EUR/USD remains bearish ahead of FOMC on Wednesday

The EUR/USD is exhibiting signs of indecision within the context of a broader technical framework. After a period of increased volatility, the pair has settled into a quieter range in the Asian session, indicating a market in contemplation. The daily chart shows the pair nestled within an ascending Ichimoku cloud, typically a sign of a trendless state where the market is seeking direction.

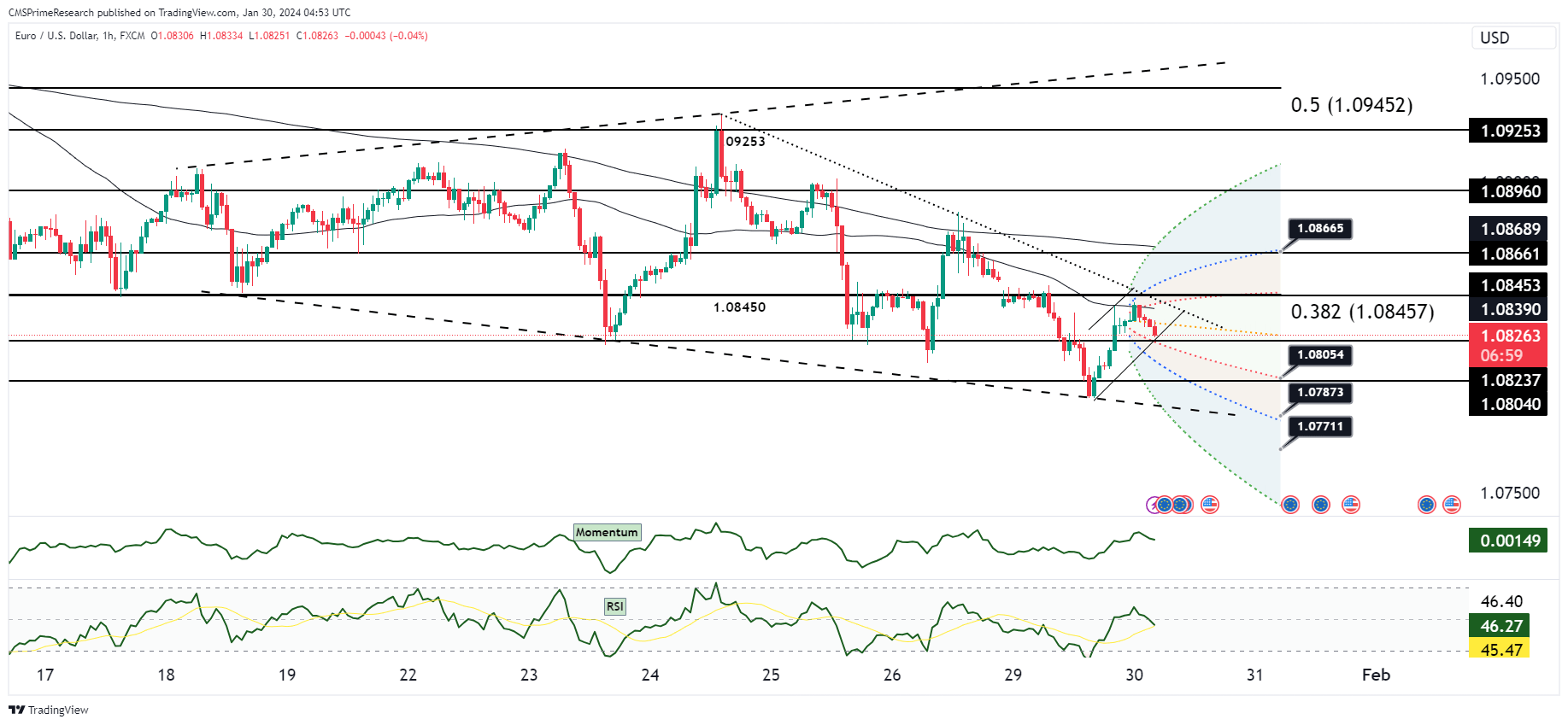

The hourly chart presents a resistance zone at the 55-Hour Moving Average (HMA) around 1.0840 and a descending hourly Ichimoku cloud ranging from 1.0844-60, suggesting that upward movements may be capped in the short term.

The momentum indicators are not signaling a clear trend, with the RSI in a neutral position and the Momentum indicator showing no strong directional bias. This technical setup suggests that the pair is in a consolidation phase, potentially awaiting new fundamental catalysts to define the next significant move.

The market is digesting the recent dovish comments from the ECB, which have led to speculation of a more accommodative stance and even a potential rate cut in April. Such a dovish turn would typically weaken the euro as it makes the currency less attractive relative to its peers offering higher yields.

The bounce from the recent lows suggests that while the market is leaning towards a softer euro, conviction is not strong, and traders are not yet ready to commit fully to a bearish EUR/USD scenario. This is further evidenced by the pair’s resilience in staying within the daily Ichimoku cloud.

The cross-pair dynamics, such as EUR/JPY and EUR/CHF, are also reflecting a weaker euro sentiment, with both pairs exhibiting a downward trajectory. This cross-pair weakness can sometimes spill over into EUR/USD, adding to the pressure on the euro.

Overall Market Sentiment:

- Positive Sentiment: 30% – Acknowledging the pair’s capacity to bounce off recent lows and the current support from option expiries.

- Negative Sentiment: 50% – Reflecting the dovish ECB stance, potential for an interest rate cut, and the technical resistance challenging upward movements.

- Neutral Sentiment: 20% – Considering the neutral momentum indicators and the pair’s position within the Ichimoku cloud, indicating a lack of strong directional consensus.

The prevailing sentiment is moderately bearish, with the market wary of the ECB’s dovish signals but still seeking confirmation before pushing the pair decisively lower. This caution is mirrored in the technical posture, with traders likely to look for further economic data or policy statements to confirm or invalidate the current sentiment.

Key Levels to Watch: : 1.07600,1.08625,1.08032

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08032 | 1.08339 |

| Level 2 | 1.07897 | 1.08394 |

| Level 3 | 1.08507 | 1.07600 |