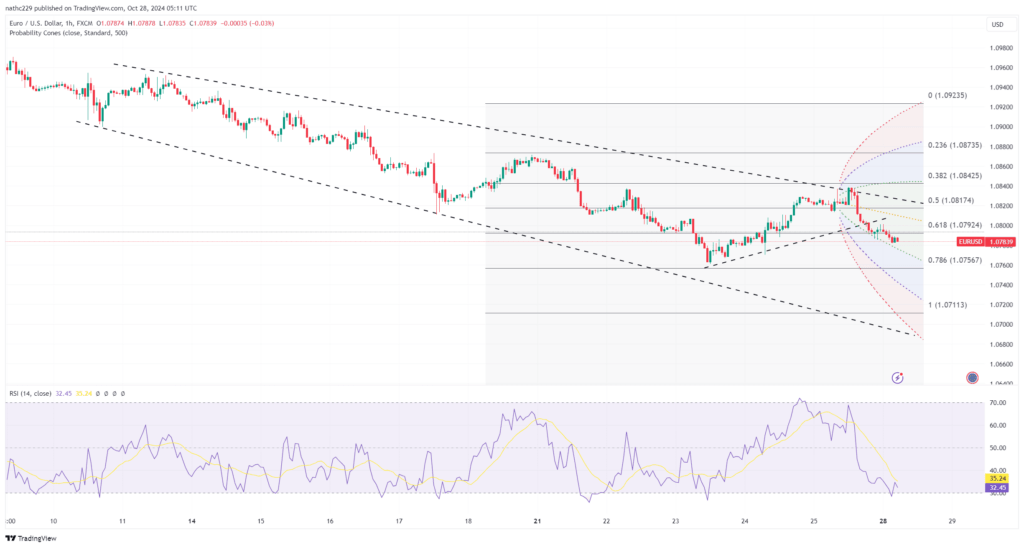

EUR/USD encountered resistance near 1.0839 after a brief rally during Friday’s New York session, ultimately turning negative and closing down at 1.0802. The pair was initially supported by a tightening German-U.S. 2-year yield spread, but stronger U.S. Treasury yields and a dollar bounce in USD/CNH soon reversed the gains. The bearish daily signals, including an RSI divergence and an inverted hammer candle, suggest that EUR/USD bulls may face an uphill battle, particularly as U.S. economic data releases next week could further favor the dollar. These technical indicators point to cautious sentiment for EUR/USD longs, with downside risks likely to persist unless bullish fundamentals emerge.

The technical landscape presents major resistance zones that bulls must overcome before they can shift momentum in their favor. Key resistance lies near 1.0860-1.0875, followed by the critical 1.0950-1.1000 range. The 23.6% Fibonacci retracement of the 1.1214-1.0761 drop, along with the 200-day moving average and recent daily highs, reinforce this first resistance zone, while September’s monthly low, the daily Ichimoku cloud base, and the 50% Fibonacci retracement at 1.0950-1.1000 serve as more formidable barriers. A sustained break above these levels could see EUR/USD bulls gain control, but this will likely require supportive U.S. economic data that narrows the dollar’s yield advantage.

Next week, key U.S. data releases, including Q3 GDP, September PCE, October ADP, JOLTS, U.S. payrolls, and ISM manufacturing PMI, present substantial risks for EUR/USD. To push through resistance, EUR/USD longs would need these data points to indicate slower economic growth and softer inflation, which could shift expectations toward more aggressive Fed cuts. Should German-U.S. spreads tighten on such developments, EUR/USD may rally past the 1.0950-1.1000 zone and trigger stop orders, opening up potential for a test of the 1.1200-1.1225 area. Until then, the pair is likely to remain under pressure as the dollar maintains its advantage.