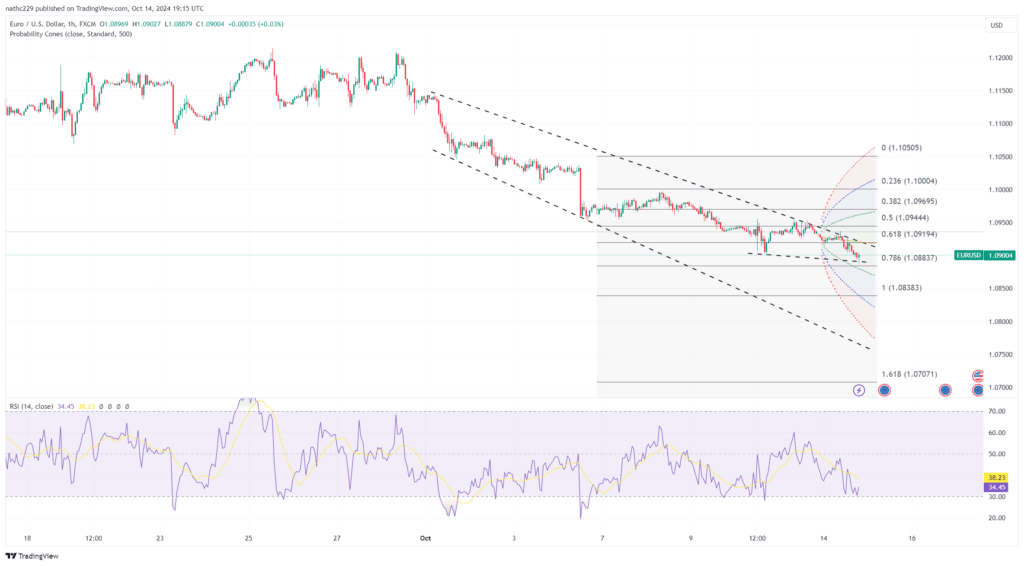

EUR/USD has extended its decline, breaking below the 100-day moving average (DMA) and daily Ichimoku cloud base, key support levels near 1.0936/45. The break below these levels confirms a bearish shift in momentum, as oversold conditions that previously limited further declines have now eased. With the bearish trend intact, there is scope for EUR/USD to test the 20-day Bollinger Band base at 1.0883. A further drop toward the influential 200-DMA at 1.0875 could intensify selling pressure, potentially leading to a flush of long positions worth approximately $5 billion, as traders adjust to the shifting landscape ahead of the European Central Bank’s (ECB) rate decision.

Technically, the breakdown below key moving averages signals further downside risks, with the 200-DMA at 1.0875 likely to act as the next major support. A decisive move below this level could trigger a cascade of long position liquidations, accelerating EUR/USD’s decline. With daily RSI levels still pointing downward and the pair remaining below the daily cloud base, bearish sentiment appears firmly entrenched. Any short-term bounce is likely to encounter resistance near the 100-DMA at 1.0936, with upside limited unless market sentiment or economic data shifts dramatically. Traders will also be eyeing the ECB’s guidance and press conference for further cues on the euro’s trajectory.

Looking ahead, the ECB’s expected 25-basis-point rate cut has already been priced into the market, with limited movement anticipated from the rate announcement itself. However, ECB President Christine Lagarde’s post-meeting comments will be pivotal, as traders look for hints of future policy direction. Lagarde is expected to maintain a cautious, data-dependent stance, reducing the impact of forward guidance in an environment marked by volatile policy expectations. The euro’s weakness may continue into the run-up to the meeting as traders position for the cut. Should Lagarde adopt a more dovish tone, EUR/USD could slide further, potentially testing the 1.0800 level in the coming sessions.