EUR/USD Balancing Bullish Trends and Key Resistance Levels Amid Subdued Global Risk Appetite

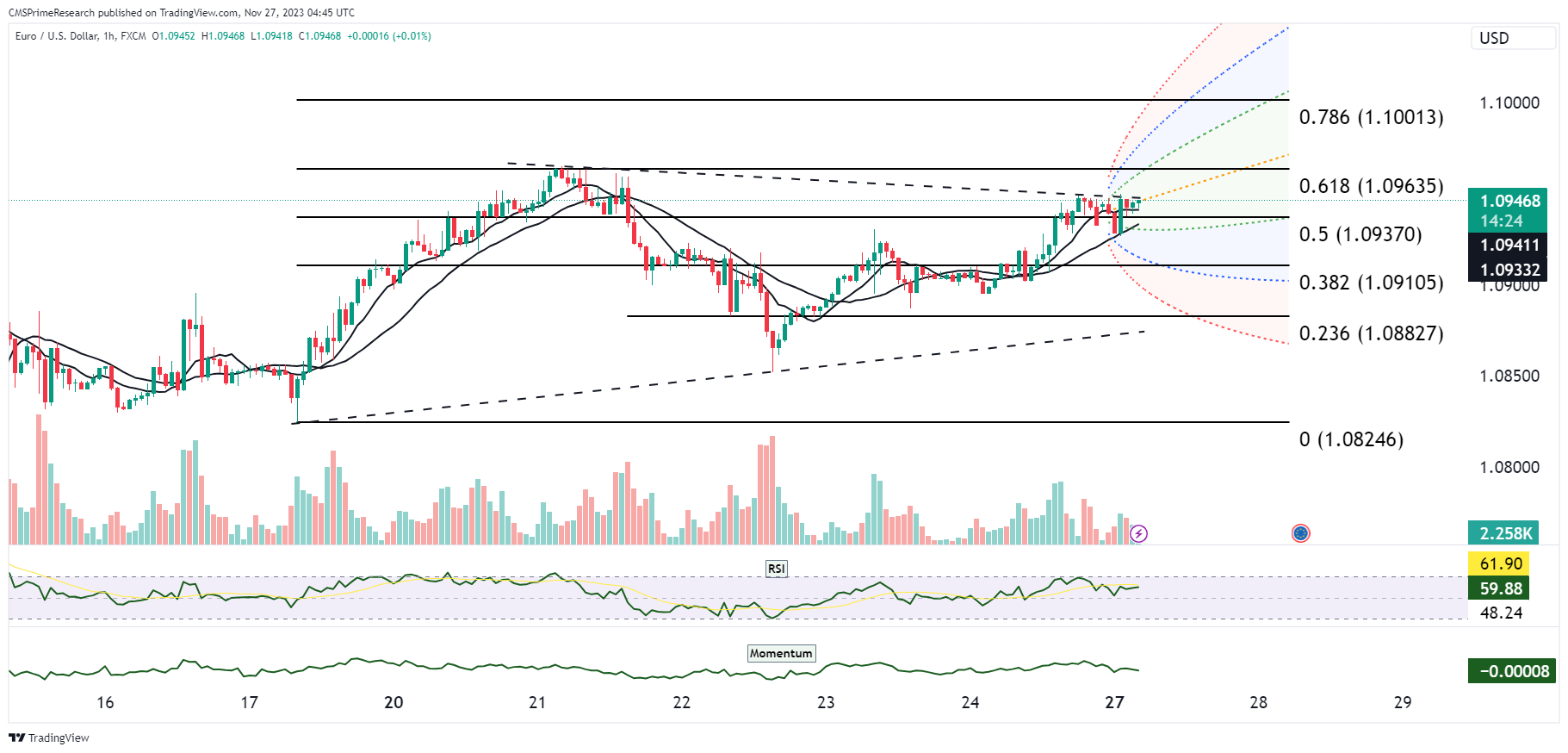

The Euro (EUR) has been exhibiting a bullish trend against the US Dollar (USD), though it lags behind the rally seen in the GBP/USD pair. The momentum for EUR began from its low at 1.0853 on Wednesday and continued to make gains, reaching 1.0945. However, for a more significant upward movement, EUR/USD needs to break above the resistance level of 1.0965, which was the high on November 22. Breaking this threshold may trigger a stronger bullish trend.

The currency pair’s movement has been influenced by various factors, including the global risk appetite, which currently appears subdued, leading to a neutral market sentiment. This subdued risk appetite is reflected in sinking volatility levels. Another key factor to consider is the position of market participants. Currently, there are fewer constraints on the rise of the EUR, with long positions significantly lower compared to levels seen in July ($15 billion vs. $25 billion).

On the US side, business activity has remained steady as per the S&P Global survey in November, which might influence the USD strength.

Technically, EUR/USD has been trading within a key range, with major levels at 1.1276 (the July high) and 1.0448 (the October 3 low). A significant bullish way marker is identified at the 76.4% Fibonacci retracement level of this range, which lies at 1.1081. Further, the longer-term charts suggest that the pair is moving towards the middle of its trading range. A critical level to watch is 1.1271, which represents the 61.8% Fibonacci retracement of the 1.2349-0.9528 drop.

The pair has shown a sustained bid tone, opening at 1.0933 after a 0.26% rise on Friday, when the USD broadly eased. The move higher was also influenced by Tokyo’s selling of USD/JPY, which gave the USD a broadly offered tone. Resistance is currently pegged at the November 21 high of 1.0965, and a break above this level could target the 76.4% Fibonacci level of the July to October fall at 1.1080. The currency pair is trending higher, with the 5, 10, and 21-day Moving Averages aligned in a bullish configuration. Support is found at the 10-day MA at 1.0901, and a break below this level could indicate the formation of a top.

Overall, the EUR/USD pair shows a bullish trend in the short term, influenced by both fundamental factors and technical indicators. However, key resistance levels must be breached for the trend to gain more significant momentum. The subdued risk appetite and steady US business activity are also crucial factors to consider in the near-term movement of this currency pair.

Key Levels to Watch: : 1.10000,1.10469,1.09370

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.09370 | 1.09635 |

| Level 2 | 1.09370 | 1.09850 |

| Level 3 | 1.09105 | 1.10012 |