EUR/USD bearish sentiment continues ahead of FOMC

The EUR/USD pair is demonstrating classic signs of a currency pair under pressure. The latest technical indicators are leaning heavily towards a strong sell, a sentiment echoed by the moving averages which are predominantly in sell territory, save for a solitary buy signal from the MA5. This suggests that in the short term there may be small bullish retracements within a larger bearish trend.

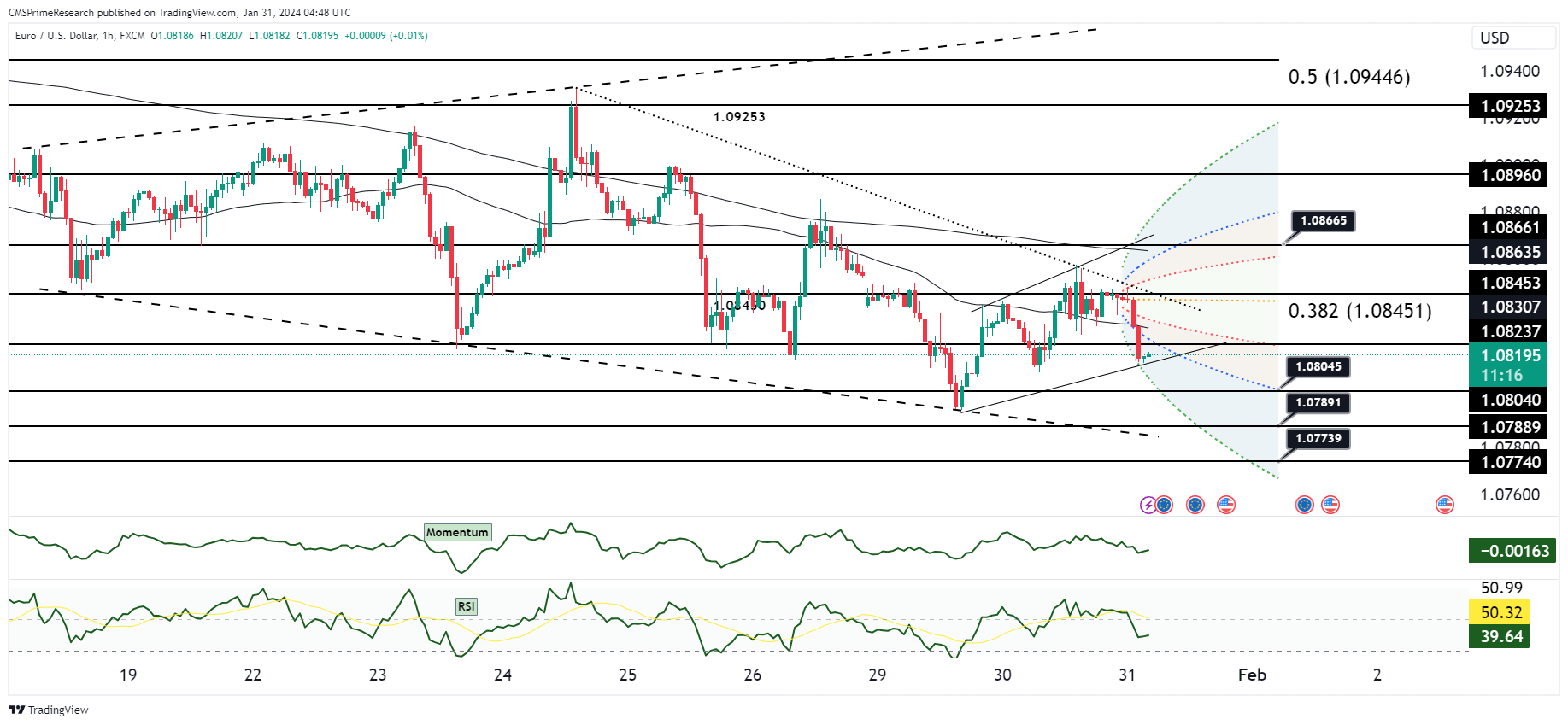

On the hourly chart, EUR/USD has struggled to gain momentum, with each rally being met with resistance, most notably near the 1.0858 level on EBS. The subsequent drop to 1.0828 and the pair’s difficulty in sustaining gains in the New York afternoon trade underscore the lack of buying conviction.

The pair is currently trading below both the 10- and 200-Day Moving Averages (DMAs), a bearish technical signal, and a falling monthly Relative Strength Index (RSI) is an additional concern for those holding long positions. Resistance is formed by the descending hourly Ichimoku cloud, which, together with the moving averages, sets a bearish technical landscape.

Fundamentally, the EUR/USD pair is facing headwinds due to contrasting economic indicators and central bank policy expectations. The upbeat U.S. ADP and consumer confidence figures have contributed to a rally in yields and the U.S. dollar, diminishing the appeal of the euro. The Chinese Yuan’s weakness against the dollar, as indicated by USD/CNH hitting highs, further pressures the EUR/USD as it represents broader dollar strength.

Investors are cautious ahead of key risk events such as the upcoming U.S. January ADP report and the Federal Reserve meeting, including Chair Powell’s press conference. Positive U.S. data could lead to a surge in yields and further dollar strength, which typically translates to a lower EUR/USD.

Overall Market Sentiment:

Given the technical and fundamental context, the market sentiment for EUR/USD can be summarized as follows:

- Positive Sentiment: 10% – This minimal bullish sentiment accounts for the slight bounce off the lows and the possibility of short-term retracements.

- Negative Sentiment: 70% – Reflecting the strong sell signals from technical indicators, the pressure from a strengthening U.S. dollar, and anticipation of U.S. economic data.

- Neutral Sentiment: 20% – This reflects the market’s current wait-and-see approach in anticipation of the Fed meeting and data releases, which could significantly impact the direction of the pair.

The overwhelming sentiment is bearish, indicating that the market is bracing for potential further downside in the EUR/USD pair. Traders will be closely monitoring the upcoming U.S. economic data and Federal Reserve communications to adjust their positions accordingly.

Key Levels to Watch: : 1.07600,1.08625,1.08032

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08032 | 1.08339 |

| Level 2 | 1.07897 | 1.08394 |

| Level 3 | 1.07740 | 1.08665 |