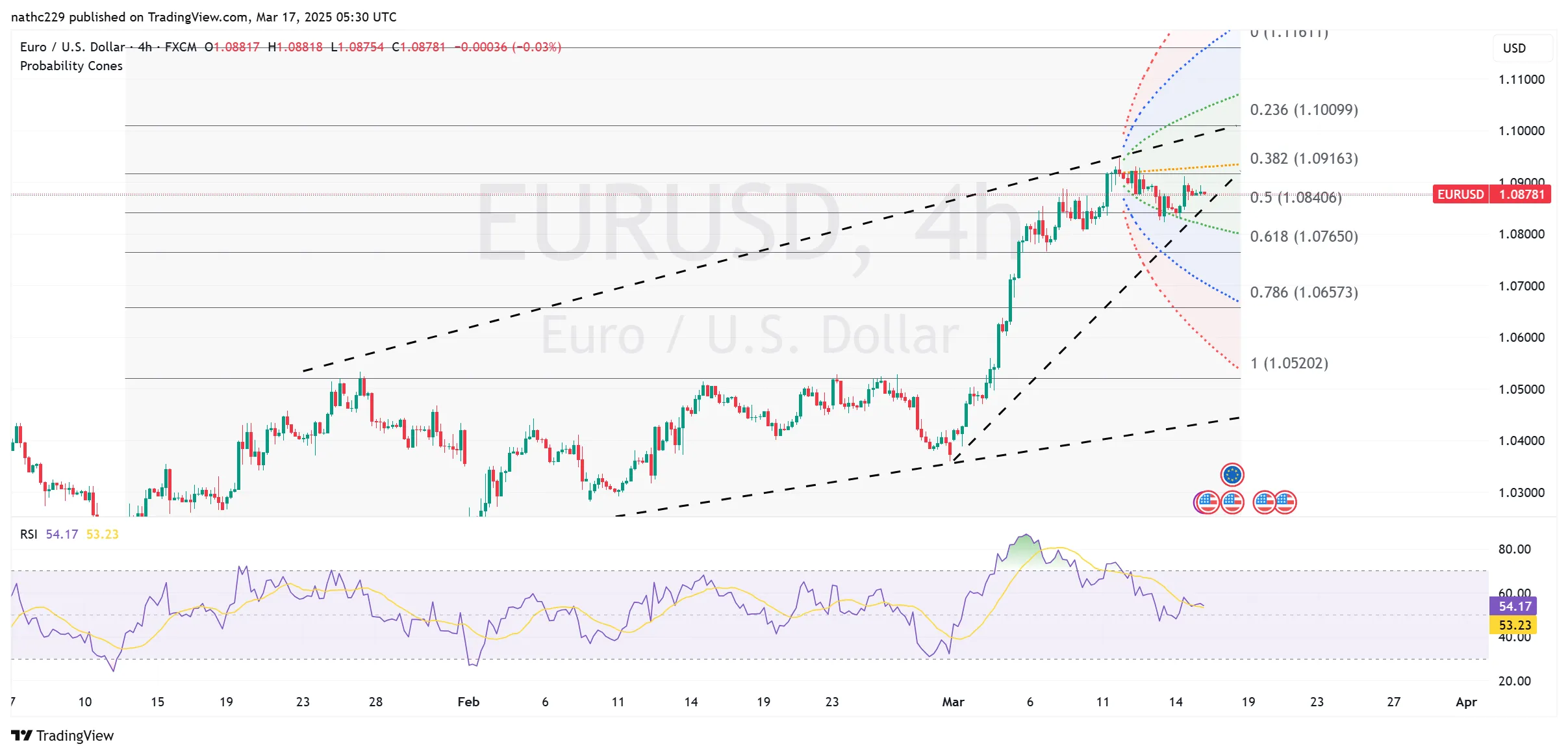

EUR/USD is consolidating near recent highs, currently trading within a narrow band around 1.0870–1.0900, maintaining proximity to its recent peak at 1.0910 set last week. Technical momentum remains supportive of a bullish continuation, underpinned by a consistent climb in the 5-, 10-, and 21-day moving averages, reflecting a strong upward bias. The pair’s technical outlook is further reinforced by expanding 21-day Bollinger Bands, which indicate an ongoing increase in volatility and a potential setup for a bullish breakout toward higher resistance levels in the short term.

Immediate resistance is now located around last week’s high at 1.0910/15, closely aligned with sizeable option expiries at 1.0900, expiring on March 17th (825 million euros), which may act as a magnet for price action in the short term. Above this resistance, the critical test would be at the December 2024 high at 1.0930, and a decisive move beyond could rapidly drive the pair toward the psychological 1.1000 mark. Conversely, initial support is clearly established at last week’s lows near 1.0840-50, followed by the key psychological level at 1.0805, aligning closely with the recent congestion zone lows.

Despite bullish technical signals, near-term caution is warranted given the upcoming geopolitical and macroeconomic events. Tuesday’s German parliamentary vote on a significant increase in state borrowing could substantially impact euro sentiment, potentially accelerating EUR/USD’s upward momentum if approved. Conversely, uncertainty surrounding Russia’s demands for guarantees in peace negotiations with Ukraine poses a geopolitical risk. Should tensions intensify, the euro could face downside pressure. Market participants will closely monitor these developments along with upcoming U.S. economic data, including the inflation and employment reports, to gauge future Fed policy moves and refine their EUR/USD positioning.