Introduction:

The Money Flow Index (MFI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR) technical indicators must be utilized together, in order to create a complete trading strategy. The Money Flow Index that is a momentum indicator incorporating price and volume and looking at overbought and oversold conditions is important for detecting market sentiment and reversals. The MACD, very famous for its efficiency in revealing changes in the force, direction, momentum, and duration of a trend in stock price, serves very vital in identifying entry and exit points through its signal line crossovers and histogram readings. The last but not the least is the Average True Range, a volatility indicator that provides valuable insights into volatility and risk assessment and thereby, allows traders to make the necessary adjustments to their strategies depending on the ever changing market conditions. Combining the signals from these three different, yet similar indicators, traders can establish a well-balanced, dynamic, and effective trading method. The strategy applies MFI as a market psychology indicator, MACD as a trend analysis and timing indicator, and ATR as a risk management indicator.

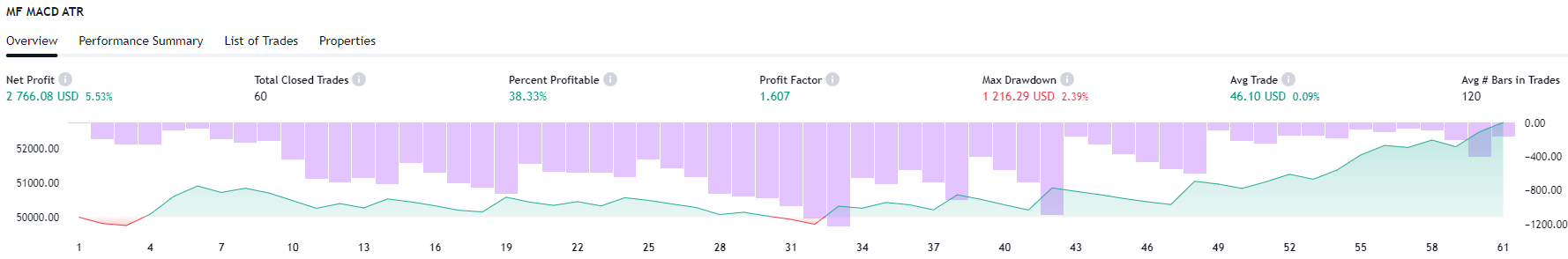

Strategy Overview and Backtesting

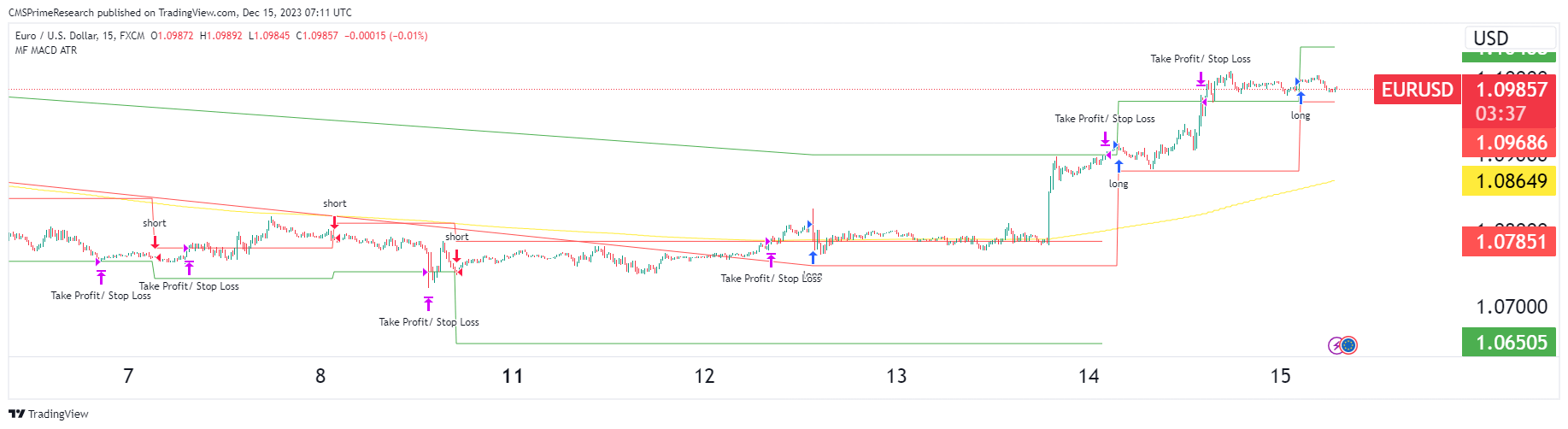

1. Entry Criteria

- Long Position

- MACD Criteria: The MACD indicator must be above the zero line. This suggests bullish momentum.

- MFI Criteria: The Money Flow Index should be above the zero line, indicating buying pressure.

