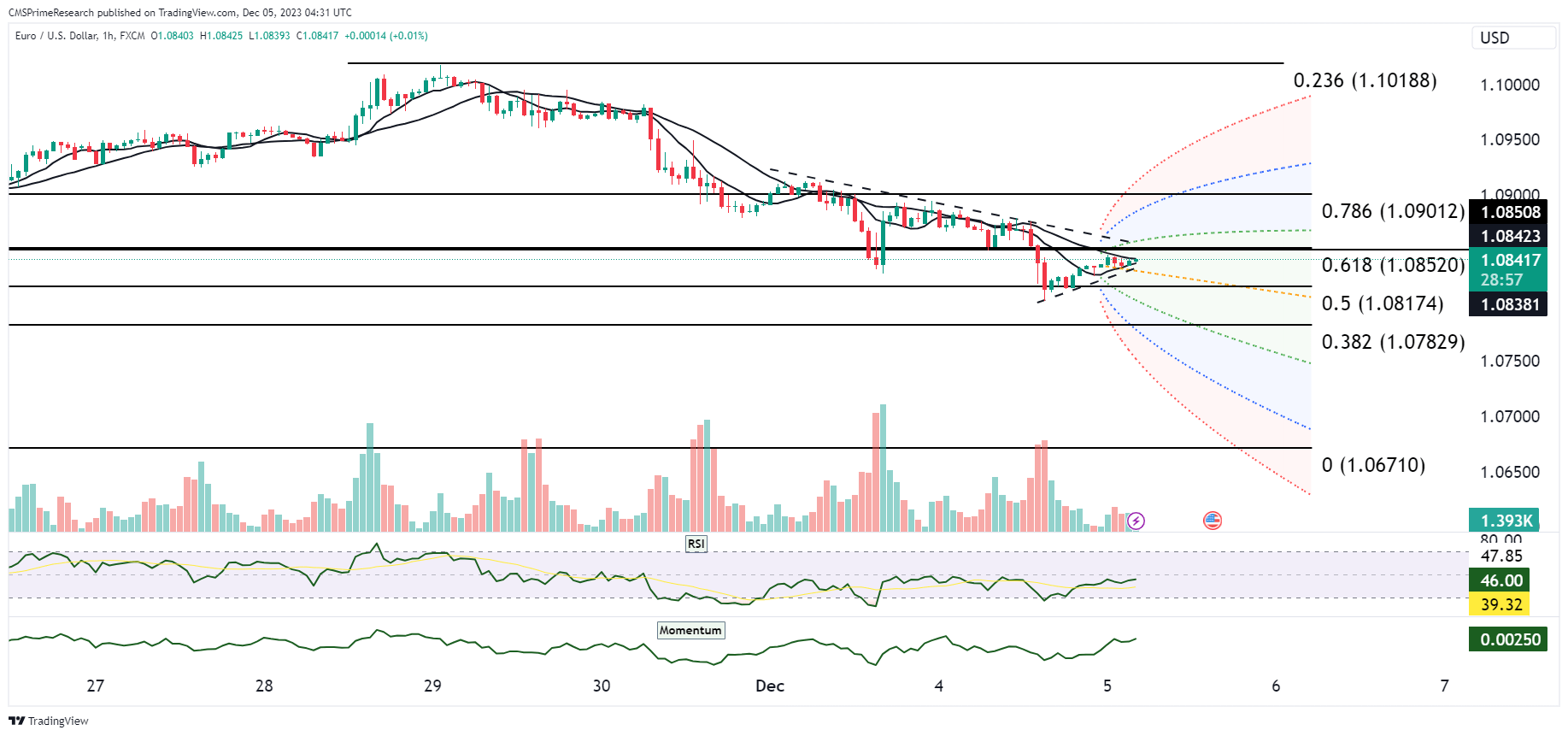

EUR/USD Bearish waiting to test the 1.08174 level

The EUR/USD pair has seen considerable movement, influenced by dynamics in U.S. yields and the dollar. In New York, the pair opened higher but it extended its slide due to intensified overnight buying of the U.S. dollar as U.S. yields rallied. The growing yield advantage of the U.S. over the euro exerted downward pressure on the EUR/USD. Moreover, a sour risk sentiment globally bolstered the U.S. dollar. This sentiment was mirrored in the declines in equities and gold, further reinforcing the demand for the U.S. dollar.

Technical indicators for EUR/USD are leaning bearish. The Relative Strength Index (RSI) is falling, and the price drop followed a doji pattern on Friday, signaling indecision now turning to bearish momentum. The pair slid below its 200-day Moving Average (MA), hitting a low of 1.0804. Upcoming economic data, including the U.S. November ISM non-manufacturing PMI and October JOLTS, are expected to be significant risk factors for the pair.

In Asian markets, EUR/USD opened lower at 1.0836, influenced by a rebound in U.S. yields. The pair consolidated within a 1.0830 to 1.0842 range and was trading at 1.0841 in the afternoon. The technical bias remains negative after the pair closed below the 21-day Moving Average, which stood at 1.0852. Key support levels are identified at the 50% Fibonacci retracement of the 1.08174 to 1.07829, and further support is seen at 1.07500. The uptrend that was observed ended as the 5-day Moving Average crossed below the 20-day MA, indicating a shift in momentum. A clear break below 1.07830 could target the next support level at 1.07500. Resistance is found at 1.08423, with selling pressure anticipated ahead of 1.0900. Ahead of key U.S. Non-Farm Payrolls data on Friday, the EUR/USD may engage in range-bound trading.

Key Levels to Watch: : 1.10000,1.09321,1.08850,1.08000

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.08109 | 1.08605 |

| Level 2 | 1.07760 | 1.08850 |

| Level 3 | 1.07467 | 1.09102 |