EUR/USD in Range after ECB decided to maintain rates. Short term bullishness to test 1.05950 level

The European Central Bank (ECB) recently opted to maintain its interest rates at 4%, marking a departure from the previous trend of ten consecutive rate hikes. Following this decision, the EUR/USD currency pair experienced a pullback, retreating from its recent monthly high of 1.0694. This outcome was largely anticipated by the financial markets, with an overwhelming 98% probability priced in for the decision.

The ECB’s choice to keep rates unchanged was influenced by several key factors. Despite potential inflationary pressures stemming from developments in the oil markets due to the Israel-Hamas war, the ECB noted a significant drop in inflation in September. Additionally, various indicators of underlying inflation showed a continuous easing trend. Furthermore, the ECB had to take into account the persistently weak business activity and rather modest growth forecasts, which projected growth rates of 0.7% for 2023 and 1% for 2024.

Importantly, the decision to maintain interest rates at their current levels should not be perceived as an indication that the ECB will not raise rates in the future. Future decisions will be contingent on incoming economic data, thereby leaving room for adjustments in monetary policy. However, traders are increasingly speculating that interest rates may be reduced in the latter part of the next year as the extended period of restrictive monetary policy begins to impact the economy.

Several external factors played a role in the Euro’s reaction to the ECB’s decision. Recession fears within the Eurozone and the competitive advantage of the American economy likely contributed to the Euro’s pullback.

In summary, the ECB’s decision to hold interest rates steady prompted a Euro pullback against the US Dollar. Nevertheless, the Euro’s exchange rate against major currencies will continue to be influenced by future ECB decisions on interest rates, as well as a range of other economic factors.

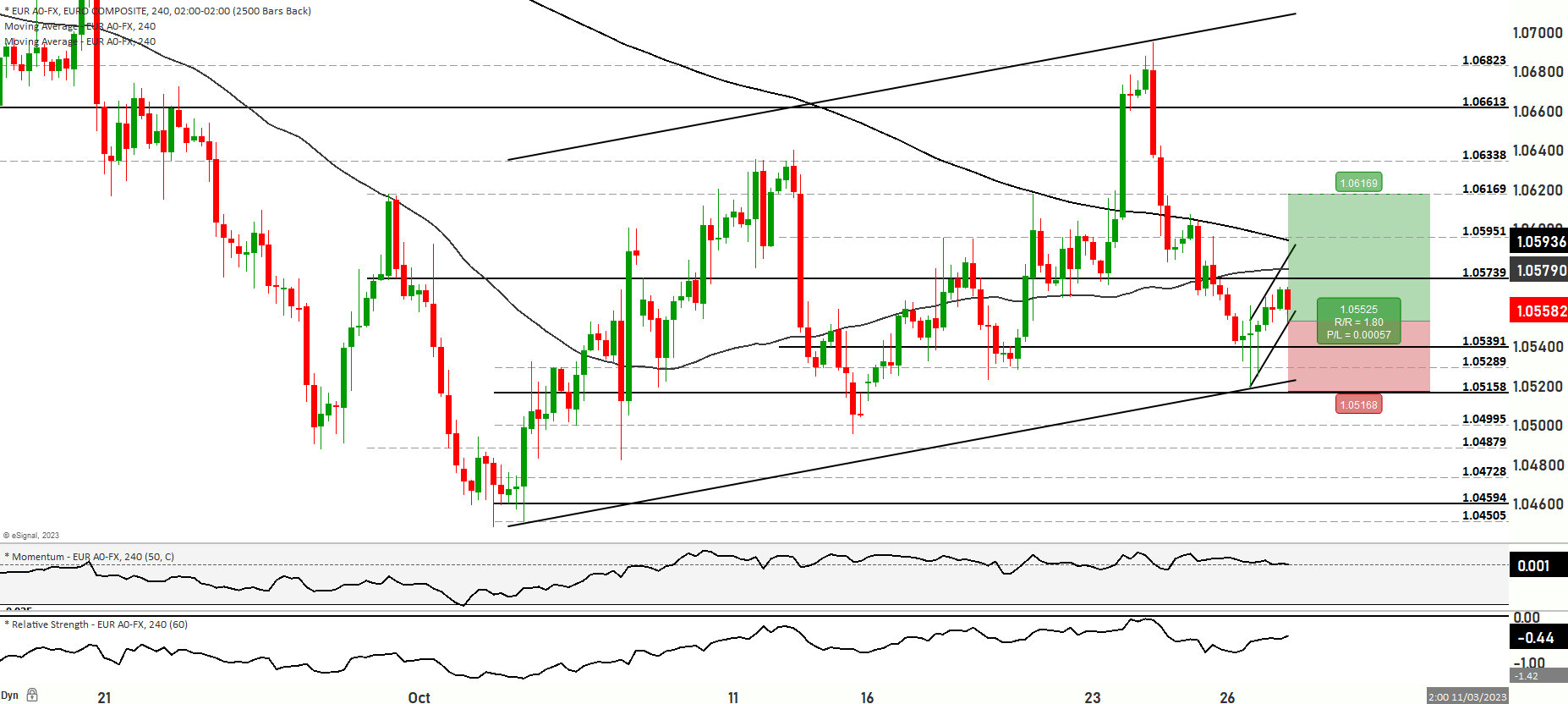

Moving on to technical analysis, the EUR/USD pair finds itself situated near both the 200-day and 50-day moving averages, indicative of a short-term bearish trend in the market. There are two potential scenarios to consider:

Scenario 1: The price could continue its upward trajectory, possibly testing the levels between 1.05867 and 1.06120, followed by further upward movement to challenge the 1.06331 level. Should bullish momentum persist, it might lead to a test of higher levels around 1.06505, signaling a strong bullish trend. Successful tests of these levels could pave the way for further upward movement, potentially reaching the topmost resistance level at 1.06889.

Scenario 2: Alternatively, the price may decline from its current position, testing support levels at 1.04913 and 1.04529. If bearish sentiment prevails, further downward movement could lead to tests at 1.04232 and 1.03972, with 1.03589 serving as a critical support level. Presently, the short-term momentum in the market is bearish. The Relative Strength Index (RSI) is in the overbought zone, suggesting a potential short-term bearish trend. The market may trade within a range in the short term, with levels spanning from 1.04913 to 1.07477. As of now, the EUR/USD price is in a short-term bearish zone with a range, with its current level around 1.05650.

In conclusion, a blend of fundamental and technical factors has shaped the recent movement in the EUR/USD pair. The ECB’s decision, economic outlook, and market sentiment will remain critical determinants of future price trends.

Key Levels to watch are 1.06120,1.06890,1.07239,1.05299,1.04913

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.05300 | 1.05867 |

| Level 2 | 1.05067 | 1.06120 |

| Level 3 | 1.04913 | 1.06331 |