The EUR/USD pair climbed to its highest level in seven months

On Friday, the EUR/USD pair saw a slight increase, reaching 1.1010, but the upward movement lacked strong conviction. The trading day began near 1.0995 in New York after the pair briefly touched 1.0971 overnight. While the euro initially rose above 1.1000, it later pulled back towards 1.0985, reflecting the market’s cautious sentiment amidst mixed U.S. economic data.

The U.S. dollar and Treasury yields experienced a decline following the release of disappointing housing data, which showed a significant drop in housing starts to their lowest level in a year and a half. This data suggested a potential weakening of the U.S. economy, leading investors to increase their expectations for a 50bps rate cut by the Federal Reserve in September, as indicated by the CME’s FedWatch Tool. However, this sentiment was somewhat offset by the University of Michigan’s preliminary consumer sentiment report for August, which came in at 67.8, up from July’s 66.4 and slightly above the expected 66.9. The improvement in consumer confidence helped U.S. yields recover from their earlier declines, offering some support to the dollar.

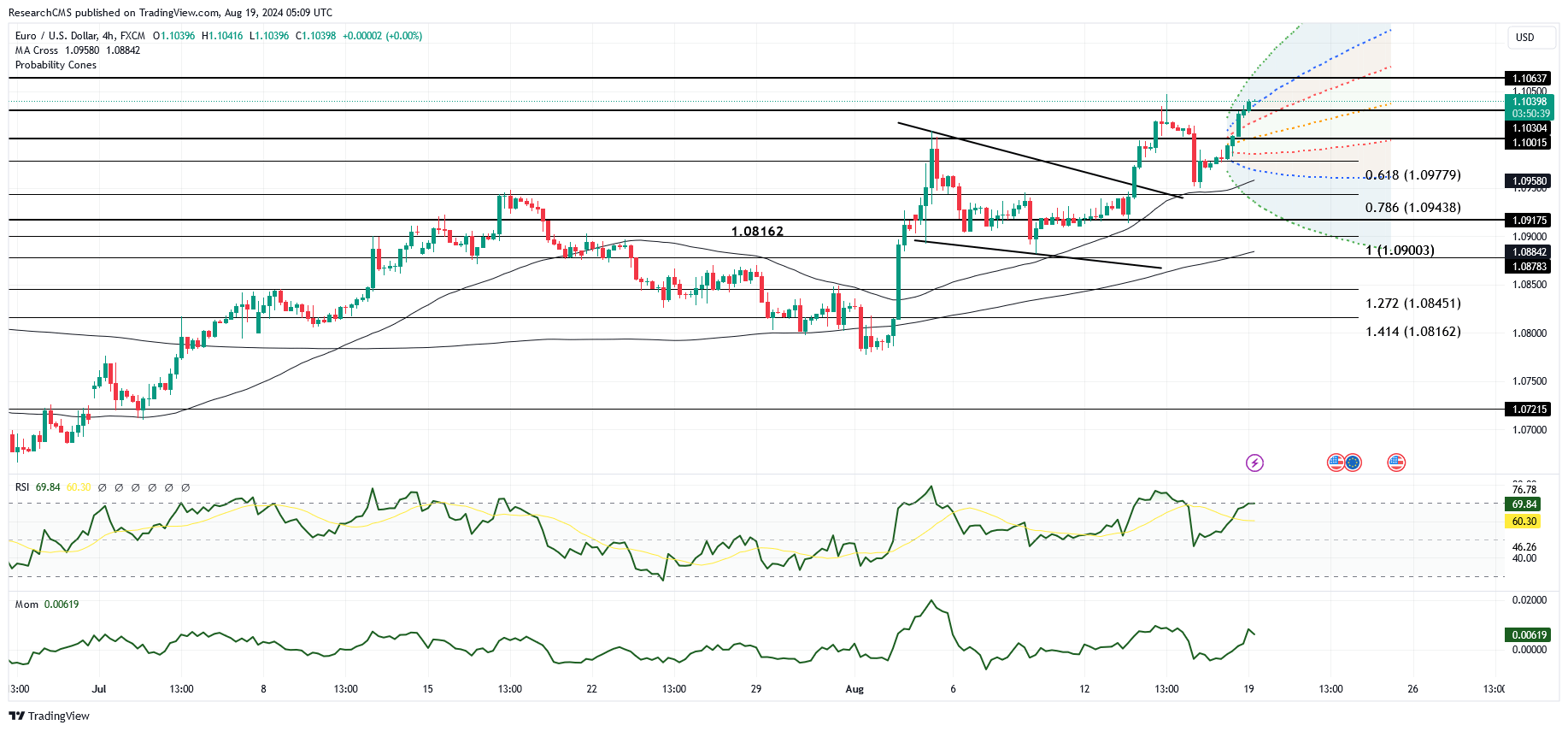

From a technical perspective, EUR/USD remains in a cautiously bullish posture. The pair is trading above a trend line drawn from the high of 2023, and the rising Relative Strength Index (RSI) signals the potential for continued upward momentum. The euro’s ability to stay above key daily moving averages and the ongoing consolidation of its recent gains bolster the bullish outlook. Nevertheless, the price action suggests some hesitation, as EUR/USD remains within the trading range set earlier in the week, on August 14-15. The formation of daily inverted and bullish hammer candlesticks during this period indicates that the market might be entering a consolidation phase.

As the market looks forward, the Federal Reserve’s upcoming Jackson Hole symposium and the release of global Purchasing Managers’ Indexes (PMIs) for August are expected to be pivotal events. These developments could influence market sentiment and risk tolerance significantly. For the euro to maintain its upward trajectory, traders may need to see more compelling evidence that the U.S. economy is slowing down, which could prompt the Fed to consider more substantial rate cuts. Upcoming U.S. economic reports, including Q2 GDP, July’s Personal Consumption Expenditures (PCE), and August payroll data, will be critical in shaping the pair’s longer-term outlook.

In conclusion, while EUR/USD has made some progress, the overall market sentiment remains mixed, keeping the bulls on alert. The sustainability of the euro’s rally will likely hinge on forthcoming economic data that could either confirm or dispel the notion of a significant U.S. economic slowdown, which would influence the Fed’s approach to monetary policy.