The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that provides information about support and resistance levels, momentum, and trend direction. This comprehensive guide will explore how traders can utilize the Ichimoku Cloud to enhance their trading setups, make more informed decisions, and potentially improve their trading results.

Understanding the Ichimoku Cloud

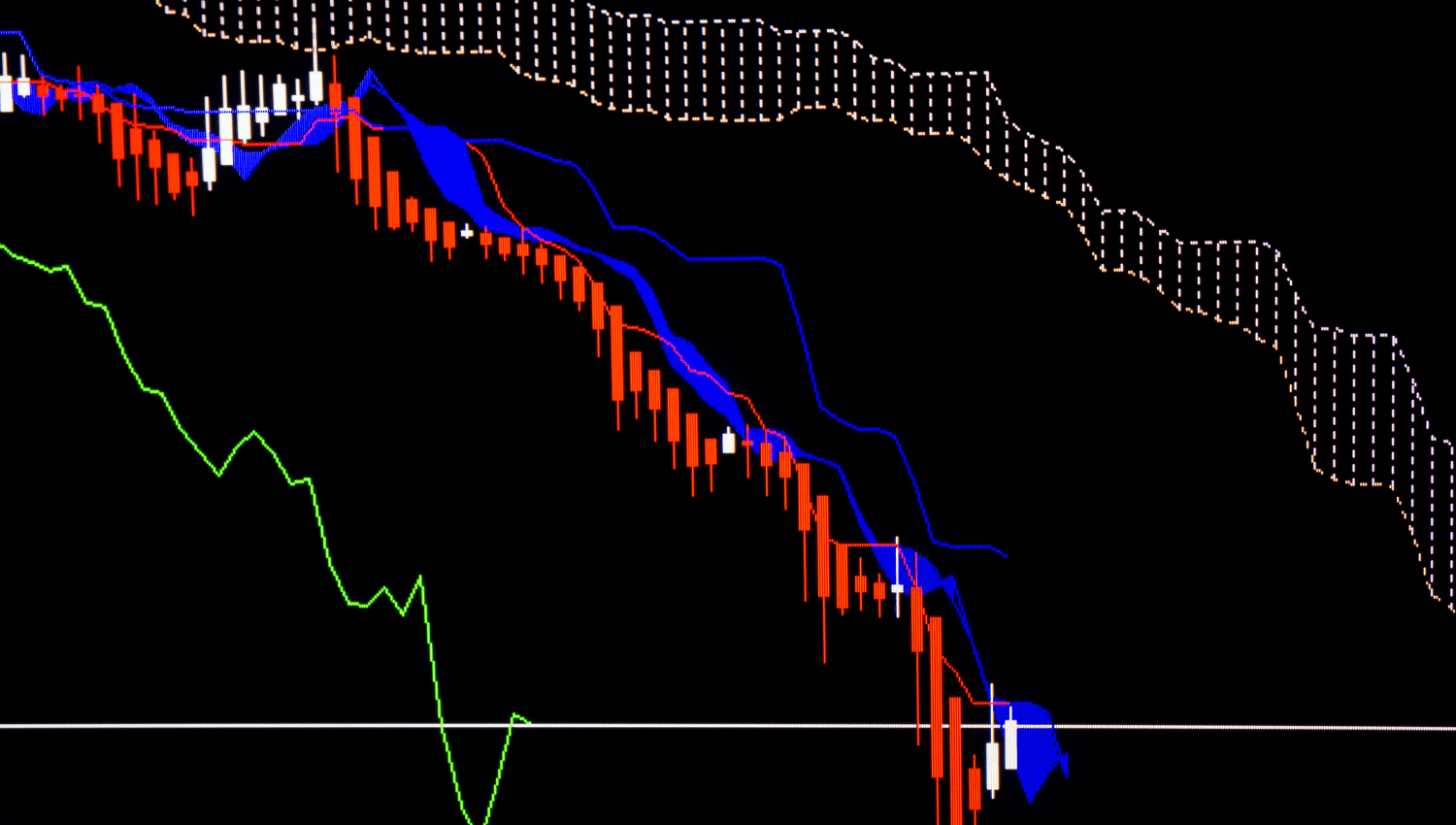

The Ichimoku Cloud consists of five main components:

- Tenkan-sen (Conversion Line): This is calculated as the average of the highest high and the lowest low over the last 9 periods. It is typically a shorter-term indicator of potential price movement.

- Kijun-sen (Base Line): This is the average of the highest high and the lowest low over the last 26 periods. It often acts as a trigger for potential trading signals.

- Senkou Span A (Leading Span A): This is the average of the Tenkan-sen and the Kijun-sen, plotted 26 periods ahead. It helps form the faster boundary of the Cloud.

- Senkou Span B (Leading Span B): This is calculated as the average of the highest high and the lowest low over the past 52 periods, plotted 26 periods ahead. It forms the slower boundary of the Cloud.

- Chikou Span (Lagging Span): This is the closing price plotted 26 periods in the past. It provides a clear view of how current prices compare to past prices.

How to Use Ichimoku Clouds in Trading

Identifying Trends

The position of the price relative to the Cloud can indicate the prevailing trend. If the price is above the Cloud, it suggests an uptrend; if below, a downtrend. When the price moves within the Cloud, it indicates a consolidation or the potential for a trend change.

Trading Signals

Ichimoku Clouds can generate several types of trading signals:

- Price Crosses: A basic signal occurs when the price crosses the Cloud. A price moving from below to above the Cloud indicates a potential buy signal, whereas a move from above to below suggests a sell signal.

- Tenkan-sen and Kijun-sen Crosses: Often called the “TK Cross,” this happens when the Tenkan-sen crosses over the Kijun-sen. A bullish signal is given when the Tenkan-sen crosses above the Kijun-sen, especially if this occurs above the Cloud. Conversely, a bearish signal is when the Tenkan-sen crosses below the Kijun-sen, especially below the Cloud.

- Chikou Span Confirmation: The Chikou Span should also confirm the sentiment shown by other signals. For a bullish signal, the Chikou Span should be above the price line 26 periods ago; for a bearish signal, below it.

Momentum and Support/Resistance Levels

The Cloud shapes themselves are visual representations of support or resistance. In an uptrend, the Cloud forms support zones that can predict where buying pressure might resume. In a downtrend, the Cloud forms resistance areas, indicating potential selling pressure.

Tips for Maximizing Ichimoku Cloud Efficacy

- Wait for Confirmation: Due to the comprehensive nature of Ichimoku, it’s advisable to wait for multiple components to confirm a signal before executing a trade.

- Use in Combination with Other Indicators: While the Ichimoku Cloud is powerful, combining it with other indicators like RSI or MACD can provide further confirmation and enhance decision-making.

- Consider the Time Frame: Ichimoku settings may be adjusted depending on the time frame and the trader’s strategy. For instance, day traders might use shorter periods, while long-term traders might use the standard settings.

Conclusion

The Ichimoku Cloud is a dynamic tool that offers a holistic view of the market’s potential future movement. By understanding and utilizing its components effectively, traders can identify trends, capture momentum, and find high-probability trades. However, like any trading tool, it requires practice and patience to master, and should be part of a well-rounded trading strategy that includes proper risk management techniques.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.