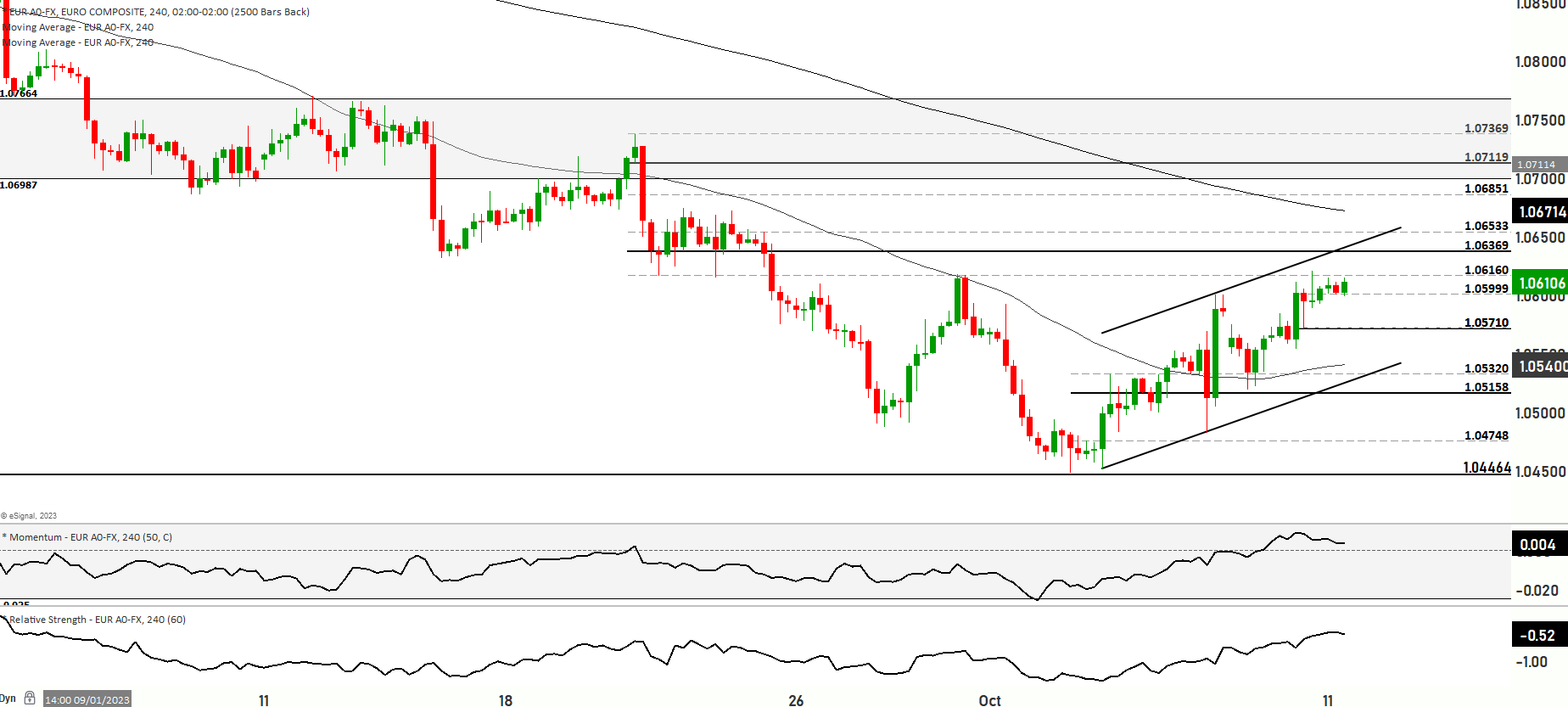

EUR USD short term consolidating, waiting on Fed Minutes later today on possible price movements

The EUR/USD currency pair witnessed a nuanced trading landscape, informed by various geopolitical and fiscal events, and opened with a gain of +0.36% at a rate of 1.0605, stimulated by a dip in U.S. yields, which in turn pressured the USD. In a notably subdued Asian trading session, the pair oscillated within a 1.0601/14 spectrum, with support mechanisms identified at the 21-day Moving Average (MA) of 1.0597 and the 10-day MA at 1.0550. A conclusive position above the 21-day MA could insinuate a solidified bottom, paving the way for further upward momentum. Strategically, a rupture above 1.0620 aims for the 38.2 Fibonacci retracement of the July/Oct downturn at 1.0764. A pivot towards a higher trajectory for EUR/USD is substantiated by a dovish recalibration in Federal Reserve expectations.

On the fundamental front, Wednesday witnessed the euro appreciating vis-a-vis the U.S. dollar, a scenario influenced by a contraction in Treasury yields, a corollary of dovish stances by Federal Reserve officials, and the anticipated stimulus maneuvers from China. Specifically, Atlanta Federal Reserve President Raphael Bostic, during his address at the American Bankers Association, asserted that additional interest rate hikes were not imperative, prompting a deceleration in the dollar index. He posited that the existing restrictive policy framework by the Fed sufficed, notwithstanding the economic slowdown induced by rate hikes. This scenario rendered a 0.25% elevation in the euro, while concurrently, the dollar index marginally retraced by approximately 0.05%.

Traders are now directing their focus towards the imminent release of minutes from the recent Fed policy conclave on Wednesday and pivotal U.S. inflation data slated for Thursday. China’s prospective sanctioning of an additional sovereign debt issuance, equating to 1 trillion yuan ($137.1 billion), is perceived as propitious for the euro. Additionally, Tuesday’s latter trading phase also encountered a diminution in U.S. dollar value, subsequent to dovish pronouncements from both Bostic and Fed Governor Christopher Waller, catalyzing a reduction in Treasury yields. Both officials underscored the Fed’s resolve to actualize a 2% inflation target, albeit without Waller providing insights into potential interest rate trajectories.

The technical analysis delineates that EUR/USD is currently entrenched in a short-term bearish zone with a Range, navigating around the 1.06060 level. Price is straddling between the 200-day and 50-day MAs, insinuating a transient bearish range for the market. Under Scenario 1, the price might elevate, potentially probing the 1.06331 level, with a continuation of bullish momentum potentially exploring the 1.06505 level, and if sustained, targeting a robust bullish test at the 1.06700 level. A triumphant breach of these junctures could initiate further ascension towards 1.06889 and 1.07070, acting as paramount resistance levels. Conversely, Scenario 2 hypothesizes a price degradation from the existing level, interrogating the 1.05867 and 1.05678 support echelons. Pervasive bearishness could drive a further descent towards 1.05480 and 1.05300, with 1.05100 emerging as a pivotal bearish support level. The short-term momentum is nestled in a bearish zone, reflecting a range-bound sentiment with the RSI in an oversold domain, indicating a transient bearishness. A plausible short-term market oscillation could materialize between 1.04529 and 1.06900, warranting vigilant observation of price responses at these levels.

Key Levels to watch are 1.04529,1.05867,1.05541,1.06120,1.06505

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.05867 | 1.06331 |

| Level 2 | 1.05678 | 1.06505 |

| Level 3 | 1.05480 | 1.06700 |