EUR/USD rallied to an 11-session high on Thursday, trading as high as 1.0888 as investors leaned on expectations that the ECB may cut rates less aggressively after the latest eurozone inflation data. Headline HICP for October surprised to the upside, coming in at 2.0% versus estimates of 1.9%, while core HICP held steady at 2.7%, suggesting inflationary pressures may persist. ECB President Christine Lagarde mentioned in an interview that the inflation target is within reach but that inflation is not yet completely under control. The tighter German-U.S. yield spreads also supported EUR/USD as the pair rallied above the 200- and 21-day moving averages, squeezing out some shorts.

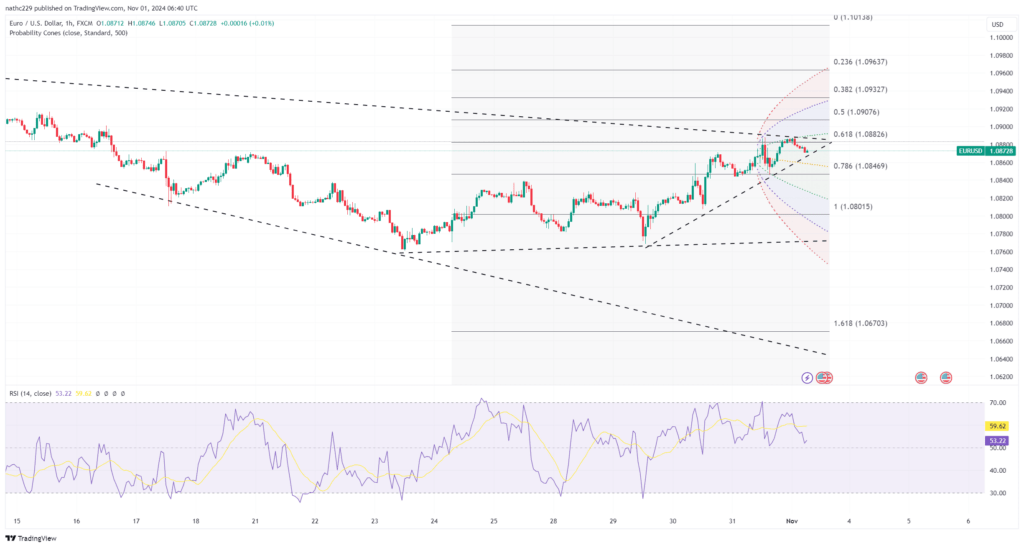

Technically, EUR/USD’s outlook remains mixed. While the daily RSI is rising, hinting at some bullish momentum, the monthly RSI continues to fall, indicating that larger downward forces may still be at play. The daily doji candle formation suggests indecision among investors, as the rally stalled below the 20-DMA. The 1.0888 level now stands as immediate resistance, while support lies around 1.0845, followed by the 1.0800 psychological mark. Bulls will need to break firmly above the 1.0900 level for a stronger rally, though the looming U.S. jobs report on Friday may complicate this effort.

Friday’s U.S. non-farm payrolls report could be pivotal for EUR/USD. Should the data come in above expectations, especially with a drop in the unemployment rate, it may decrease the likelihood of deep Fed rate cuts, boosting U.S. yields and the dollar. In such a scenario, EUR/USD could quickly reverse recent gains and test key support levels, with the 1.0800 area potentially back in focus. Bulls may find it challenging to hold momentum as Fed-ECB rate differentials persist, particularly if the U.S. economy shows continued resilience.