- Short Position

- The criteria for short positions are the inverse of long positions. The MACD should be below the zero line, and the MFI should be below the zero line, indicating selling pressure.

2. Exit Criteria

- ATR-Based Exit: For exit points, use the Average True Range (ATR). The value of ATR at the time of entry is multiplied by a specified “Profit factor ATR” and “Stop factor ATR.” When the price reaches this calculated value, the position is closed.

Additional Strategy Using MFI and MACD

Another approach that combines MACD and MFI can be detailed as follows:

- MACD and MFI for Entry: Use the crossover of the MACD as an entry signal. Wait for the MFI to signal overbought or oversold conditions. For instance, if the MFI indicates an oversold condition, and there’s a bullish crossover in MACD, it generates a long signal.

- Exit Strategy: Hold the position until the MACD line crosses in the opposite direction, indicating a potential shift in momentum or trend.

What can be Considered as Options:

- Optimization: It’s crucial to optimize the script for each coin or currency pair. This means adjusting the parameters of the indicators according to the specific characteristics of the market you are trading in.

- Trend Identification: A trend strategy like this generally performs better in trending markets. Using EMA (Exponential Moving Average) and SMA (Simple Moving Average) interactions can help identify the trend direction.

- Risk Management: Implement risk management strategies, including setting take profit and stop-loss levels. This can be done using a fixed amount in dollars or percentages based on the ATR value at the entry point.

- Testing and Adaptation: Before applying this strategy in live trading, it should be thoroughly back-tested using historical data. This will help in understanding its effectiveness and making necessary adjustments.

Combining MFI, MACD, and ATR can provide a structured approach to trading, focusing on momentum (MACD), market sentiment and volume (MFI), and volatility (ATR). However, as with any strategy, it is essential to test and adapt it to individual trading styles and the specific market conditions being traded.

Adapting MFI, MACD, and ATR for Market Conditions

Developing a strategy based on the Money Flow Index (MFI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR) must be adjusted to suit different market conditions.

1. Market conditions and adapting MFI in different situations:

MFI in Trending Markets: MFI combines price and volume data, which are effective in detecting changes in market trends. In a trending market find divergences between the price and MFI. For example, if the MFI is decreasing as the price is increasing, it may indicate a waning trend, potentially signaling a possible reversal.

MFI in Range-bound Markets: MFI is useful in identifying reversals in extreme levels in range-bound conditions. MFI crosses up through 20 signals buying, while crossing down through 80 indicates overbought or oversold condition, that is, selling signals.

2. The application of MACD for various market conditions:

MACD in Trending Markets: Adjusting MACD settings may improve its efficiency in trending markets. This entails decreasing durations for greater responsiveness, expanding the smoothing factor to reduce noise, and high threshold levels affirm strong trends.

MACD in Range-bound Markets: Increasing the MACD periods is useful for smoothing out the fluctuations in price for the range-bound markets. It narrows the smoothing factor to capture small swings and focuses on the signal line crossovers as potential reversals and breakouts.

3. Adapting ATR into Different Market conditions:

ATR in Trending Markets: ATR can be employed to form dynamic stop-loss and take-profit based on current volatility while in trending markets. This facilitates the trending price movements and the larger movements.

ATR in Range-bound Markets: In range-bound markets, the ATR can still be useful in setting stop-loss and profit targets but may require adjustments. For example, using a lower multiplier for the ATR value when setting stop-loss and profit targets can help adapt to the narrower price ranges typically seen in these markets.

ATR Timeframe Adjustments: The period of the ATR can be adjusted according to market conditions. Shorter periods, like 5 days, react faster to price changes, while longer periods, like 50 days, provide a smoother analysis of volatility.

Combining the Indicators:

Combining these three indicators requires a strategic approach. For instance, in a trending market, you might wait for MACD to confirm the direction of the trend, use MFI to identify potential trend exhaustion, and use ATR to set appropriate risk parameters like stop-loss and profit targets. In contrast, in a range-bound market, you might focus more on MACD and MFI for identifying potential reversals at key support and resistance levels, while using ATR to adjust your risk management strategy.

Optimizing MACD, MFI, and ATR with Insights on Combining Trend Movements and Anomaly Capture

Optimizing the parameters of MACD, MFI, and ATR for various asset classes is essential for tailoring the strategy to different market environments and enhancing its robustness.

1. Optimizing MACD

- In Trending Markets: In a 1-hour chart, you can adjust MACD settings by decreasing the periods to increase responsiveness, widening the smoothing factor to reduce noise, and raising the threshold levels to confirm strong trends.

- In Range-Bound Markets: Increase the periods to smooth out price fluctuations, narrow the smoothing factor to capture smaller oscillations, and focus on signal line crossovers near support or resistance levels.

