EUR/USD Gains as Lower U.S. Yields Pressure Dollar; Focus Shifts to Upcoming U.S. CPI Data

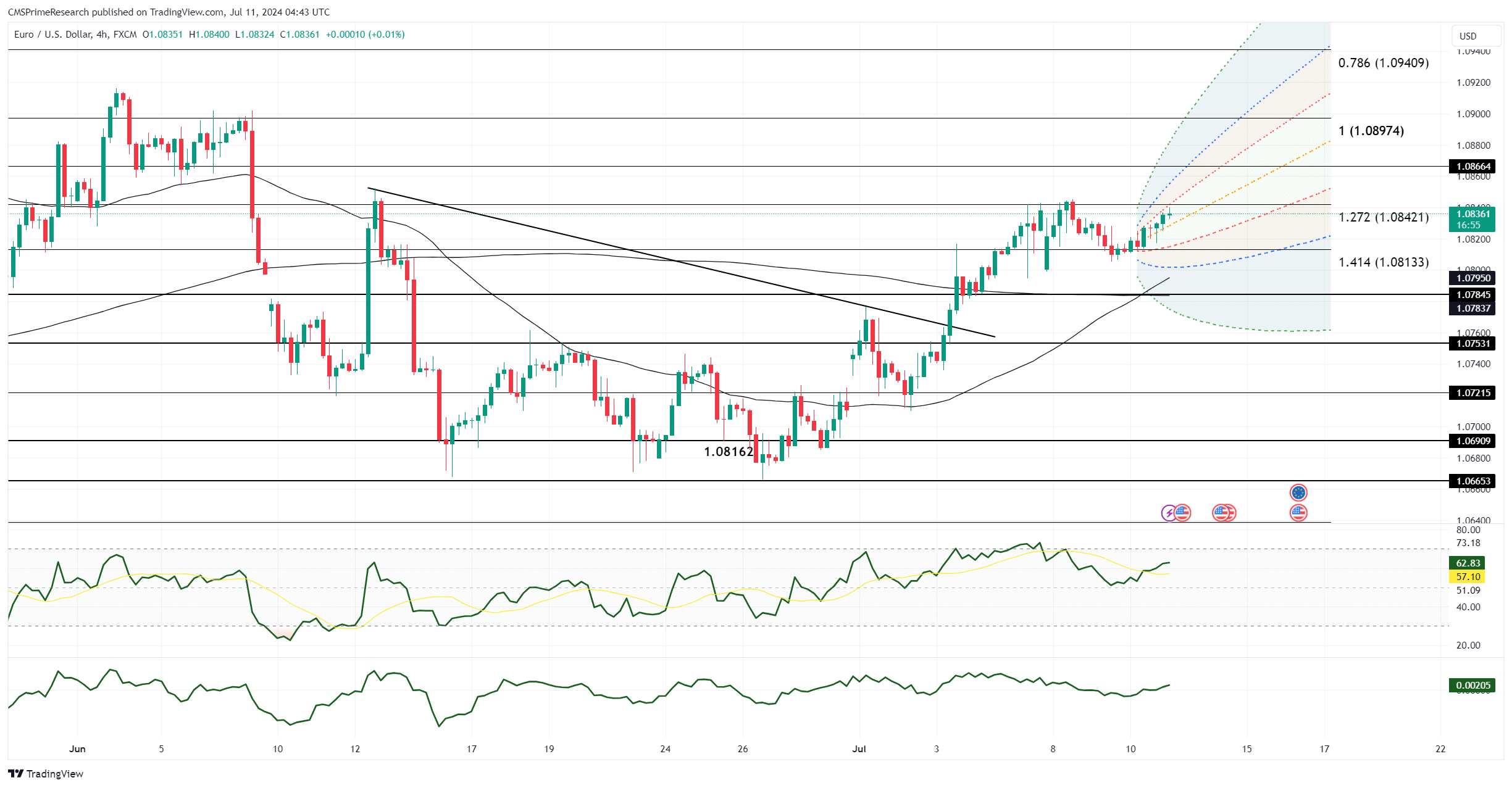

The EUR/USD traded higher on Wednesday, supported by lower U.S. yields that applied downward pressure on the dollar. This price action bolsters bullish technical signals, but confirmation will likely hinge on upcoming U.S. pricing and employment reports. Daily charts reveal that gains off the June 26 low are consolidating, with EUR/USD trading above several daily moving averages and near the top of the daily cloud. Both monthly and daily RSIs are rising but have not yet reached overbought territory, indicating that upward momentum remains robust. With bullish technicals suggesting further upside potential, EUR/USD longs now await supportive U.S. data.

Key data releases include June CPI and PPI, along with weekly jobless claims. Should the pricing data indicate that disinflation is occurring and the Fed’s inflation target is nearing, and if the jobless claims suggest a weakening job market, EUR/USD’s rally could resume. In this scenario, U.S. yields may decline further, placing additional pressure on the dollar. The dollar’s yield advantage over the euro could diminish as German-U.S. spreads tighten, potentially allowing EUR/USD to test the 1.0980/1.1000 resistance levels.

In New York, EUR/USD opened near 1.0820 after trading at 1.0811 overnight on EBS. The rally extended slightly due to softer U.S. yields and a weaker dollar, with EUR/USD trading up to 1.0829. A rally in EUR/JPY to a record high of 175.065 also helped buoy EUR/USD, alongside gains in gold and equity markets. The pair pulled back slightly, nearing 1.0825 late in the session but still up 0.10%. Technically, the outlook remains bullish, with rising RSIs and the pair trading above the 200-day moving average, indicating ongoing consolidation.