EUR/USD Bullish Trends Amidst USD Fluctuations, Eyes on Key Support at 1.0831

The EUR/USD currency pair has been experiencing a slight upward trajectory, influenced by movements in the USD/CNH pair. The session began with a minor decline in the EUR/USD, opening at 1.0911, attributed to a strengthening of the USD during the U.S. trading session. However, as the day progressed, a weakening of the USD against the Chinese Yuan (CNH) contributed to an upward drift in the EUR/USD pair. By the afternoon, the pair was trading around its session highs, in the range of 1.0920 to 1.0925.

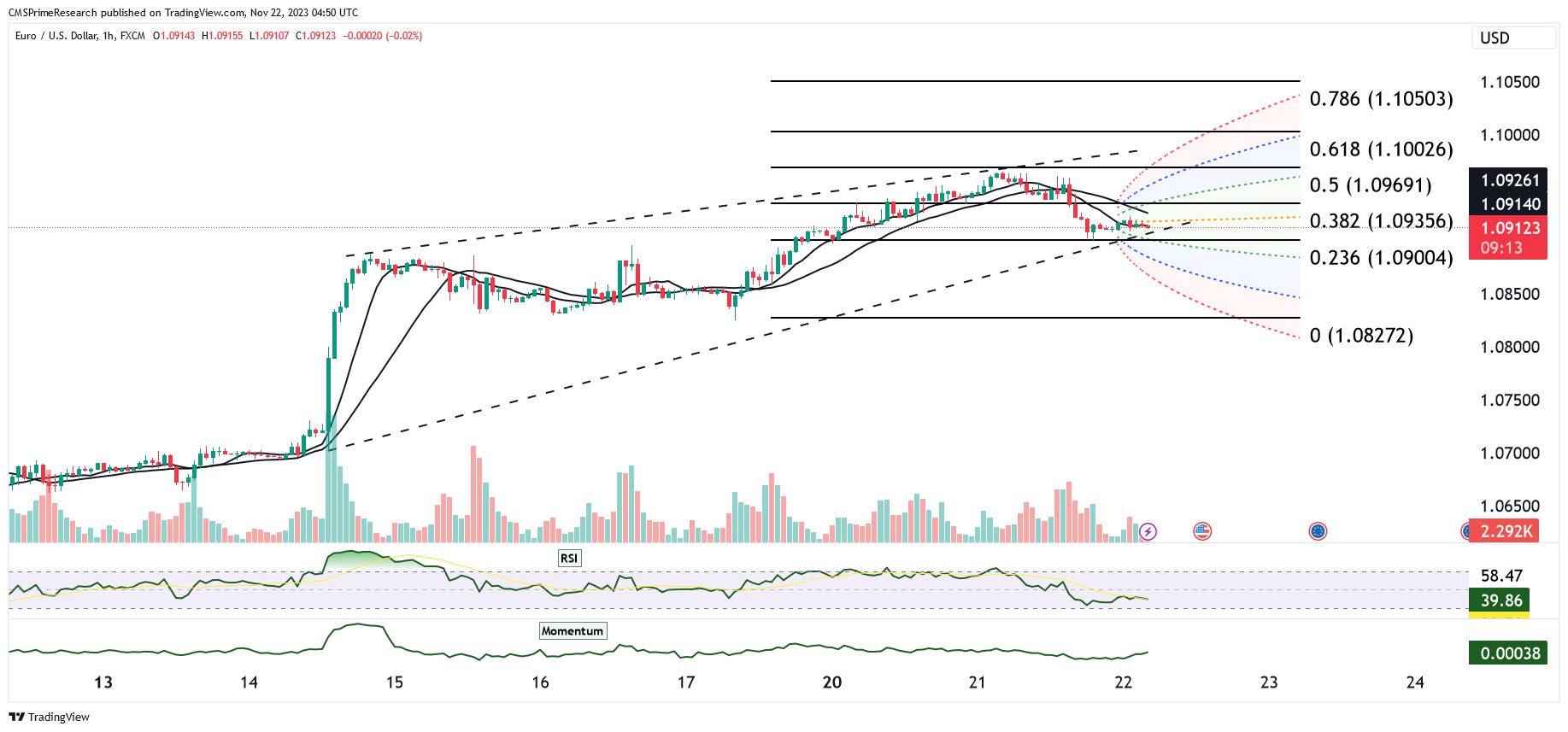

This movement can be seen as a consolidation phase for the EUR/USD, following its recent peak near the 61.8% Fibonacci retracement level of the July to October decline, which was at 1.0958. The trend appears to be bullish, as indicated by the alignment of the 5, 10, and 21-day moving averages. Currently, the key support level is identified at the 10-day moving average, around 1.0831. A breach below this level could reduce the upward momentum.

In the short term, the EUR/USD pair may exhibit a range-bound behavior, especially ahead of the upcoming U.S. holiday on Thursday. The overall bias seems to be tilted towards an upward movement, as long as the pair maintains its stance above the 1.0831 support level on any downward fluctuations.

In conclusion, the fundamental aspects, such as the USD’s performance against the CNH, are significantly influencing the EUR/USD pair. The technical indicators suggest a bullish alignment but also point towards potential consolidation in the near term. The support level at 1.0831 remains crucial for sustaining the upward trend. Investors and traders should closely monitor these levels and indicators to gauge the pair’s future trajectory.

Key Levels to Watch: : 1.09200,1.08935,1.09565,1.08850,1.08393

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08850 | 1.09322 |

| Level 2 | 1.08630 | 1.09460 |

| Level 3 | 1.08393 | 1.09650 |