EUR/USD remains neutral, sentiment to the Upside in the Short Term

The price action is currently ensconced within an ascending daily Ichimoku cloud, suggesting a potential bullish bias in the medium-term trend. However, the pair remains under pressure in the near term as it trades near the recent lows, indicating that bearish sentiment has not been fully alleviated.

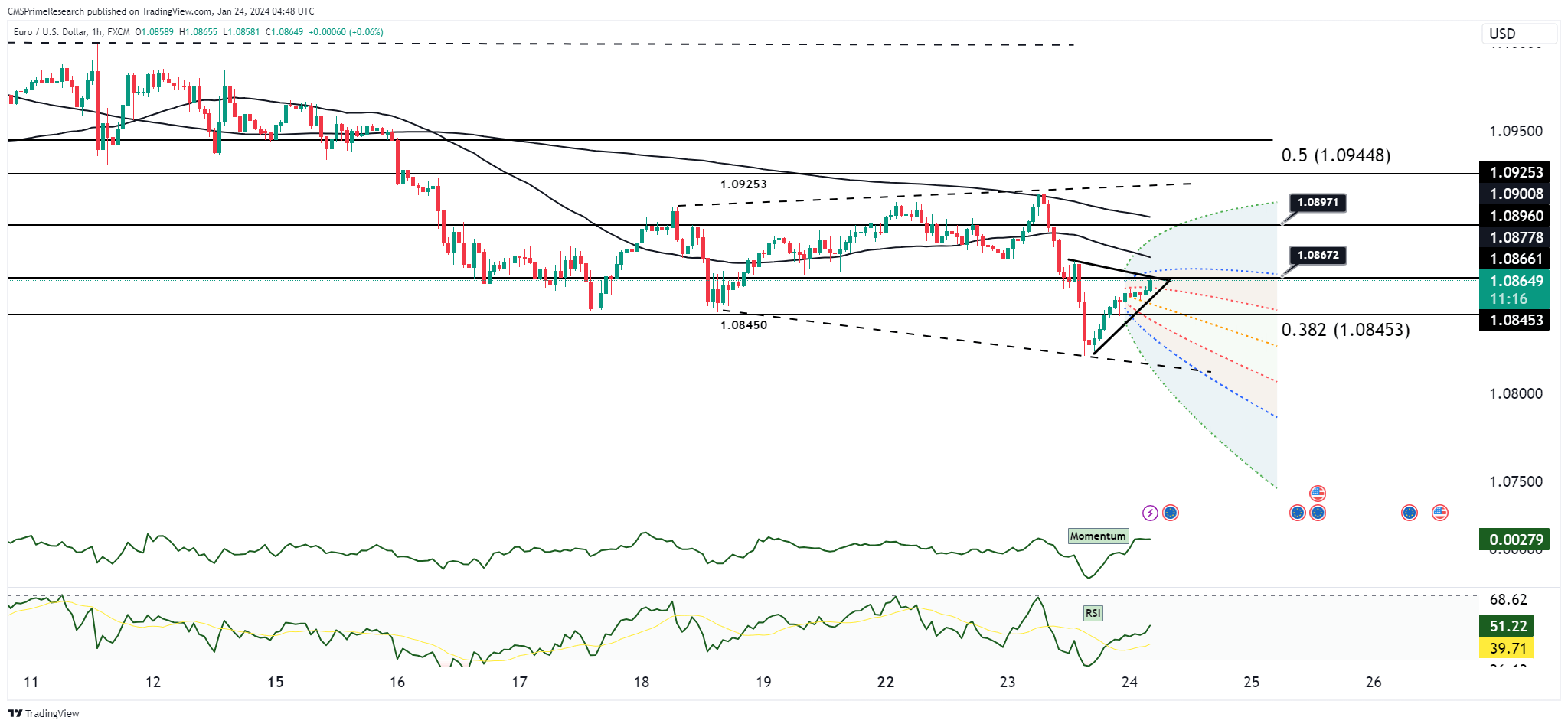

The approach towards the cloud top and the hovering around the hourly Ichimoku tenkan line at 1.0870 offer resistance, potentially capping upward movements. On the downside, the recent bounce from 1.0820 underscores a tentative support zone.

Momentum indicators such as the RSI are neutral, lingering around the midpoint, which does not provide a clear directional bias. The price’s interaction with the Ichimoku cloud’s parameters and the reaction to the significant options expiry levels will be pivotal for the next directional move.

The EUR/USD dynamics are being influenced by contrasting monetary policy expectations and economic performance indicators between the Eurozone and the United States. The currency pair’s recent bid in Asia reflects a temporary reprieve from bearish pressure, possibly due to a recalibration of yield differentials as market participants await further cues from the US yield movements.

With the cross-rates like EUR/JPY remaining near recent highs due to the Bank of Japan’s (BOJ) policy hold, the euro finds some support. However, the single currency’s performance against other pairs such as EUR/GBP and EUR/CHF is muted, suggesting that the euro’s strength is not broad-based but rather selective against the backdrop of BOJ’s dovishness.

Overall Market Sentiment:

The sentiment analysis reveals the following sentiment breakdown for the EUR/USD pair:

- Positive Sentiment: 35% – This is likely due to the bounce from the recent lows and the relatively stable performance against JPY.

- Negative Sentiment: 45% – The proximity to recent lows and significant resistance levels contribute to a bearish outlook.

- Neutral Sentiment: 20% – Indecision is reflected in the neutral RSI readings and the anticipation of future yield movements.

The weighted sentiment suggests a market that is slightly leaning towards bearishness, with a prevailing caution due to technical resistance and fundamental uncertainties. The upcoming economic events and data releases will be critical in shaping the sentiment further, as they may provide the impetus for a break out of the current technical patterns.

Key Levels to Watch: : 1.08850,1.08340,1.08708

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08515 | 1.08708 |

| Level 2 | 1.08394 | 1.08830 |

| Level 3 | 1.08340 | 1.08915 |