Introduction:

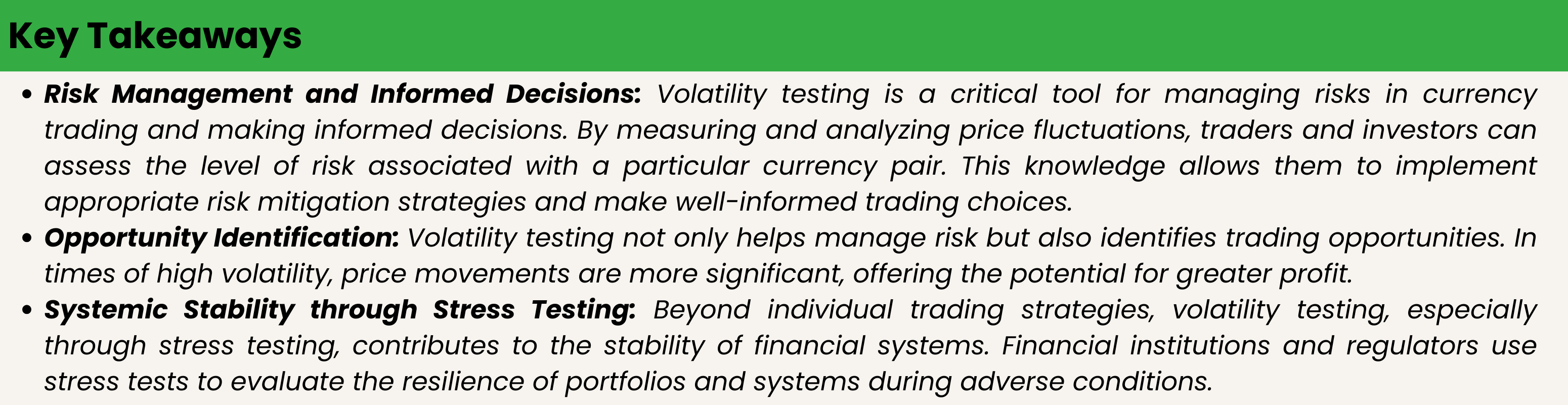

Volatility testing in currency markets refers to the measurement of the frequency and extent of changes in a currency’s value. It is a measure of the overall price fluctuations over a certain time, and this information can be used to detect potential breakouts. Volatility is often measured using indicators such as Moving Averages, Bollinger Bands, and Average True Range (ATR). High volatility means more trading risk, but also more opportunity for traders as the price moves are larger. Volatility testing holds importance in markets especially when it comes to currency trading for various compelling reasons. Firstly it acts as a tool, for managing risks enabling traders and investors to evaluate and prepare for the uncertainties in market behavior. By measuring the magnitude and frequency of price fluctuations volatility testing offers insights into the risks associated with specific currency pairs or assets. Secondly volatility testing plays a role in identifying trading opportunities. During periods of volatility price movements tend to be more evident presenting the possibility of profit or loss. Traders who can accurately assess and interpret volatility patterns are better equipped to make decisions and take advantage of market trends. Moreover volatility testing contributes to the stability of systems. Institutions and regulators employ stress tests that involve manipulating scenarios of volatility to assess the resilience of portfolios and systems, under conditions. This proactive approach helps preempt failures and financial crises by identifying vulnerabilities in advance.

Volatility Testing:

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In finance, volatility is often measured using the standard deviation of logarithmic returns. To understand and visualize the volatility of EUR/USD and GBP/USD:

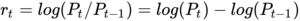

Calculate Log Returns:

where rtrt is the return at time tt, PtPt is the price at time tt, and Pt−1Pt−1 is the price at time t−1t−1.

Compute Rolling Volatility: Calculate the rolling standard deviation of the log returns using a specified window (e.g., 20, 50, or 200 days) to get a moving measure of volatility.

Visualize Volatility: Plot the computed rolling volatility to visualize how it has changed over time for both currency pairs.

Firstly lets calculate the log returns and visualizing them alongside the original price data. Then, we’ll compute and visualize the rolling volatility.

