EUR/USD Steady Near 13-Month High as Investors Await Powell’s Jackson Hole Speech

The EUR/USD pair traded near flat on Wednesday, stabilizing close to a 13-month high as the market awaited crucial signals from Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium. The broader uptrend in the euro paused as traders showed caution ahead of what is expected to be a key event in determining the future direction of the currency pair. Many investors are expecting Powell to lay the groundwork for the beginning of the Fed’s rate cut cycle, though there is also speculation that he may offer clues about the potential for deeper cuts than currently forecasted by the U.S. central bank.

Wednesday’s trading was influenced by the U.S. Department of Labor’s preliminary estimate of the Nonfarm Payrolls (NFP) benchmark revision, which revealed a significant downward adjustment, indicating that 818,000 fewer jobs were created than previously reported. This revision casts doubt on the robustness of the U.S. labor market and bolsters the case for more aggressive monetary easing. The report also contributed to a decline in U.S. Treasury 2-year yields to a 5-session low, diminishing the dollar’s yield advantage over the euro. Furthermore, the spread between German and U.S. yields tightened to its narrowest point since August 6, adding further support to the euro. The rates market has responded by pricing in just over 100bps of Fed cuts for 2024, up from slightly more than 90bps on Tuesday.

Despite these bullish signals, EUR/USD traders are exercising caution ahead of Powell’s speech. Should Powell express concerns about the weakening U.S. labor market, it could lead to further declines in U.S. yields and a corresponding drop in the dollar. In this scenario, the euro might break through its December monthly high, triggering stop-buying and pushing the pair towards the 1.1275/1.1300 range.

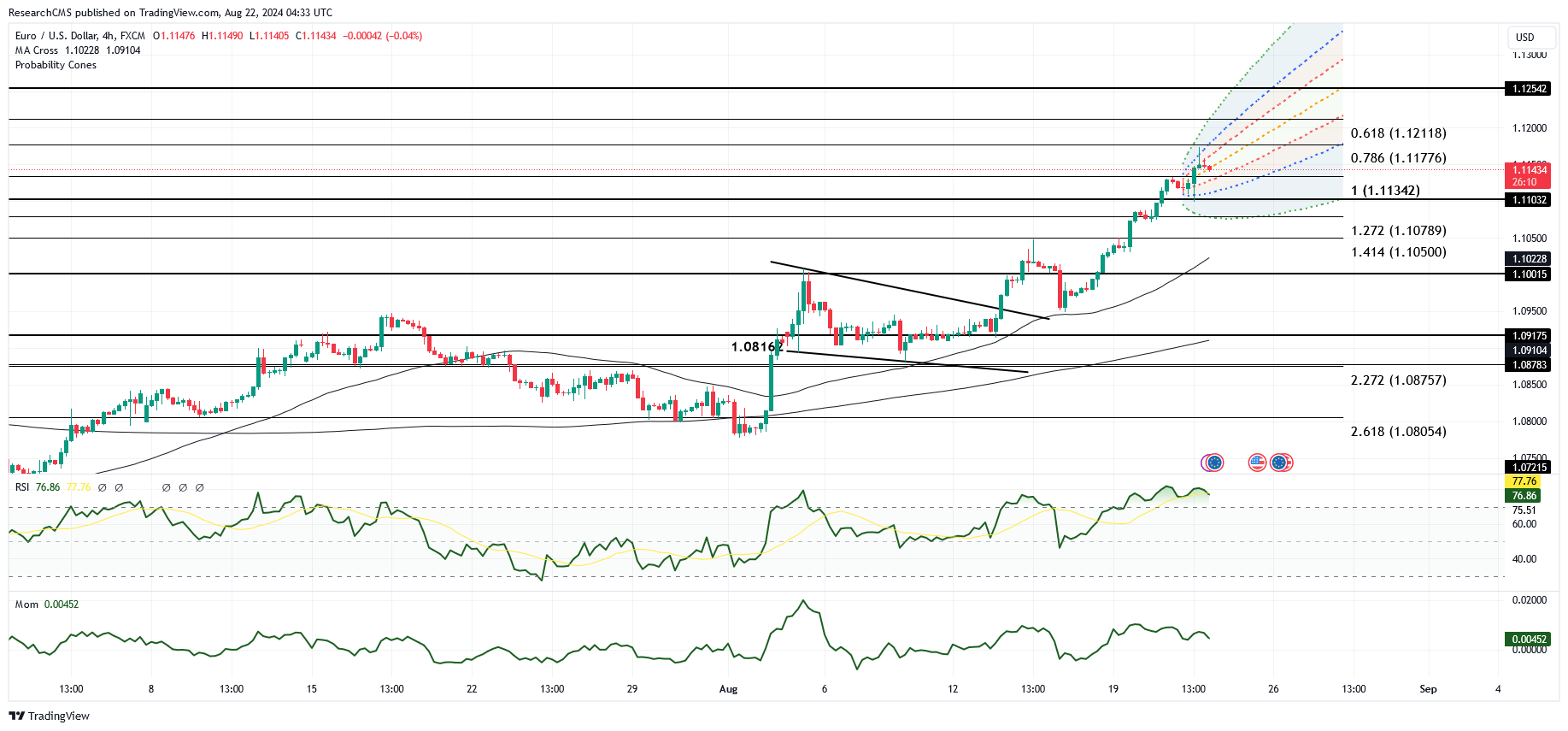

From a technical standpoint, EUR/USD is displaying bullish characteristics, with rising Relative Strength Index (RSI) levels and the formation of bullish hammer candlestick patterns on both daily and monthly charts. These technical indicators suggest that the pair’s uptrend could continue if Powell’s remarks align with market expectations. However, upcoming economic data releases, including the Eurozone’s August HCOB PMIs and U.S. weekly jobless claims along with August S&P Global PMIs, could introduce some short-term volatility, especially with Powell’s Jackson Hole speech on the horizon.

In conclusion, EUR/USD remains near its recent highs, but the direction of the next move is likely to be heavily influenced by Powell’s upcoming speech. If Powell signals a more dovish stance, particularly in light of labor market concerns, the euro could see further gains. Conversely, if he emphasizes the underlying strength of the U.S. economy, the dollar could rebound, potentially leading to a pullback in EUR/USD.