EUR/USD Under Pressure: Technical Signals Bearish Amid US Data and French Political Uncertainty

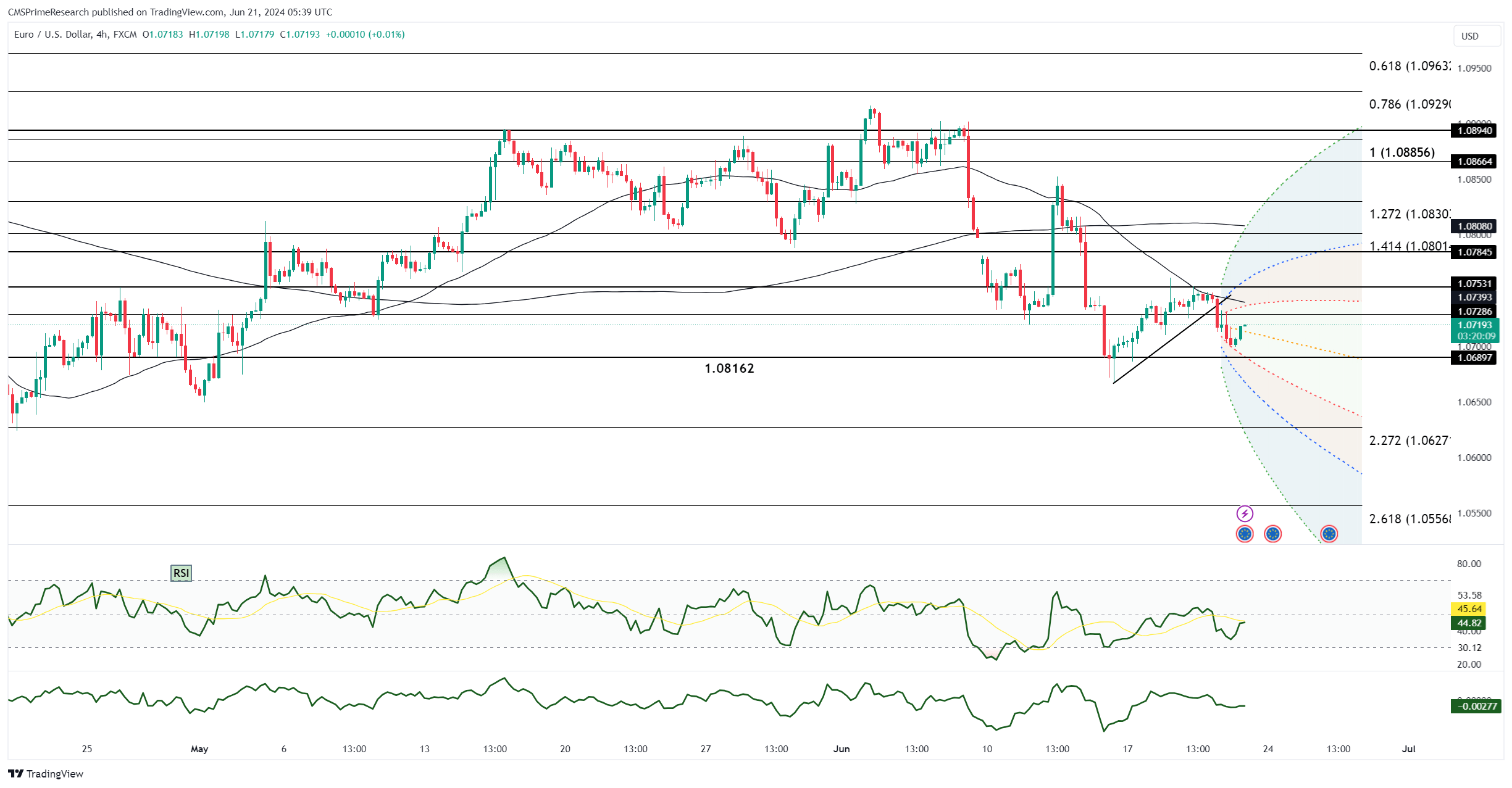

Fundamental analysis reveals that EUR/USD longs might be uneasy as the currency pair slipped below the 10-day moving average (10-DMA) on Thursday, despite generally favorable factors. U.S. weekly jobless claims surpassed forecasts, with the previous week’s numbers adjusted upwards, and continuing claims also rose. Additionally, the Philly Fed business index and housing starts underperformed expectations. These developments bolstered investor sentiment that the Federal Reserve will reduce rates twice in 2024. Even with a broad rally in stocks, gold, and oil, the EUR/USD couldn’t sustain its post-data gains and traded lower. Technically, the EUR/USD remains under pressure with bearish signals. Both daily and monthly Relative Strength Indexes (RSIs) are declining and haven’t yet reached oversold territory, indicating ongoing downward momentum. The pair is trading below several daily moving averages and the daily cloud, reinforcing the bearish outlook. The recent rise from the June 14 low seems to be a corrective bounce rather than a sustained rally. Price action and technical indicators suggest a higher likelihood of testing April’s low, with a break below this support potentially targeting the 1.0450/1.0500 range.

Recent market activity saw New York opening near 1.0730 after trading at 1.0749 overnight on EBS, with the slide continuing. The pair rallied above 1.0730 following the U.S. jobless claims, Philly Fed, and housing reports. Despite a dip in U.S. yields and the dollar post-data, both reversed and rallied later. The German-U.S. yield spreads widened, and USD/CNH rallied towards 7.2920. Stocks turned negative, and gold gave up some earlier gains. EUR/USD dropped further from the 10-DMA, trading at 1.0704, down 0.37% late in the session. Technical indicators remain bearish with falling RSIs and the pair below several daily moving averages and the daily cloud. Looking ahead, the June EZ HCOB PMIs and U.S. June S&P PMIs are critical data risks for Friday. Political uncertainty remains with the French elections, raising concerns about potential fiscal policy changes that could lead to a budget crisis. In Asia, EUR/USD was bid ahead of a series of European PMI data, trading in a 1.0701-1.0717 range with the USD down 0.05%. European and U.S. Services and Manufacturing PMI data present significant data risks, while political risk persists with Macron’s centrists lagging in French polls. Technical charts show slipping momentum studies, expanding 21-day Bollinger bands, and falling 10 and 21-day moving averages, indicating a net negative bias. The pair targets a test of 1.0594/1.0601, aligning with 0.786% of the Oct-Dec rise and April’s low. Initial support and resistance are identified at Monday’s 1.0686 low and Tuesday’s 1.0761 high, respectively, with option strikes for June 21 at 1.0690/00 at 2.817BLN and 1.0720/25 at 1.316BLN. In conclusion, EUR/USD faces a challenging environment with bearish technical signals and uncertainties from economic data and political risks, warranting close monitoring of upcoming PMI data and French election developments.