EUR/USD Gains Ground Ahead of US Payroll Report While Bullish Momentum Persists

EUR/USD opened with a 0.49% gain at 1.0622, benefiting from a weakening US dollar as US yields dipped. The Asian session saw the pair trading in a narrow range of 1.0615 to 1.0628, and it is currently hovering around 1.0625. The currency pair seems poised for an upward trend, supported by the alignment of the 5, 10, and 21-day moving averages in a bullish formation. To confirm the trend, a close above the 55-day MA at 1.0654 is required. However, the 21-day MA at 1.0582 serves as a crucial support level, and any break below it could negate the positive setup. The upcoming US non-farm payrolls report is likely to determine the short-term range, with a benign report potentially boosting the EUR/USD.

EUR/USD opened in New York near 1.0635 after an overnight rally. The rally extended as US yields declined and the US dollar weakened following weekly claims and Q3 labor cost reports that suggested some softness in the job market and a decrease in upward wage pressure. Risk-on sentiment prevailed, driving equities and gold higher. The currency pair reached 1.0667 on EBS, but sellers emerged, pushing it closer to 1.0610. Despite a rebound and trading up 0.52% later in the session, EUR/USD faces payroll risk. Technical indicators lean bullish, with rising RSIs and the pair trading above the 10- and 21-day DMAs. A close above the 55-DMA, daily cloud base, and the October 24th high would strengthen bullish signals. However, a downside surprise in the US October payroll report could induce a significant rally.

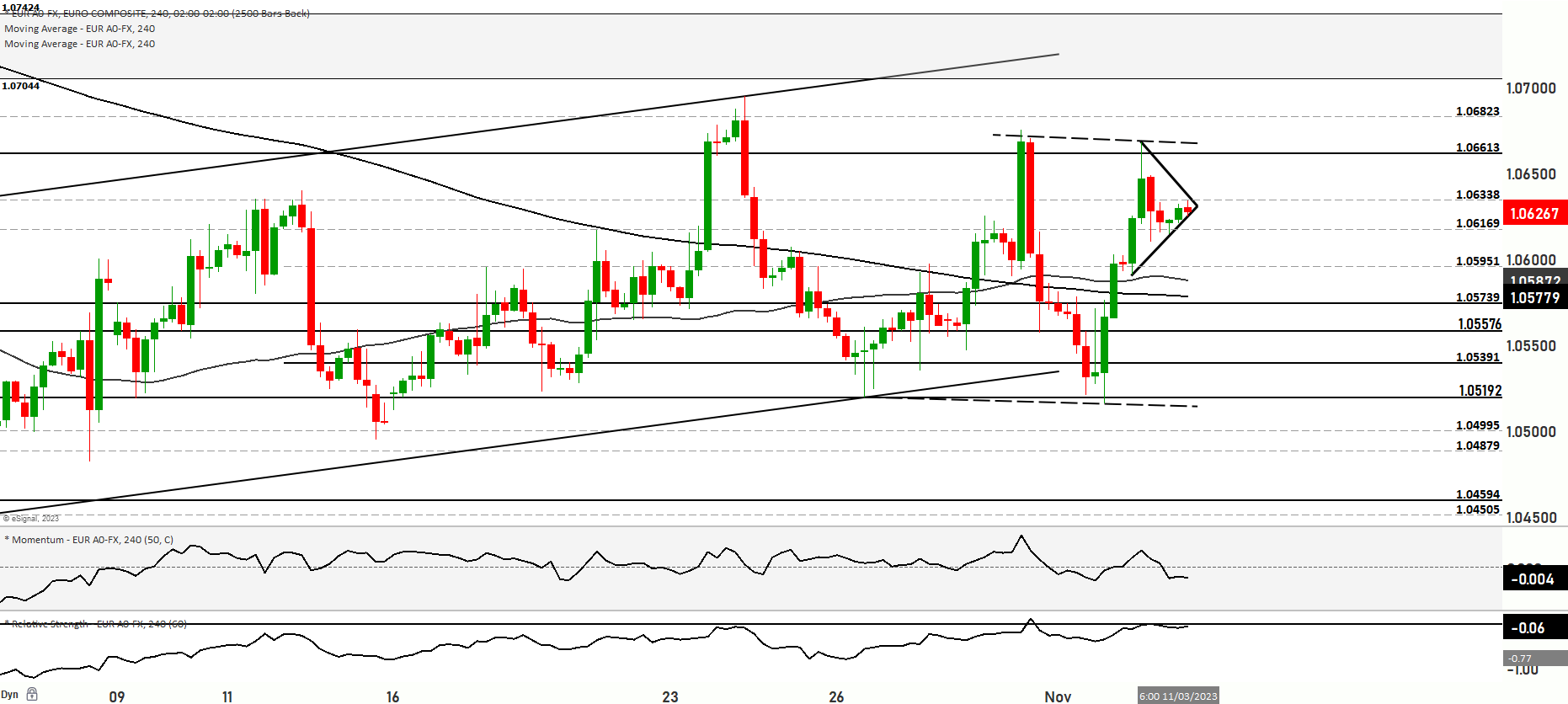

EUR/USD is currently situated in a short-term bearish zone with a range centered around the 1.06270 level. The price remains close to or above the 200-day and 50-day moving averages, indicating a short-term bearish range.

Scenario 1: If the price continues to rise, it may test the 1.06338 level, followed by further upward movement to reach the 1.06405 level. If bullish momentum persists, the price could target levels like 1.06505, signifying a strong bullish move to the upside. Successful tests of these levels could lead to further upward movement towards the topmost resistance levels at 1.06889.

Scenario 2: Alternatively, if the price declines from its current level, it could test support levels at 1.05951, 1.05739, and 1.05300. Further downward movement might lead to testing the levels at 1.05289 and 1.05158, with 1.05158 acting as a significant bearish support level.

The short-term market momentum appears bearish, with the Relative Strength Index (RSI) suggesting a mild short-term bearish sentiment. The market might trade within a range of 1.04913 to 1.07477 in the short term, so it’s important to monitor price reactions around these levels.

Key Levels to watch are 1.06120,1.06890,1.07239,1.07044,1.07424,1.05192

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.05951 | 1.06613 |

| Level 2 | 1.05739 | 1.06823 |

| Level 3 | 1.05391 | 1.07044 |