EUR USD Range Bound waiting on Key Eurozone Indicators and FED interest Rate Decisions

EUR/USD faced a slip lower as the US dollar (USD) started to recover some of its lost ground. The currency pair opened with a 0.47% gain after the USD broadly weakened, particularly against the Japanese yen (USD/JPY). However, the USD began to strengthen in the Asian session ahead of the Bank of Japan’s decision, causing EUR/USD to slip to 1.0595, its session low. Key support levels include the 10-day moving average (MA) at 1.0587 and the 21-day MA at 1.0569, while a significant resistance level lies at the 55-day MA at 1.0669. The EUR/USD pair is expected to remain within recent trading ranges leading up to the Federal Reserve’s decision on Wednesday. A close below the 21-day MA (1.0569) could shift pressure back to the downside.

Despite the opening near 1.0575 in New York, EUR/USD showed a muted reaction to the German October inflation report. After trading at 1.0547 on overnight, the pair experienced an overnight rally that continued. Factors like the fall in USD/CNH towards 7.3200 and gains in equities buoyed riskier assets. The drop in oil prices away from the 200-day moving average also encouraged EUR/USD bulls. The pair reached 1.0625, but a fall in EUR/JPY due to a Nikkei BOJ report weighed on EUR/USD somewhat. From there, the pair neared 1.0600 but then bounced back above 1.0610 late in the session. Technical indicators lean bullish, with rising RSIs and the pair trading above the 10- and 21-day moving averages. A monthly doji candlestick pattern could be a signal that the drop from July’s high might reverse. Risks in the Asian session include the BOJ meeting and China’s October NBS manufacturing and non-manufacturing PMIs.

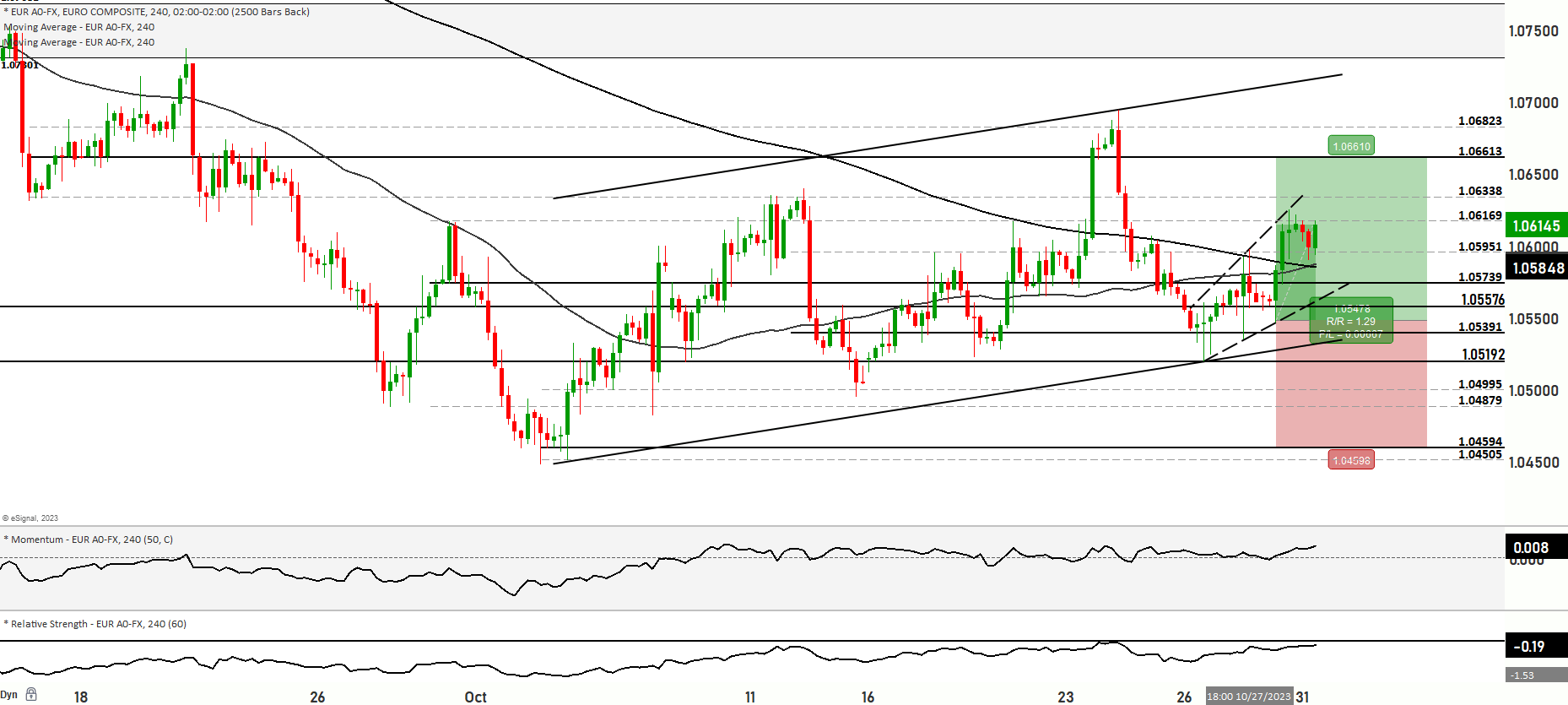

From a technical perspective, the EUR/USD pair is currently in a short-term bearish zone, trading within a range around the 1.05960 level. The price is positioned near and above the 200-day and 50-day moving averages, indicating a short-term bearish range for the market. Scenario 1 suggests the price may continue to move higher, potentially testing the 1.06120 level, followed by further upward movement to test 1.06338. If the bullish momentum persists, it could reach the 1.06505 level, signaling a strong bullish move. Successful tests of these levels could lead to further upward movement towards the topmost resistance at 1.06889. Scenario 2, on the other hand, envisions a decline from the current level to test support at 1.05739 and 1.05300. Further bearishness could lead to testing levels at 1.05289 and 1.05158, with 1.05158 as a significant support level. The short-term momentum in the market is currently bearish, with the Relative Strength Index (RSI) in an overbought zone, indicating some short-term bearishness. The market may trade within the 1.04913 to 1.07477 range in the short term, and it’s essential to observe how prices react around these levels.

Key Levels to watch are 1.06120,1.06890,1.07239,1.05299,1.04913,1.03589

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.05740 | 1.06170 |

| Level 2 | 1.05582 | 1.06338 |

| Level 3 | 1.05289 | 1.06613 |