EUR/USD trades bearish, key weekly data risk include US PCE

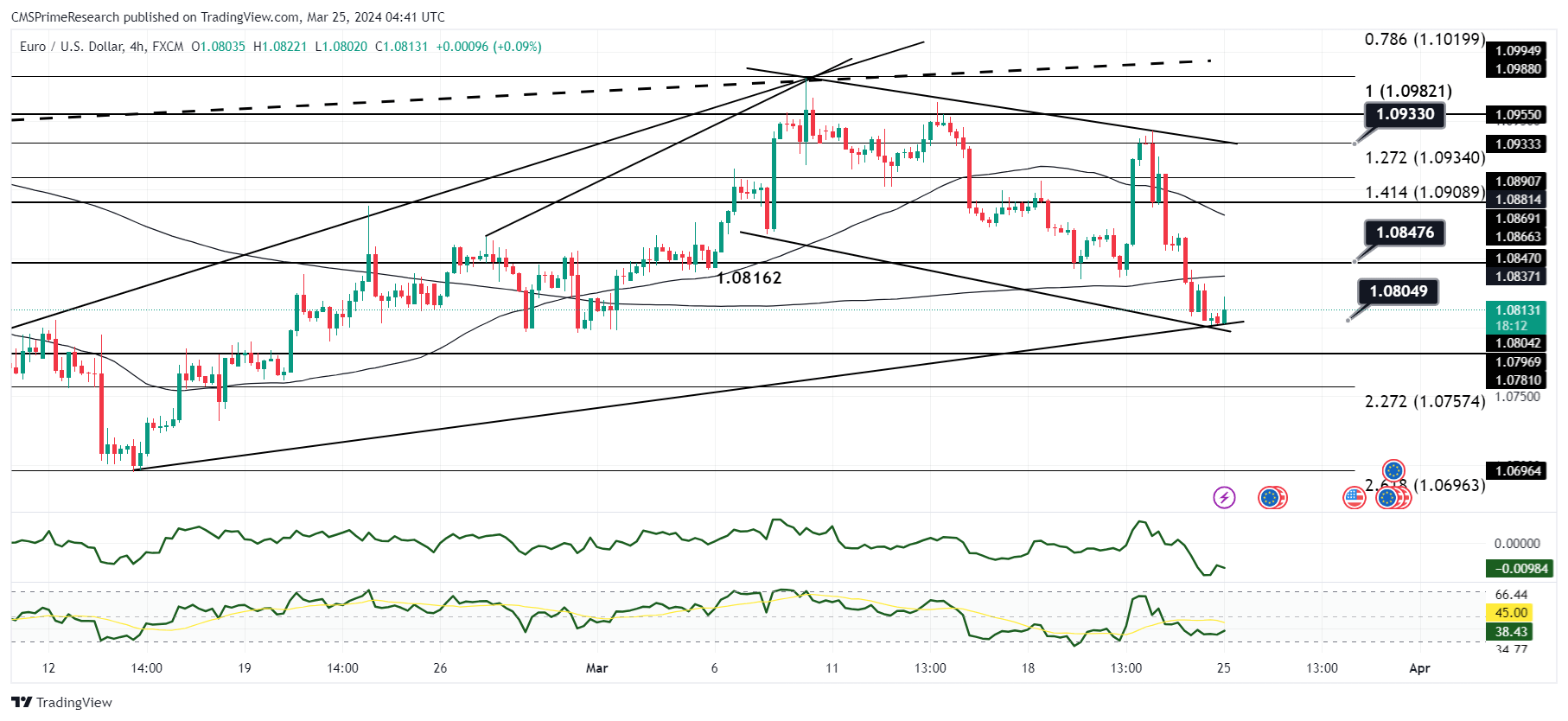

The EUR/USD pair commenced the session near 1.0810, with a brief ascend to 1.08650 before retreating as market participants pivoted towards safer assets, leading to a downturn towards the 1.0800 level, culminating in a 0.45% decline. Technically, the pair is facing immediate pressure, with key support levels being tested including recent daily lows and the base of the daily Ichimoku cloud.

The formation of a monthly gravestone doji pattern, falling Relative Strength Indices (RSIs), and a breach of the 200-Day Moving Average (DMA) all converge to emit bearish signals. Moreover, the consistent positioning of closing prices below the cloud suggests sustained bearish momentum.

Fundamental Analysis: Fundamental factors contributing to the risk-off sentiment include uncertainties surrounding upcoming economic data, specifically the U.S. weekly jobless claims and the February core Personal Consumption Expenditures (PCE) index, which is a key inflation indicator closely monitored by the Federal Reserve.

Overall Market Sentiment: The market sentiment leans towards caution and risk aversion in light of the recent bearish technical indicators and looming economic data releases.

Sentiment Percentage Breakdown:

- 30% Positive: Limited bullish sentiment is buoyed by the initial overnight lift, indicating some resilience in the euro.

- 20% Neutral: A degree of neutrality persists as the market evaluates the potential impact of impending U.S. economic data.

- 50% Negative: The predominant sentiment is bearish due to the technical breakdown and anticipation of possibly strong U.S. economic indicators that could fortify the dollar.

The dominant negative sentiment reflects the confluence of bearish technical patterns and the prospect of forthcoming U.S. economic data that could support a firmer U.S. dollar. The positive sentiment is derived from the pair’s ability to secure minor gains overnight, indicating pockets of buying interest, while the neutral sentiment acknowledges the pending data releases which hold the potential to materially alter market direction.

Key Levels to Watch: : 1.08339,1.08160,1.08394,1.07897

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08032 | 1.08340 |

| Level 2 | 1.07961 | 1.08394 |

| Level 3 | 1.07792 | 1.08516 |