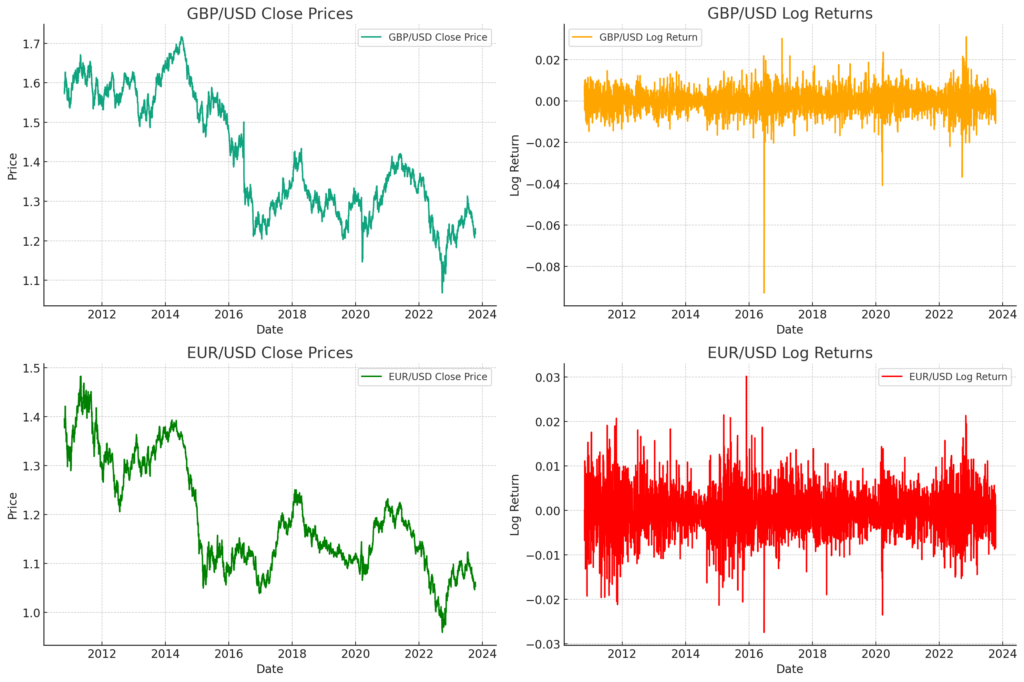

The plots above illustrate the following:

- Top Left: The GBP/USD close prices over time.

- Top Right: The logarithmic returns of GBP/USD.

- Bottom Left: The EUR/USD close prices over time.

- Bottom Right: The logarithmic returns of EUR/USD.

Logarithmic returns provide us with a continuous compounding return between two price points and tend to be normally distributed, which is a useful property for statistical analysis

Observations of Volatility Testing:

Short-Term Volatility (20-day rolling window): Short-term volatility can be more sensitive to recent price movements.

Intermediate-Term Volatility (50-day rolling window): A smoother representation of volatility, capturing intermediate-term trends and fluctuations.

Long-Term Volatility (200-day rolling window): Provides a longer-term perspective on volatility, smoothing out short-term noise and highlighting longer-term trends.

- Short-term volatility tends to be more erratic and responsive to recent market events.

- Intermediate-term volatility provides a clearer trend, showing periods of increased and decreased volatility.

- Long-term volatility captures the overall trend in volatility over an extended period.

Stress Testing Volatility:

Stress testing is a computer simulation technique used to evaluate the resilience of institutions and investment portfolios against possible future financial situations. It is customarily used by the financial industry to help gauge investment risk and the adequacy of assets, and to help evaluate internal processes and controls. In recent years, regulators have also required financial institutions to carry out stress tests to ensure their capital holdings and other assets are adequate.

In the context of volatility testing, stress testing involves increasing the volatility variable to an extent consistent with a crisis. The purpose of a stress test is to identify hidden vulnerabilities, especially those based off of methodological assumptions. There are different Value at Risk (VaR) methods, such as Monte Carlo simulations, historical simulations, and parametric VaR, that one can stress test in different ways. Most VaR models assume away extremely high levels of volatility, making VaR particularly poorly adapted, yet well-suited, for stress testing.

Stress testing involves running simulations under crises for which a model was not inherently designed to adjust. The scenarios used for stress testing can be historical, hypothetical, or stylized. In a historical scenario, the business, or asset class, portfolio, or individual investment is run through a simulation based on a previous crisis. A hypothetical stress test is normally more firm-specific. For example, a firm in California might stress test against a hypothetical earthquake or an oil company might stress test against the outbreak of a war in the Middle East. Stylized scenarios are a little more scientific in the sense that only one or a few test variables are adjusted at once.

Especially in times of high volatility, it is critical to stress test your sensitivity not only to market levels but to assumptions about correlations, term structure, the volatility surface, and to other markets such as Forex and commodities.

In conclusion, stress testing in volatility testing is a crucial tool for identifying potential vulnerabilities in a financial system or portfolio, especially during times of high volatility. It provides a way to simulate the effects of various crisis scenarios, helping institutions to better understand their risk profile and make informed decisions about risk management.

Common Assumptions made in Stress Testing Scenarios:

In stress testing scenarios there are assumptions that are typically considered

1. Relevance; The assumptions should be directly related to the objectives, scope and data of the test. They should be specifically tailored to the context and goals, at hand. Address the significant risks and uncertainties faced by the system, portfolio or business.

2. Realism; The assumptions should be based on plausible evidence. They need to align with expected patterns and trends while reflecting scenarios that could realistically occur in practice.

3. Rigor; The assumptions must demonstrate consistency, coherence and logical reasoning. They should align with the purpose of the stress test as its scenarios and data. Additionally they ought to be coherent with each other without any contradictions or overlaps.

4. Robustness; The assumptions should encompass a range of conditions and effects. They need to be strong enough to withstand stress scenarios while being supported by detailed data.

5. Plausibility; Stress test scenarios should be severe yet plausible, in natureThis implies that the stress events used in the tests should be both significant and plausible. It is important for the stress test results to be useful that the scenarios reflect situations that could realistically happen.

These assumptions play a role, in ensuring the efficacy of stress testing. They guarantee that the tests accurately capture the risks and vulnerabilities that may arise for a system, portfolio or business, in adverse scenarios.

Conclusion:

In conclusion, stress testing within the realm of volatility analysis is an indispensable tool, particularly during times of heightened market turbulence. It empowers financial institutions and investors to assess vulnerabilities, evaluate risk profiles, and make well-informed choices. By adhering to key assumptions—relevance, realism, rigor, robustness, and plausibility—stress testing scenarios enable a comprehensive understanding of potential challenges and the ability to navigate them effectively in the ever-fluctuating world of currency markets.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.