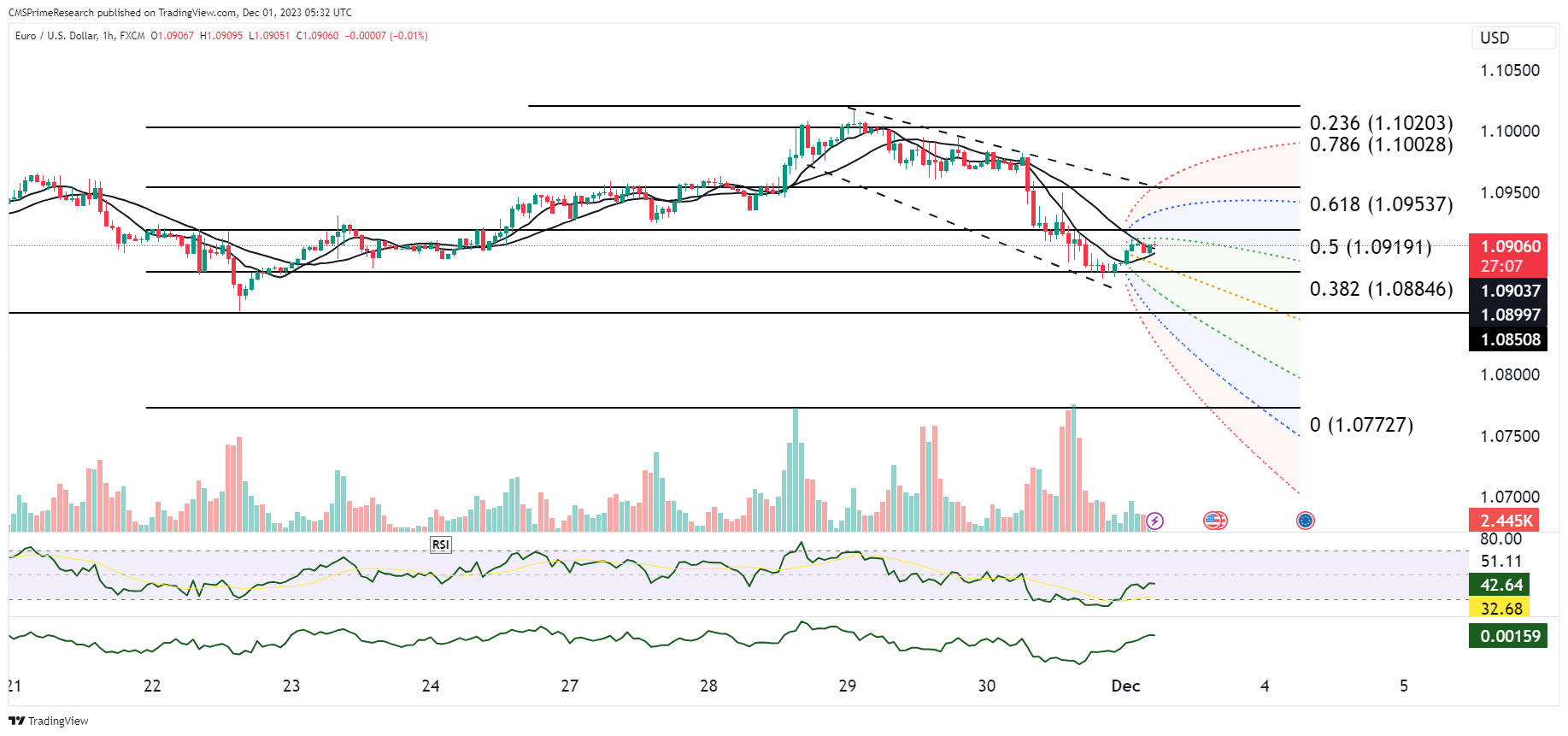

EUR/USD Bearish waiting to test the 1.08997 level

EUR/USD currency pair has recently undergone notable movements. After a drop from the high on Wednesday, the pair experienced a brief recovery overnight before encountering renewed selling pressure. This dynamic coincided with a rise in U.S. yields and the U.S. dollar, even though some economic data suggested a potential dovish stance from the Federal Reserve.

Technically, the pair reached a low of 1.0888, closing the day with a slight decrease from previous day. Technical indicators such as the Relative Strength Index (RSI) show a downward trend, with the pair falling below its 50-Day Moving Average at 1.09335. However, a rising monthly RSI and the pair’s position above the 200-Day MA 1.07368 at offer some reassurance to bullish investors.

Looking ahead, key data releases like the Chinese November Caixin Manufacturing PMI and U.S. November ISM Manufacturing PMI pose potential risks. Furthermore, speeches by Fed Chair Powell at Spelman College are anticipated as significant events that could influence market dynamics. These appearances are particularly crucial as they precede the Fed’s blackout period starting Saturday, ahead of the December 13th Fed decision. Market participants are keenly awaiting these speeches for indications about the Fed’s future policy direction, especially regarding market expectations of interest rate cuts in 2024. The bond market’s response to these events, along with relative movements in Eurozone/U.S. yields, will be critical in determining the short-term trajectory of the EUR/USD pair.

Key Levels to Watch: : 1.10000,1.09321,1.08850,1.08000

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08850 | 1.09321 |

| Level 2 | 1.08635 | 1.09850 |

| Level 3 | 1.08394 | 1.10000 |