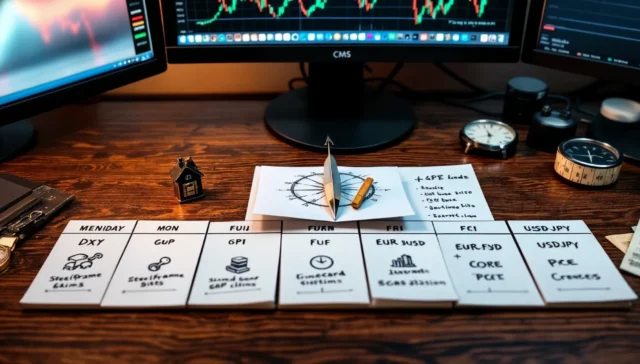

Tariffs, Tension, and the Tape: Inside Friday’s Shock to Risk Assets

The quick take U.S. stocks suffered their sharpest one-day fall since April as a revived U.S.–China tariff escalation punctured weeks of low realized volatility and…

Adding {{itemName}} to cart

Added {{itemName}} to cart