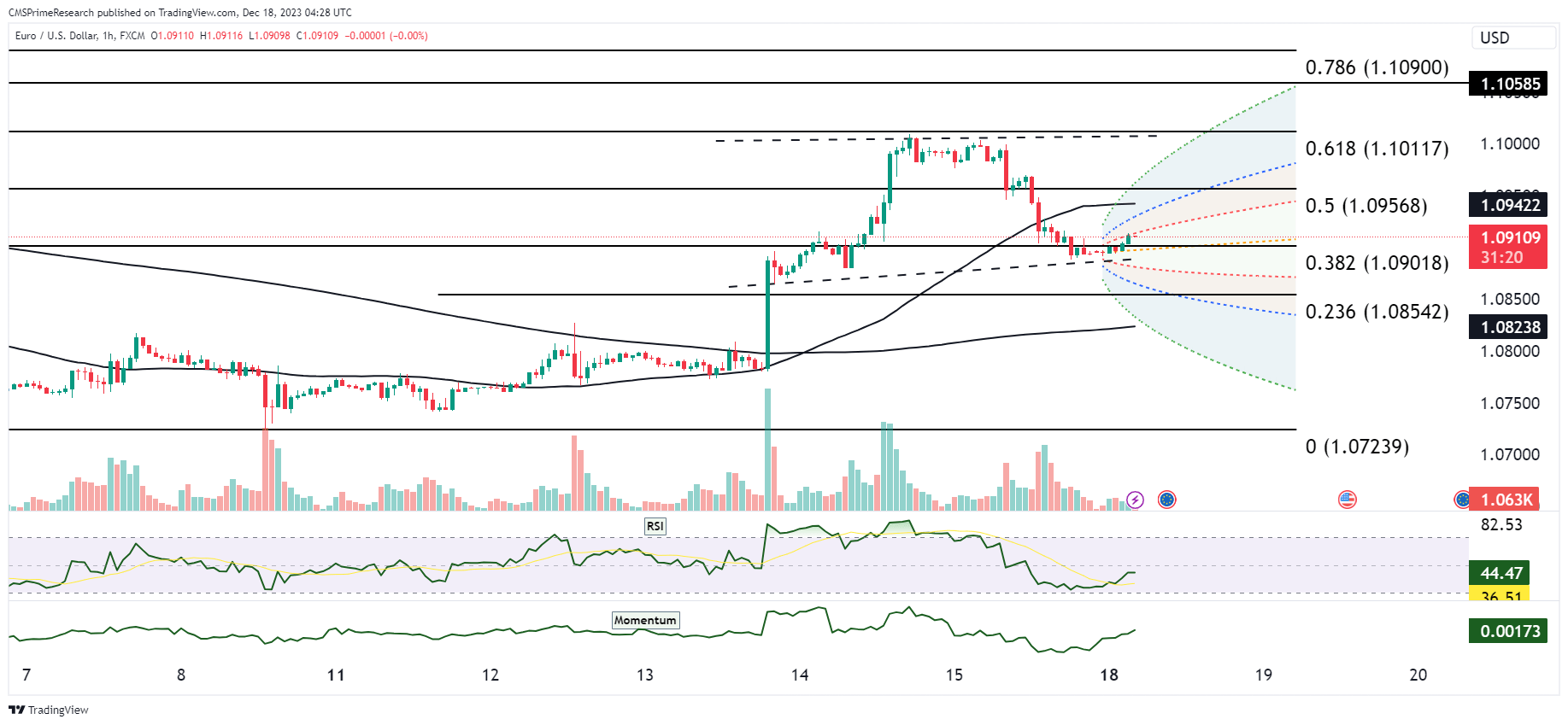

EUR/USD in consolidation between the 1.09018 to 1.10117

EUR/USD’s technical posture suggests bearish momentum as evidenced by its position below key moving averages and a descending trendline, with immediate support and resistance observed at 1.09019 USD and 1.10585 USD respectively. The Fibonacci retracement levels add granularity to potential pivot points, with the price hovering around the 0.382 mark, indicating a crucial juncture that could lead to a test of higher resistance at 1.09568 USD or support at 1.08542 USD if breached. The RSI and momentum indicators hint at a tentative shift in sentiment, though not decisively pointing to a reversal.

On the fundamental front, forthcoming economic events carry substantial weight for the pair’s trajectory. The BoJ’s interest rate decision, if aligned with the forecast, could strengthen the JPY, impacting EUR/USD indirectly. The Eurozone CPI will be pivotal for the EUR; an uptick could fortify the currency, whereas a downtick might weaken it against the USD. The US economic indicators, namely GDP growth rate and jobless claims, will influence USD strength. The market’s reaction to these events will be critical, with a higher-than-expected US GDP or lower jobless claims potentially pressuring EUR/USD downwards, while a higher Core PCE Price Index could bolster the USD, adding further downward pressure on the pair. Conversely, softer data could offer the EUR some respite, allowing for a potential push towards 1.09568 USD or even the resistance level at 1.10585 USD.

Key Levels to Watch: : 1.09830,1.08635,1.08160,1.10032

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08850 | 1.09321 |

| Level 2 | 1.08635 | 1.09478 |

| Level 3 | 1.08340 | 1.09673 |