EUR/USD remains neutral, waiting on ECB Interest Rate Decision this Week

The technical landscape shows a mixed sentiment. The Moving Averages are largely signaling a ‘Buy,’ suggesting a bullish trend with potential for upward price action. This is further supported by the Buy signal from the 5-day MA, indicating short-term upward momentum. However, the 20-day and 50-day MAs signal ‘Sell,’ suggesting caution as the longer-term trend may not be definitively bullish.

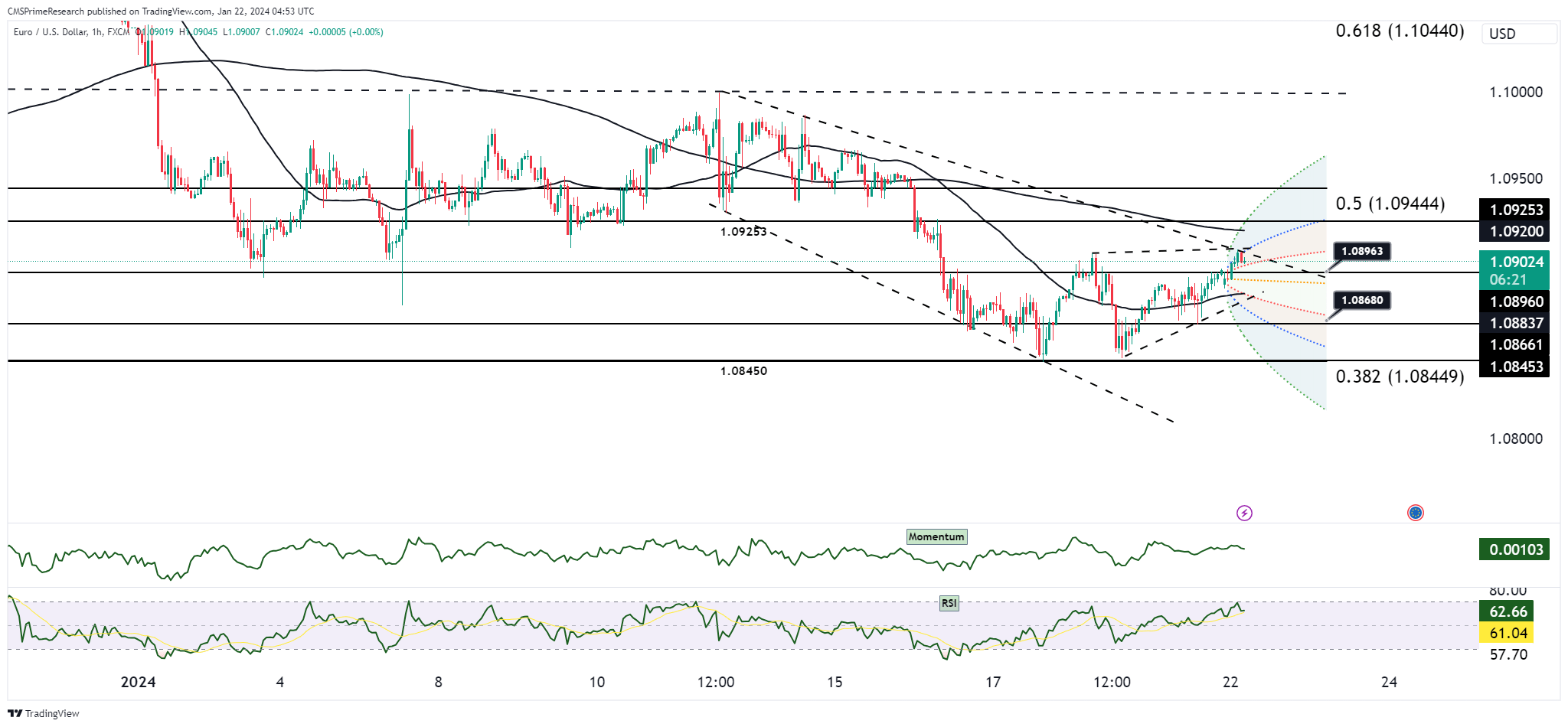

The chart presents a price action consolidating above the Ichimoku cloud, which generally indicates support and a bullish market sentiment. The currency pair fluctuates between the descending 100-hour and 200-hour Moving Averages, at 1.0883 and 1.0920 respectively, which could signify a tight trading range.

The market is reacting to the anticipation that the ECB will maintain its policy stance in the upcoming week. This stability in policy may be lending strength to the euro. Additionally, with the BOJ expected to hold its policy until at least April, this has put downward pressure on the JPY and, by extension, the USD, as the pairs are often traded in tandem.

Market Sentiment Ratings:

- Bullish Sentiment: 40% – The support from the Ichimoku cloud and the short-term Moving Average indicators provide a somewhat bullish outlook.

- Neutral Sentiment: 50% – The conflicting signals from the technical indicators and the uncertainties surrounding central bank policies contribute to a neutral market sentiment.

- Bearish Sentiment: 10% – There remains a small bearish sentiment due to the ‘Sell’ signals from the longer-term MAs and potential resistance near the 200-hour MA.

Overall, the EUR/USD pair is showing resilience above the Ichimoku cloud, with a neutral to slightly bullish market sentiment prevailing in the current technical setup. The market appears to be waiting for more definitive signals from upcoming central bank decisions and is weighing the potential impacts of these on the currency pair. Traders should stay attuned to central bank communications and other economic indicators that may provide further direction for the EUR/USD.

Key Levels to Watch: : 1.09321,1.08850,1.09098

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08944 | 1.09100 |

| Level 2 | 1.08850 | 1.09212 |

| Level 3 | 1.08635 | 1.09321 |