Key Treasury Yields and Central Bank Comments Drive EUR/USD Moves

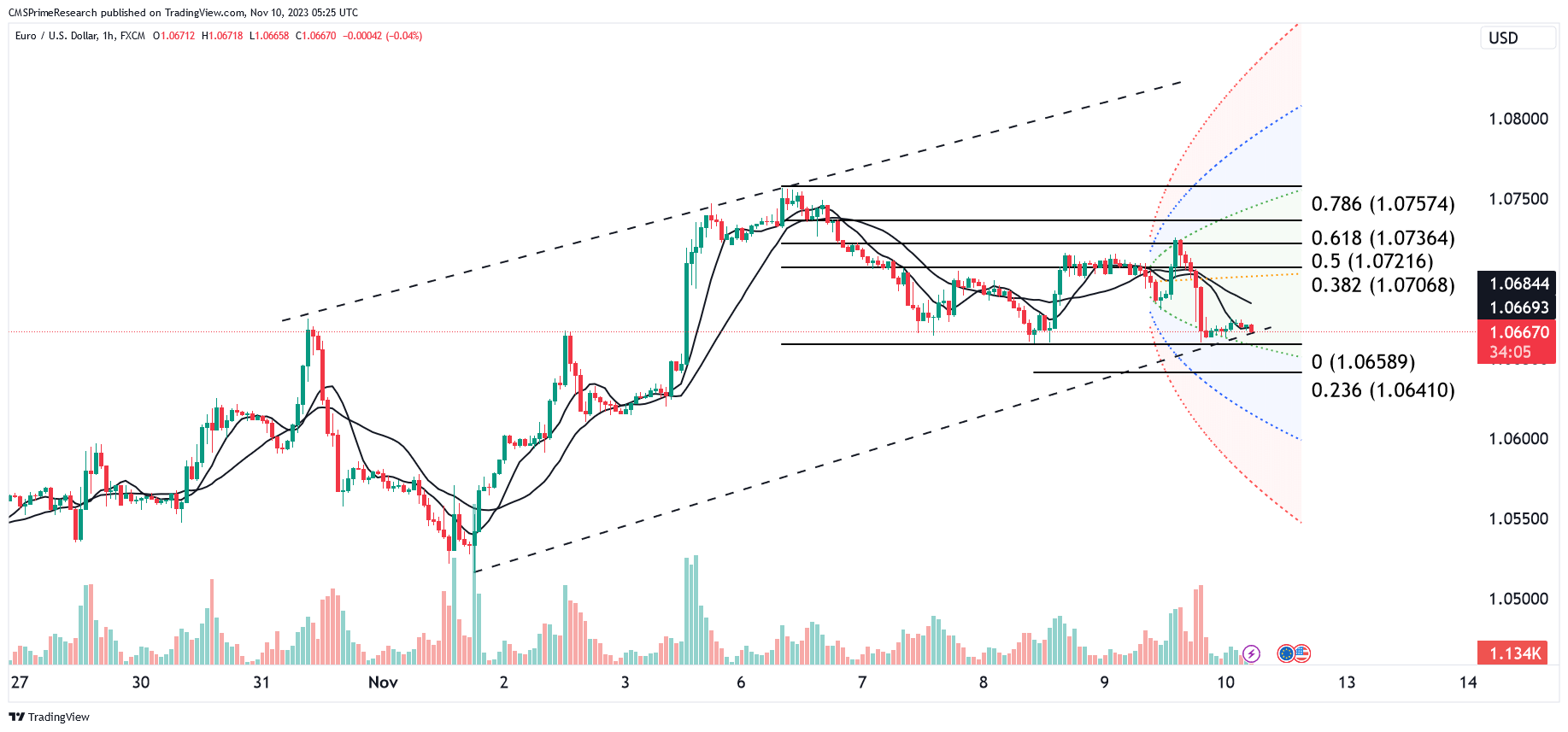

EUR/USD found itself influenced by Treasury yields during the recent trading sessions. The currency pair initially opened near 1.0690 and experienced a rally to 1.0726 in New York’s morning session. This surge was supported by the softening US dollar and higher US yields, driven by weekly claims reports. Additionally, equity gains and a drop in USD/CNH below 7.2900 provided further buoyancy to EUR/USD. However, as the US dollar began to firm up and risk sentiment deteriorated, sellers entered the market. US yields and the dollar strengthened after a poorly received US Treasury 30-year auction, leading to a decline in risk appetite. EUR/USD briefly touched 1.0673 before experiencing a minor bounce. Despite the retreat, the currency pair remained above key moving averages, and a rising monthly RSI offered some comfort to long positions. The upcoming release of the U.S. November University of Michigan survey data poses a potential risk for the currency pair on Friday.

In the Asian trading session, EUR/USD continued to exhibit a heavy tone due to hawkish comments from Fed Chair Powell and higher US yields. The currency pair saw a relatively quiet and light trading environment, with a range of 1.0663-1.0675 on EBS, while the overnight low reached 1.0660. It managed to hold above key levels, including the ascending 200-hour moving average at 1.0659 and the 55-day moving average at 1.0642. EUR/USD remained within the confines of the 1.0598-1.0798 daily Ichimoku cloud, with tenkan and kijun lines situated at 1.0636 and 1.0619, respectively. The presence of significant nearby option expiries provided some containment of price action, with expiries ranging from 1.0630 to 1.0730. Despite the subdued performance of EUR/USD, Euro crosses displayed strength, supported by recent hawkish signals from the European Central Bank (ECB). EUR/JPY traded in the range of 161.38-161.47, marking its highest level since 2008, while EUR/GBP reached levels not seen since early November. EUR/CHF also remained stable, with notable option expiries throughout the day.

Key Levels to watch are 1.06889, 1.07240,1.07600,1.07640

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.06889 | 1.07240 |

| Level 2 | 1.06700 | 1.07440 |

| Level 3 | 1.06505 | 1.07600 |