2. Optimizing MFI

- General Setting: The best setting for MFI is 14 on a 1-minute or daily chart, based on backtesting results. This setting produced a 43% win rate, which is significant considering the nature of the indicator.

- Market Sensitivity: Avoid using MFI on a 5-minute chart, as it has shown only a 23% win rate in this time frame, indicating less effectiveness in capturing market trends or reversals.

3. Optimizing ATR

- Standard Setting: The standard setting for ATR is typically 14 days, but this can be adjusted to suit different strategies and asset classes.

- Sensitivity Adjustment: Using an ATR setting lower than 14 makes the indicator more sensitive and produces a choppier moving average line, while a higher setting makes it less sensitive and provides a smoother reading.

Combinatorial Dynamics

- Trend Movements: In trending markets, a sensitive MACD can quickly respond to trend changes, while a standard MFI setting can provide robust confirmation of trend strength. ATR can be used to set dynamic stop losses and profit targets, considering the increased volatility in such markets.

- Market Anomaly Capture: In range-bound markets, a less sensitive MACD helps identify potential reversals at key levels, and MFI can confirm overbought or oversold conditions. A smoother ATR setting can provide a consistent measure of volatility, helping to avoid false signals.

- Interplay of Indicators: The synergy between MACD, MFI, and ATR lies in their ability to complement each other. While MACD and MFI focus on momentum and market sentiment, respectively, ATR provides a volatility perspective. This combination offers a holistic view of the market, enhancing the strategy’s ability to adapt to different conditions.

Optimizing the settings of MACD, MFI, and ATR for various asset classes enhances the strategy’s adaptability and effectiveness across different market conditions. The combinatorial use of these indicators allows for a nuanced approach to capturing trends and anomalies in the market, providing a more comprehensive trading strategy. Regular backtesting and adjustment of these settings are crucial to maintain the strategy’s effectiveness in diverse market scenarios.

Impact of Economic Indicators on Strategy Signals and Parameter Adjustments

We can analyze the potential impacts and considerations for adjusting these indicators in response to major economic events from a theoretical perspective:

MACD (Moving Average Convergence Divergence):

Impact of Economic Events: Major economic events can significantly impact market trends and momentum, which are key aspects measured by MACD. For instance, a strong economic report might reinforce a bullish trend, leading to a more pronounced divergence in the MACD.

Adjustment Strategy: In anticipation of major events, traders might adjust the sensitivity of MACD. A shorter time frame can make it more responsive to immediate market reactions, whereas a longer time frame can help filter out noise and short-term volatility.

MFI (Money Flow Index):

Impact of Economic Events: MFI, which takes into account both price and volume, can be influenced by economic events that affect trading volumes and asset valuations. For example, a positive economic indicator might lead to increased buying pressure, reflected in higher MFI values.

Adjustment Strategy: Adjustments to the MFI in anticipation of economic events could involve focusing on the extremities of the MFI scale (overbought/oversold conditions) to identify potential reactions to the news.

ATR (Average True Range):

Impact of Economic Events: ATR measures market volatility, which can spike during major economic announcements. High-impact news can lead to larger-than-usual price movements, reflected in increased ATR values.

Adjustment Strategy: In volatile periods around major economic events, traders might use a higher ATR multiplier for setting stop-loss or profit-target levels to accommodate increased volatility.

- Economic events do not occur in isolation. Their impact is often interrelated with other market factors, such as geopolitical tensions, monetary policies, and investor sentiment. For example, a positive employment report in the U.S. might have different implications in a context of rising inflation versus stable inflation.

- The response of different asset classes to economic indicators can vary. Equities might react differently from forex or commodities. Thus, a probabilistic approach, where the likelihood of different outcomes based on past data is considered, can be valuable.

Structural dynamics, such as market liquidity and the prevailing trend direction, also influence how a strategy should be adjusted. For example, in a low-liquidity environment, even minor economic reports can cause significant price movements. - The adjustment of the MACD, MFI, and ATR should be based on both historical data and a forward-looking assessment of potential market reactions. This might involve backtesting strategies under different economic scenarios. Continuous monitoring and adaptive strategies are key. Post-economic announcement periods can provide new data to refine these indicators’ settings further.

Conclusion

In conclusion, integrating the Money Flow Index (MFI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR) in a trading strategy requires careful adaptation to different market conditions and asset classes. The effectiveness of this strategy hinges on optimizing indicator parameters, such as adjusting MACD for responsiveness in trending markets, fine-tuning MFI for market sentiment analysis, and using ATR for volatility-based risk management. Understanding the impact of economic indicators and global events on these indicators is crucial, as these events can significantly influence market momentum, volume, and volatility. This necessitates a strategic approach, involving situational analysis and probabilistic quantification, to adapt the strategy to the unique dynamics of interconnected financial markets. Continuous monitoring and adjustments are essential for maintaining the robustness and relevance of the strategy across various market scenarios.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.